Cigna 2011 Annual Report Download - page 132

Download and view the complete annual report

Please find page 132 of the 2011 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

110 CIGNA CORPORATION2011 Form10K

PART II

ITEM 8 Financial Statements and Supplementary Data

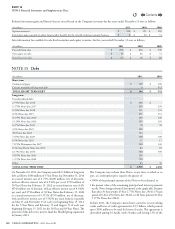

On November16,2011, the Company issued 15.2million shares

of its common stock at $42.75 per share. Proceeds of $650million

($629million net of underwriting discount and fees) were used to

fund the HealthSpring acquisition in January2012.

e Company maintains a share repurchase program, which was

authorized by its Board of Directors. e decision to repurchase shares

depends on market conditions and alternative uses of capital. e

Company has, and may continue from time to time, to repurchase

shares on the open market through a Rule10b5-1 plan that permits

a company to repurchase its shares at times when it otherwise might

be precluded from doing so under insider trading laws or because of

self-imposed trading blackout periods.

During 2011, and through February23,2012, the Company repurchased

5.3million shares for approximately $225million. e total remaining

share repurchase authorization as of February23,2012 was $522million.

e Company repurchased 6.2million shares for $201million during 2010.

e Company has authorized a total of 25million shares of $1 par

value preferred stock. No shares of preferred stock were outstanding

at December31,2011 or 2010.

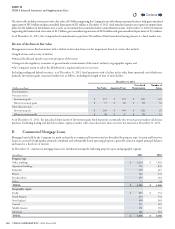

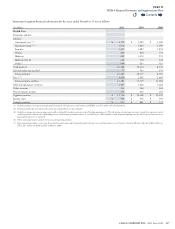

NOTE 17 Accumulated Other Comprehensive Income (Loss)

Accumulated other comprehensive income (loss) excludes amounts required to adjust future policy benets for the run-o settlement annuity

business.

Changes in accumulated other comprehensive income (loss) were as follows:

2011

(In millions)

Pre-Tax

Tax (Expense)

Benet After-Tax

Net unrealized appreciation, securities:

Net unrealized appreciation on securities arising during the year $ 366 $ (127) $ 239

Reclassication adjustment for losses (gains) included in shareholders’ net income (49) 18 (31)

Net unrealized appreciation, securities $ 317 $ (109) $ 208

Net unrealized appreciation, derivatives $ 1 $ - $ 1

Net translation of foreign currencies $ (30) $ 2 $ (28)

Postretirement benets liability adjustment:

Reclassication adjustment for amortization of net losses from past experience and prior

service costs $ 22 $ (7) $ 15

Net change arising from assumption and plan changes and experience (580) 205 (375)

Net postretirement benets liability adjustment $ (558) $ 198 $ (360)

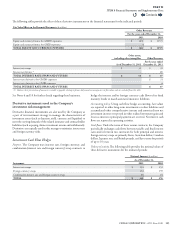

2010

(In millions)

Pre-Tax

Tax (Expense)

Benet After-Tax

Net unrealized appreciation, securities:

Net unrealized appreciation on securities arising during the year $ 319 $ (109) $ 210

Reclassication adjustment for (gains) included in net income (92) 32 (60)

Net unrealized appreciation, securities $ 227 $ (77) $ 150

Net unrealized appreciation, derivatives $ 8 $ (2) $ 6

Net translation of foreign currencies $ 48 $ (11) $ 37

Postretirement benets liability adjustment:

Reclassication adjustment for amortization of net losses from past experience and prior

service costs $ 10 $ (4) $ 6

Net change arising from assumption and plan changes and experience (311) 116 (195)

Net postretirement benets liability adjustment $ (301) $ 112 $ (189)

Contents

Q