WeightWatchers 2011 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2011 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Franchise Acquisitions

From time to time, we repurchase franchise territories. Since the beginning of fiscal 2001, we have acquired

19 franchise operations for a total net purchase price of approximately $681.3 million. These acquisitions are

typically accretive to our earnings per share. There have been no key franchise acquisitions since fiscal 2008. For

fiscal 2011, the attendance of our remaining franchise operations accounted for less than 17% of total worldwide

attendance at Weight Watchers meetings.

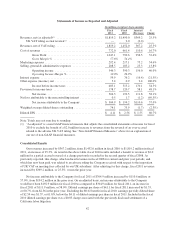

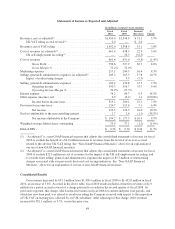

Non-GAAP Financial Measures

To supplement our consolidated results presented in accordance with accounting principles generally

accepted in the United States, or GAAP, we have disclosed non-GAAP measures of operating results that

exclude or adjust certain items. Net revenues, cost of revenues, gross profit and gross margin, operating income

and operating income margin, effective tax rate, including components thereof, are discussed in this Annual

Report on Form 10-K both as reported (on a GAAP basis) and as adjusted (on a non-GAAP basis) to exclude

from fiscal 2010 the revenue benefit of a partial accrual reversal of a charge originally recorded in the second

quarter of fiscal 2008 in connection with the previously disclosed adverse UK VAT ruling; and to adjust the

fiscal 2009 results for both the impact of the adverse UK tax ruling relating to the self-employment status of our

UK leaders and the impact of restructuring charges associated with our previously disclosed cost savings

initiatives. See “Item 3. Legal Proceedings–UK Self-Employment Matter” in Part I of this Annual Report on

Form 10-K for further details on the UK self-employment ruling. We generally refer to such non-GAAP

measures as excluding or adjusting for the impact of the accrual reversal, these rulings and/or these restructuring

charges. Our management believes these non-GAAP financial measures provide supplemental information to

investors regarding the performance of our business and are useful for period-over-period comparisons of the

performance of our business. While we believe that these financial measures are useful in evaluating our

business, this information should be considered as supplemental in nature and is not meant to be considered in

isolation or as a substitute for the related financial information prepared in accordance with GAAP. In addition,

these non-GAAP financial measures may not be the same as similarly entitled measures reported by other

companies.

Use of Constant Currency

As exchange rates are an important factor in understanding period-to-period comparisons, we believe the

presentation of results on a constant currency basis in addition to reported results helps improve investors’ ability

to understand our operating results and evaluate our performance in comparison to prior periods. Constant

currency information compares results between periods as if exchange rates had remained constant period-over-

period. We use results on a constant currency basis as one measure to evaluate our performance. In this Annual

Report on Form 10-K, we calculate constant currency by calculating current-year results using prior-year foreign

currency exchange rates. We generally refer to such amounts calculated on a constant currency basis as excluding

or adjusting for the impact of foreign currency. These results should be considered in addition to, not as a

substitute for, results reported in accordance with GAAP. Results on a constant currency basis, as we present

them, may not be comparable to similarly titled measures used by other companies and are not measures of

performance presented in accordance with GAAP.

Critical Accounting Policies

“Management’s Discussion and Analysis of Financial Condition and Results of Operations” is based upon

our consolidated financial statements, which have been prepared in accordance with GAAP. The preparation of

these financial statements requires us to make estimates and judgments that affect the reported amounts of assets,

liabilities, revenues and expenses, and related disclosure of contingent assets and liabilities. On an ongoing basis,

we evaluate our estimates and judgments, including those related to inventories, the impairment analysis for

goodwill and other indefinite-lived intangible assets, share-based compensation, income taxes, tax contingencies

38