Cigna 2011 Annual Report Download - page 125

Download and view the complete annual report

Please find page 125 of the 2011 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

103CIGNA CORPORATION2011 Form10K

PART II

ITEM 8 Financial Statements and Supplementary Data

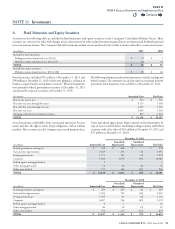

C. Real Estate

As of December31,2011 and 2010, real estate investments consisted primarily of oce and industrial buildings in California. Investments

with a carrying value of $49million as of December31,2011 and 2010 were non-income producing during the preceding twelve months. As

of December31,2011, the Company had commitments to contribute additional equity of $9million to real estate investments.

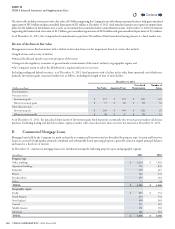

D. Other Long-Term Investments

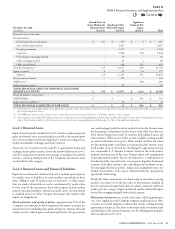

As of December31, other long-term investments consisted of the following:

(In millions)

2011 2010

Real estate entities $ 665 $ 394

Securities partnerships 298 288

Interest rate and foreign currency swaps 12 19

Mezzanine loans 31 13

Other 52 45

TOTAL $ 1,058 $ 759

Investments in real estate entities and securities partnerships with a

carrying value of $171million at December31,2011 and $169million

at December31,2010 were non-income producing during the preceding

twelve months.

As of December31,2011, the Company had commitments to contribute:

•

$165million to limited liability entities that hold either real estate

or loans to real estate entities that are diversied by property type

and geographic region; and

•

$242million to entities that hold securities diversied by issuer and

maturity date.

e Company expects to disburse approximately 50% of the committed

amounts in 2012.

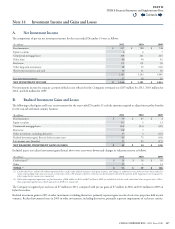

E. Short-Term Investments and Cash

Equivalents

Short-term investments and cash equivalents included corporate

securities of $4.1billion, federal government securities of $164million

and money market funds of $40million as of December31,2011.

e Company’s short-term investments and cash equivalents as of

December31,2010 included corporate securities of $1.1billion,

federal government securities of $137million and money market

funds of $40million. e increase during 2011 is primarily due to

proceeds from the Company’s debt and equity issuances that were

used to partially fund the HealthSpring acquisition. See Note3 for

further information.

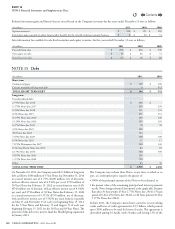

F. Concentration of Risk

As of December31,2011 and 2010, the Company did not have a concentration of investments in a single issuer or borrower exceeding 10%

of shareholders’ equity.

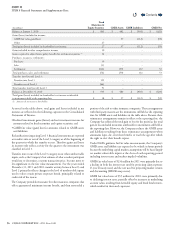

NOTE 12 Derivative Financial Instruments

e Company has written and purchased reinsurance contracts under

its run-o reinsurance segment that are accounted for as free standing

derivatives. e Company also uses derivative nancial instruments

to manage the equity, foreign currency, and certain interest rate risk

exposures of its run-o reinsurance segment. In addition, the Company

uses derivative nancial instruments to manage the characteristics of

investment assets to meet the varying demands of the related insurance

and contractholder liabilities. See Note2 for information on the

Company’s accounting policy for derivative nancial instruments.

Derivatives in the Company’s separate accounts are excluded from

the following discussion because associated gains and losses generally

accrue directly to separate account policyholders.

Collateral and termination features. e Company routinely monitors

exposure to credit risk associated with derivatives and diversies the

portfolio among approved dealers of high credit quality to minimize this

risk. Certain of the Company’s over-the-counter derivative instruments

contain provisions requiring either the Company or the counterparty

to post collateral or demand immediate payment depending on the

amount of the net liability position and predened nancial strength

or credit rating thresholds. Collateral posting requirements vary by

counterparty. e net liability positions of these derivatives were not

material as of December31,2011 or 2010.

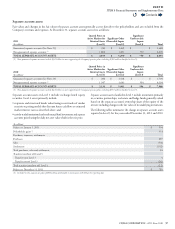

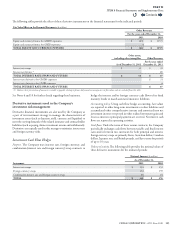

Derivative instruments associated with the Company’s

run-off reinsurance segment

Guaranteed Minimum Income Benefits (GMIB)

Purpose. e Company has written reinsurance contracts with issuers

of variable annuity contracts that provide annuitants with certain

guarantees of minimum income benets resulting from the level of

variable annuity account values compared with a contractually guaranteed

amount (“GMIB liabilities”). According to the contractual terms of the

written reinsurance contracts, payment by the Company depends on

Contents

Q