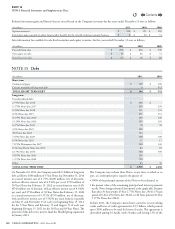

Cigna 2011 Annual Report Download - page 121

Download and view the complete annual report

Please find page 121 of the 2011 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

99CIGNA CORPORATION2011 Form10K

PART II

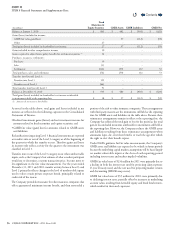

ITEM 8 Financial Statements and Supplementary Data

NOTE 11 Investments

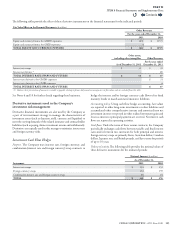

A. Fixed Maturities and Equity Securities

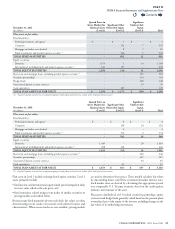

Securities in the following table are included in xed maturities and equity securities on the Company’s Consolidated Balance Sheets. ese

securities are carried at fair value with changes in fair value reported in other realized investment gains (losses) and interest and dividends reported

in net investment income. e Company’s hybrid investments include certain preferred stock or debt securities with call or conversion features.

(In millions)

2011 2010

Included in xed maturities:

Trading securities (amortized cost: $2; $3) $ 2 $ 3

Hybrid securities (amortized cost: $26; $45) 28 52

TOTAL $ 30 $ 55

Included in equity securities:

Hybrid securities (amortized cost: $90; $108) $ 65 $ 86

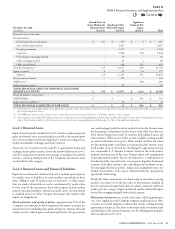

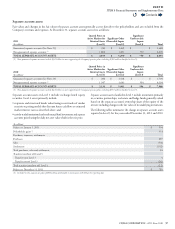

Fixed maturities included $79million at December31,2011 and

$98million at December31,2010, which were pledged as collateral to

brokers as required under certain futures contracts. ese xed maturities

were primarily federal government securities at December31,2011

and primarily corporate securities at December31,2010.

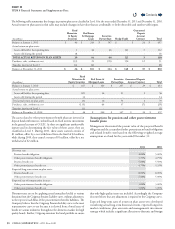

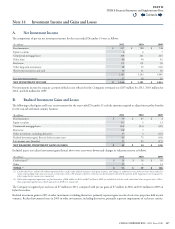

e following information about xed maturities excludes trading and

hybrid securities. e amortized cost and fair value by contractual maturity

periods for xed maturities were as follows at December31,2011:

(In millions)

Amortized Cost Fair Value

Due in one year or less $ 955 $ 967

Due after one year through ve years 4,719 5,060

Due after ve years through ten years 4,997 5,581

Due after ten years 2,699 3,565

Mortgage and other asset-backed securities 859 1,014

TOTAL $ 14,229 $ 16,187

Actual maturities could dier from contractual maturities because

issuers may have the right to call or prepay obligations, with or without

penalties. Also, in some cases the Company may extend maturity dates.

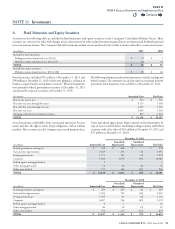

Gross unrealized appreciation (depreciation) on xed maturities by

type of issuer is shown below (excluding trading securities and hybrid

securities with a fair value of $30million at December31,2011 and

$55million at December31,2010).

(In millions)

Amortized Cost

December31,2011

Unrealized

Appreciation

Unrealized

Depreciation Fair Value

Federal government and agency $ 552 $ 406 $ - $ 958

State and local government 2,185 274 (3) 2,456

Foreign government 1,173 103 (2) 1,274

Corporate 9,460 1,070 (45) 10,485

Federal agency mortgage-backed 9 - - 9

Other mortgage-backed 73 10 (4) 79

Other asset-backed 777 160 (11) 926

TOTAL $ 14,229 $ 2,023 $ 65 $ 16,187

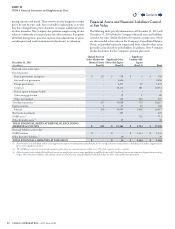

(In millions)

Amortized Cost

December31,2010

Unrealized

Appreciation

Unrealized

Depreciation Fair Value

Federal government and agency $ 459 $ 229 $ (1) $ 687

State and local government 2,305 172 (10) 2,467

Foreign government 1,095 63 (4) 1,154

Corporate 8,697 744 (49) 9,392

Federal agency mortgage-backed 9 1 - 10

Other mortgage-backed 80 10 (3) 87

Other asset-backed 752 117 (12) 857

TOTAL $ 13,397 $ 1,336 $ 79 $ 14,654

Contents

Q