WeightWatchers 2011 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2011 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

WEIGHT WATCHERS INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(IN THOUSANDS, EXCEPT PER SHARE AMOUNTS)

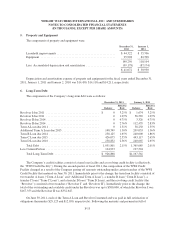

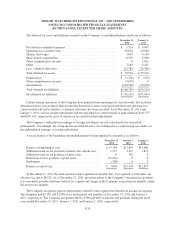

The deferred tax assets and liabilities recorded on the Company’s consolidated balance sheets are as follows:

December 31,

2011

January 1,

2011

Provision for estimated expenses .................................. $ 7,514 $ 6,807

Operating loss carryforwards ..................................... 29,676 29,068

Salaries and wages ............................................. 7,663 4,104

Share-based compensation ....................................... 6,339 8,960

Other comprehensive income .................................... 0 2,811

Other ........................................................ 7,183 6,451

Less: valuation allowance ....................................... (25,781) (24,989)

Total deferred tax assets ......................................... $ 32,594 $ 33,212

Depreciation .................................................. $ (2,740) $ (165)

Other comprehensive income .................................... (3,659) 0

Amortization ................................................. (102,306) (76,054)

Total deferred tax liabilities ...................................... $(108,705) $(76,219)

Net deferred tax liabilities ....................................... $ (76,111) $(43,007)

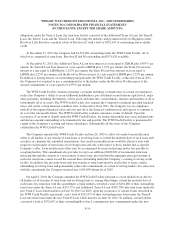

Certain foreign operations of the Company have generated net operating loss carryforwards. If it has been

determined that it is more likely than not that the deferred tax assets associated with these net operating loss

carryforwards will not be utilized, a valuation allowance has been recorded. As of December 31, 2011 and

January 1, 2011, various foreign subsidiaries had net operating loss carryforwards of approximately $105,575

and $107,411, respectively, most of which can be carried forward indefinitely.

The Company’s undistributed earnings of foreign subsidiaries are not considered to be reinvested

permanently. Accordingly, the Company has recorded all taxes, after taking into account foreign tax credits, on

the undistributed earnings of foreign subsidiaries.

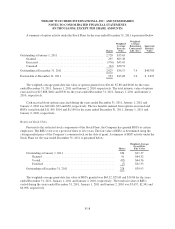

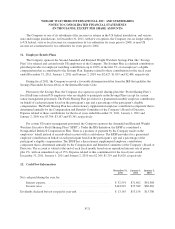

A reconciliation of the beginning and ending amount of unrecognized tax benefits is as follows:

December 31,

2011

January 1,

2011

January 2,

2010

Balance at beginning of year ........................... $15,794 $12,897 $11,086

Additions based on tax positions related to the current year . . . 1,537 2,115 1,811

Additions based on tax positions of prior years ............ 0 782 0

Reductions for tax positions of prior years ................ (11,901) 0 0

Settlements ........................................ (390) 0 0

Balance at end of year ................................ $ 5,040 $15,794 $12,897

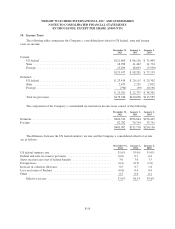

At December 31, 2011, the total amount of unrecognized tax benefits that, if recognized, would affect our

effective tax rate is $4,129. As of December 31, 2011, given the nature of the Company’s uncertain tax positions,

it is reasonably possible that there will not be a significant change in the Company’s uncertain tax benefits within

the next twelve months.

The Company recognizes interest and penalties related to unrecognized tax benefits in income tax expense.

The Company had $2,582 and $2,838 of accrued interest and penalties at December 31, 2011 and January 1,

2011, respectively. The Company recognized ($256), $780 and $403 in interest and penalties during the fiscal

years ended December 31, 2011, January 1, 2011 and January 2, 2010, respectively.

F-20