WeightWatchers 2011 Annual Report Download - page 94

Download and view the complete annual report

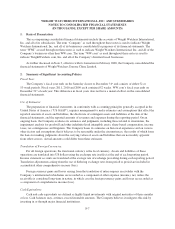

Please find page 94 of the 2011 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.WEIGHT WATCHERS INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(IN THOUSANDS, EXCEPT PER SHARE AMOUNTS)

WW.com primarily generates revenue from monthly subscriptions for its Internet subscription products.

Subscription fee revenues are recognized over the period that products are provided. One-time sign-up fees are

deferred and recognized over the expected customer relationship period. Subscription fee revenues that are paid

in advance are deferred and recognized on a straight-line basis over the subscription period. Online advertising

revenue is recognized when the advertisement is viewed by the user of the website.

The Company grants refunds in aggregate amounts that historically have not been material. Because the

period of payment of the refund generally approximates the period revenue was originally recognized, refunds

are recorded as a reduction of revenue when paid.

Advertising Costs:

Advertising costs consist primarily of national and local direct mail, television, online media and

spokesperson’s fees. All costs related to advertising are expensed in the period incurred, except for media

production related costs, which are expensed the first time the advertising takes place. Total advertising expenses

for the fiscal years ended December 31, 2011, January 1, 2011 and January 2, 2010 were $283,674, $208,604 and

$190,999, respectively.

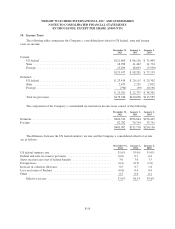

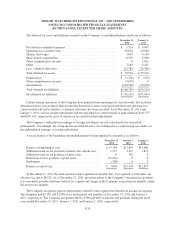

Income Taxes:

Deferred income tax assets and liabilities result primarily from temporary differences between the financial

statement and tax bases of assets and liabilities, using enacted tax rates in effect for the year in which differences

are expected to reverse. If it is more likely than not that some portion of a deferred tax asset will not be realized,

a valuation allowance is recognized. The Company considers historic levels of income, estimates of future

taxable income and feasible tax planning strategies in assessing the need for a tax valuation allowance.

In addition, assets and liabilities acquired in purchase business combinations are assigned their fair values

and deferred taxes are provided for lower or higher tax bases.

Derivative Instruments and Hedging:

The Company is exposed to certain risks related to its ongoing business operations, primarily interest rate

risk and foreign currency risk. The primary risk managed by using derivative instruments is interest rate risk.

Interest rate swaps are entered into to hedge a portion of the cash flow exposure associated with the Company’s

variable-rate borrowings. The Company does not use any derivative instruments for trading or speculative

purposes.

The Company recognizes the fair value of all derivative instruments as either assets or liabilities on the

balance sheet. The Company has designated and accounted for interest rate swaps as cash flow hedges of its

variable-rate borrowings. For derivative instruments that are designated and qualify as cash flow hedges, the

effective portion of the gain or loss on the derivative is reported as a component of accumulated other

comprehensive income (loss) and reclassified into earnings in the periods during which the hedged transactions

affect earnings. Gains and losses on the derivative representing either hedge ineffectiveness or hedge components

excluded from the assessment of effectiveness are recognized in current earnings.

The fair value of the Company’s interest rate swaps is reported in derivative payable and prepaid expenses

and other current assets on its balance sheet. See Note 15 for a further discussion regarding the fair value of the

Company’s interest rate swaps. The net effect of the interest payable and receivable under the Company’s

interest rate swaps is included in interest expense on the statement of income.

F-10