WeightWatchers 2011 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2011 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.WEIGHT WATCHERS INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(IN THOUSANDS, EXCEPT PER SHARE AMOUNTS)

13. Commitments and Contingencies

UK Self-Employment Matter

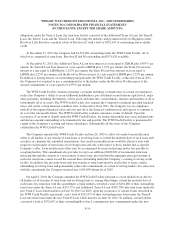

In July 2007, Her Majesty’s Revenue and Customs (“HMRC”) issued to the Company notices of

determination and decisions that, for the period April 2001 to April 2007, its leaders and certain other service

providers in the United Kingdom should have been classified as employees for tax purposes and, as such, the

Company should have withheld tax from the leaders and certain other service providers pursuant to the “Pay As

You Earn” (“PAYE”) and national insurance contributions (“NIC”) collection rules and remitted such amounts to

HMRC. HMRC also issued a claim to the Company in October 2008 in respect of NIC which corresponds to the

prior notices of assessment with respect to PAYE previously raised by HMRC.

In September 2007, the Company appealed to the UK First Tier Tribunal (Tax Chamber) (formerly known

as the UK VAT and Duties Tribunal and hereinafter referred to as the “First Tier Tribunal”) HMRC’s notices as

to these classifications and against any amount of PAYE and NIC liability claimed to be owed by the Company.

In February 2010, the First Tier Tribunal issued a ruling that the Company’s UK leaders should have been

classified as employees for UK tax purposes and, as such, the Company should have withheld tax from its leaders

pursuant to the PAYE and NIC collection rules for the period from April 2001 to April 2007 with respect to

services performed by the leaders for the Company. The Company appealed the First Tier Tribunal’s adverse

ruling to the UK Upper Tribunal (Tax and Chancery Chamber) (the “Upper Tribunal”), and in October 2011, the

Upper Tribunal issued a ruling dismissing the Company’s appeal. The Company is currently seeking permission

from the UK Court of Appeal to appeal the Upper Tribunal’s ruling.

In December 2011, HMRC’s claim in respect of NIC was amended to increase the claimed amount for the

period April 2002 to April 2007 and include the interest accrued thereon through December 2011. In addition, in

February 2012, HMRC asserted a claim in respect of PAYE for the period April 2007 to April 2011 similar to

what it had claimed for the period April 2001 to April 2007. The Company plans to appeal this PAYE claim to

the First Tier Tribunal.

In light of the First Tier Tribunal’s adverse ruling and in accordance with accounting guidance for

contingencies, the Company recorded in the fourth quarter of fiscal 2009 a reserve for the period from April 2001

through the end of fiscal 2009, inclusive of estimated accrued interest. On a quarterly basis, beginning in the first

quarter of fiscal 2010 and through the second quarter of fiscal 2011, the Company recorded a reserve for UK

withholding taxes with respect to its UK leaders consistent with this ruling. The reserve at the end of the second

quarter of fiscal 2011 equaled approximately $43,671 in the aggregate based on the exchange rates at the end of

fiscal 2011. As of the beginning of the third quarter of fiscal 2011, the Company employs its UK leaders and

therefore has ceased recording any further reserves for this matter. In addition, we do not currently expect

additional reserves will be required in connection with the December 2011 amended NIC claim and the February

2012 PAYE claim by HMRC, as reserves had previously been made for these amounts.

Sabatino v. Weight Watchers North America, Inc.

In September 2009, a lawsuit was filed in the Superior Court of California by one of the Company’s former

leaders alleging violations of certain California wage and hour laws on behalf of herself, and, if approved by the

court, other leaders and those employees who have performed the location coordinator function in California

since September 17, 2005. In this matter, the plaintiff sought unpaid wages and certain other damages. In October

2009, the Company answered the complaint and removed the case to the U.S. District Court for the Northern

District of California (the “Federal Court”). In July 2010, the plaintiff filed an amended complaint adding two

additional named plaintiffs for this matter. In October 2010, the parties engaged in mediation and reached an

F-22