WeightWatchers 2011 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2011 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

WEIGHT WATCHERS INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(IN THOUSANDS, EXCEPT PER SHARE AMOUNTS)

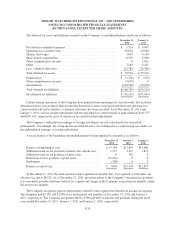

The Company is hedging forecasted transactions for periods not exceeding the next five years. At

December 31, 2011, given the current configuration of its debt, the Company estimates that no derivative gains

or losses reported in accumulated other comprehensive income (loss) will be reclassified to the statement of

income within the next 12 months due to hedge ineffectiveness.

As of December 31, 2011 and January 1, 2011, cumulative unrealized losses for qualifying hedges were

reported as a component of accumulated other comprehensive income (loss) in the amounts of $13,322 ($21,840

before taxes) and $24,118 ($39,539 before taxes), respectively. For the fiscal years ended December 31,

2011, January 1, 2011 and January 2, 2010 there were no fair value adjustments recorded in the statements of

income since all hedges were considered qualifying and effective.

The Company expects approximately $8,332 ($13,659 before taxes) of derivative losses included in

accumulated other comprehensive income (loss) at December 31, 2011, based on current market rates, will be

reclassified into earnings within the next 12 months.

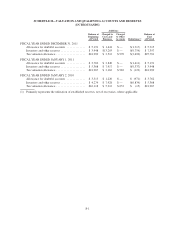

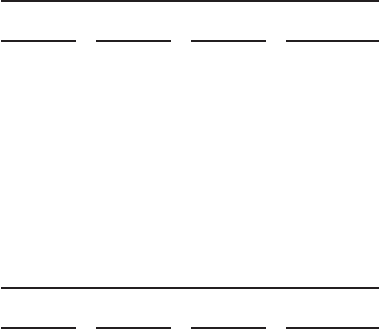

17. Quarterly Financial Information (Unaudited)

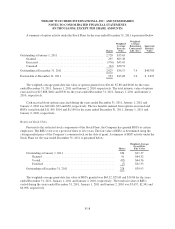

The following is a summary of the unaudited quarterly consolidated results of operations for the fiscal years

ended December 31, 2011 and January 1, 2011.

For the Fiscal Quarters Ended

April 2,

2011

July 2,

2011

October 1,

2011

December 31,

2011

Fiscal year ended December 31, 2011

Revenues, net ........................................ $503,432 $486,013 $428,434 $401,277

Gross profit ......................................... 283,142 287,150 251,183 225,665

Operating income .................................... 135,731 155,330 138,299 116,968

Net income .......................................... 73,177 86,856 80,650 63,661

Net income attributable to the Company ................... 73,593 86,963 80,650 63,661

Basic EPS atributable to the Company .................... $ 1.01 $ 1.19 $ 1.10 $ 0.87

Diluted EPS attributable to the Company .................. $ 1.00 $ 1.17 $ 1.09 $ 0.86

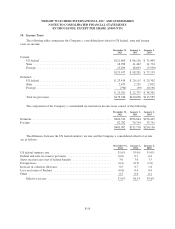

For the Fiscal Quarters Ended

April 3,

2010

July 3,

2010

October 2,

2010

January 1,

2011

Fiscal year ended January 1, 2011

Revenues, net ........................................ $387,997 $376,742 $330,606 $356,692

Gross profit ......................................... 211,683 211,671 178,509 188,767

Operating income .................................... 91,427 112,158 90,447 96,313

Net income .......................................... 44,086 55,943 44,010 48,483

Net income attributable to the Company ................... 44,577 56,306 44,437 48,915

Basic EPS atributable to the Company .................... $ 0.58 $ 0.73 $ 0.59 $ 0.66

Diluted EPS attributable to the Company .................. $ 0.58 $ 0.73 $ 0.59 $ 0.66

Basic and diluted EPS are computed independently for each of the periods presented. Accordingly, the sum

of the quarterly EPS amounts may not agree to the total for the year.

In the fourth quarter of fiscal 2010, the Company paid the UK VAT assessment that had been previously

accrued and reversed the remaining reserve related to this matter in the amount of approximately $2,028. The

amount was recorded as a benefit to revenue.

F-27