Cigna 2011 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2011 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

83CIGNA CORPORATION2011 Form10K

PART II

ITEM 8 Financial Statements and Supplementary Data

contracts, the claim mortality assumption depends on age, gender,

and net amount at risk for the policy.

•

e lapse rate assumption is 0% to 24%, depending on contract type,

policy duration and the ratio of the net amount at risk to account value.

During 2011, the Company completed its normal review of reserves

(including assumptions) and recorded additional other benet expenses

of $70million ($45million after-tax) to strengthen GMDB reserves.

e reserve strengthening was driven primarily by:

•

adverse impacts of $34million ($22million after-tax) due to volatile

equity market conditions. Volatility risk is not covered by the hedging

programs. Also, the equity market volatility reduced the eectiveness

of the hedging program for equity market exposures, in part because

the market does not oer futures contracts that exactly match the

diverse mix of equity fund investments held by contractholders.

•

adverse interest rate impacts of $23million ($15million after-tax)

reecting management’s consideration of the anticipated impact of

continuing low current short-term interest rates. is evaluation

also led management to lower the mean investment performance

assumption for equity funds from 5% to 4.75% for those funds not

subject to the growth interest rate hedge program.

•

adverse impacts of overall market declines in the third quarter of

$13million ($8million after-tax), that include an increase in the

provision for expected future partial surrenders and declines in the

value of contractholders’ non-equity investments such as bond funds,

neither of which are included in the hedge programs.

During 2010, the Company performed its periodic review of assumptions

resulting in a charge of $52million pre-tax ($34million after-tax) to

strengthen GMDB reserves. During 2010 current short-term interest

rates had declined from the level anticipated at December31,2009,

leading the Company to increase reserves. is interest rate risk was

not even partially hedged at that time. e Company also updated

the lapse assumption for policies that have already taken or may take

a signicant partial withdrawal, which had a lesser reserve impact.

During 2009, the Company reported a charge of $73million pre-tax

($47million after-tax) to strengthen GMDB reserves. e reserve

strengthening primarily reected an increase in the provision for future

partial surrenders due to market declines, adverse volatility-related impacts

due to turbulent equity market conditions, and interest rate impacts.

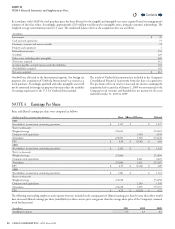

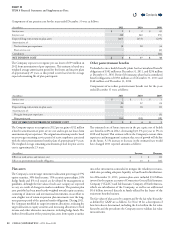

Activity in future policy benet reserves for these GMDB contracts

was as follows:

(In millions)

2011 2010 2009

Balance at January1, $ 1,138 $ 1,285 $ 1,609

Add: Unpaid claims 37 36 34

Less: Reinsurance and other amounts recoverable 51 53 83

Balance at January1, net 1,124 1,268 1,560

Add: Incurred benets 138 (20) (122)

Less: Paid benets 105 124 170

Ending balance, net 1,157 1,124 1,268

Less: Unpaid claims 40 37 36

Add: Reinsurance and other amounts recoverable 53 51 53

Balance at December31, $ 1,170 $ 1,138 $ 1,285

Benets paid and incurred are net of ceded amounts. Incurred benets

reect the (favorable) or unfavorable impact of a rising or falling equity

market on the liability, and include the charges discussed above. Losses

or gains have been recorded in other revenues as a result of the GMDB

equity and growth interest rate hedge programs to reduce equity market

and certain interest rate exposures.

e majority of the Company’s exposure arises under annuities that

guarantee that the benet received at death will be no less than the highest

historical account value of the related mutual fund investments on a

contractholder’s anniversary date. Under this type of death benet, the

Company is liable to the extent the highest historical anniversary account

value exceeds the fair value of the related mutual fund investments at

the time of a contractholder’s death. Other annuity designs that the

Company reinsured guarantee that the benet received at death will be:

•

the contractholder’s account value as of the last anniversary date

(anniversary reset); or

•

no less than net deposits paid into the contract accumulated at a

specied rate or net deposits paid into the contract.

Contents

Q