WeightWatchers 2011 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2011 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

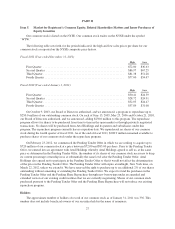

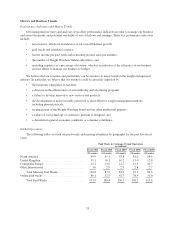

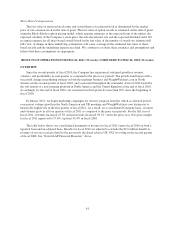

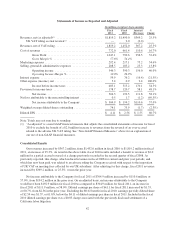

Meeting Attendance in Company-Owned Operations

(in millions)

Fiscal 2011 Fiscal 2010 Fiscal 2009 Fiscal 2008 Fiscal 2007

(52 weeks) (52 weeks) (52 weeks) (53 weeks) (52 weeks)

North America ............................... 36.0 30.3 32.1 36.5 38.1

United Kingdom ............................. 11.6 10.2 11.4 11.6 11.9

Continental Europe ........................... 7.2 8.5 8.6 9.8 10.2

Other International ........................... 2.2 2.0 2.2 2.1 2.5

Total ................................... 57.0 51.0 54.3 60.0 62.7

The “paid week” metric reports total paid weeks by our customers in Company-owned operations for a

given period. For meetings, paid weeks is the sum of total paid commitment plan weeks (e.g., Monthly Pass

weeks) and total pay-as-you-go weeks for a given period. Before the launch of our commitment plans in the

meetings business, our members were largely on a pay-as-you-go basis, and accordingly, growth in meeting

attendance essentially approximated growth in meeting paid weeks. However, as of fiscal 2011, approximately

80% of meeting paid weeks was attributable to commitment plans and therefore attendance and paid weeks are

no longer directly correlated. For Weight Watchers Online, paid weeks is the total paid Weight Watchers Online

subscriber weeks for a given period.

As shown in the table above, our worldwide meeting paid weeks grew from 84.6 million in fiscal 2007 to

104.8 million in fiscal 2011, an increase of 24.0%, or 5.5% on a compound annual growth rate basis. The

difference between meeting paid weeks and attendance widened year-over-year primarily due to growth in new

Monthly Pass subscribers as Monthly Pass penetration expanded globally. In NACO, where Monthly Pass is

highly penetrated, fiscal 2011 meeting paid weeks of 69.9 million exceeded meeting attendance of 36.0 million

by 94.0%. Weight Watchers Online paid weeks grew at a compound annual growth rate of 30.2% from 2007 to

2011, increasing from 31.0 million to 89.1 million.

As shown in the table above, our worldwide annual meeting attendance in our Company-owned operations

has declined from 62.7 million for fiscal 2007 to 57.0 million for fiscal 2011, a decline of 2.3% on a compound

annual growth rate basis. Our worldwide average meeting revenue per attendee, however, has increased over the

same period, largely as a result of Monthly Pass’ growing penetration in NACO and other markets and growth in

product sales per attendee.

North America Meeting Metrics and Business Trends

NACO meeting paid weeks grew by 4.5% from 2007 to 2008, as a result of the increased penetration of

Monthly Pass, first introduced into the North American meetings business in the fall of 2006. Attendance over

the same period declined by 4.3% because not all members who purchase Monthly Pass attend all the meetings

for which they have paid.

In 2008 and 2009, the weak economy in the United States had a significant impact on our meetings

business. In fiscal 2008, we were able to maintain growth in paid weeks, which increased 4.5% over the prior

year, largely as a result of increased Monthly Pass penetration, but in fiscal 2009, paid weeks declined by 8.4%

versus fiscal 2008. Meeting attendance, however, declined in fiscal 2008 over the prior year by 4.3% (6.2%

excluding the impact of franchise acquisitions), and declined by a further 11.8% in fiscal 2009 over the prior

year. The economic recession, coupled with reduced credit availability, adversely impacted consumer spending.

We saw the impact most acutely in enrollments, particularly of new members who had never been to Weight

Watchers. In addition to the economic factors affecting these two years, the lack of a meaningful program

innovation in NACO for several years contributed to the decline in the NACO meetings business.

34