WeightWatchers 2011 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2011 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

WEIGHT WATCHERS INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(IN THOUSANDS, EXCEPT PER SHARE AMOUNTS)

Revolver II which terminates on June 30, 2014 (or 2013, upon the occurrence of certain events described in the

WWI Credit Facility agreement), including a proportionate amount of their outstanding Revolver I loans into

Revolver II loans. Following these conversions of a total of $1,029,002 of loans and commitments, at April 8,

2010, the Company had the same amount of debt outstanding under the WWI Credit Facility and amount of

availability under the Revolver as it had immediately prior to such conversions. In connection with this loan

modification offer, the Company incurred fees of $11,483 during the second quarter of fiscal 2010.

See Note 19 for discussion regarding the February 2012 financing related to the pending tender offer and the

pending share repurchase.

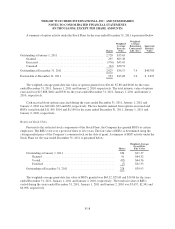

Maturities

At December 31, 2011, the aggregate amounts of the Company’s existing long-term debt maturing in each

of the next five years are as follows:

2012 ........................................................... $ 124,933

2013 ........................................................... 79,103

2014 ........................................................... 264,555

2015 ........................................................... 354,037

2016 ........................................................... 229,173

$1,051,801

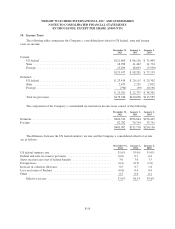

7. Treasury Stock

On October 9, 2003, the Company’s Board of Directors authorized, and the Company announced, a program

to repurchase up to $250,000 of the Company’s outstanding common stock. On each of June 13, 2005, May 25,

2006 and October 21, 2010, the Company’s Board of Directors authorized, and the Company announced, adding

$250,000 to this program. The repurchase program allows for shares to be purchased from time to time in the

open market or through privately negotiated transactions. No shares will be purchased from Artal Holdings and

its parents and subsidiaries under the program. The repurchase program currently has no expiration date.

During the fiscal years ended December 31, 2011 and January 1, 2011, the Company purchased 813 and

3,739 shares of its common stock, respectively, in the open market under the repurchase program for a total cost

of $31,550 and $109,990, respectively. During the fiscal year ended January 2, 2010, the Company did not

purchase any shares of its common stock.

See Note 19 for discussion regarding the pending tender offer and the pending share repurchase.

8. Earnings Per Share

Basic earnings per share (“EPS”) are calculated utilizing the weighted average number of common shares

outstanding during the periods presented. Diluted EPS is calculated utilizing the weighted average number of

common shares outstanding during the periods presented adjusted for the effect of dilutive common stock

equivalents.

F-15