WeightWatchers 2011 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2011 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

may deem relevant. Our Board of Directors may decide at any time to increase or decrease the amount of

dividends or discontinue the payment of dividends based on these factors. The WWI Credit Facility also contains

restrictions on our ability to pay dividends on our common stock.

The WWI Credit Facility provides that we are permitted to pay dividends and extraordinary dividends, as

well as repurchase shares of our common stock, so long as we are not in default under the WWI Credit Facility

agreement. However, payment of extraordinary dividends and stock repurchases shall not exceed $150.0 million

in the aggregate in any fiscal year if net debt to EBITDA (as defined in the WWI Credit Facility agreement) is

greater than or equal to 3.75:1 and an investment grade rating date (as defined in the WWI Credit Facility

agreement) has not occurred. We do not expect this restriction to impair our ability to pay dividends or make

stock repurchases, but it could do so.

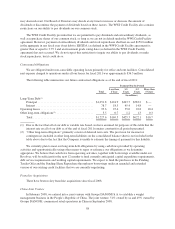

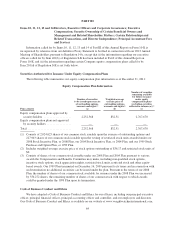

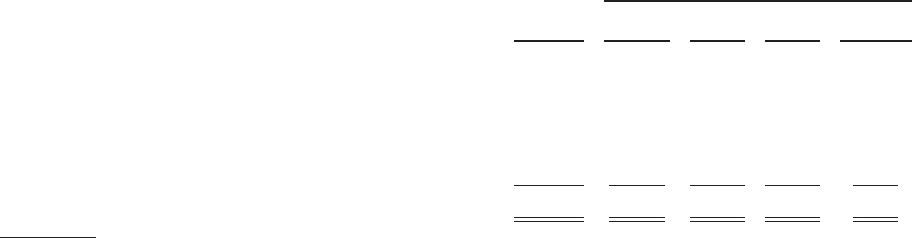

Contractual Obligations

We are obligated under non-cancelable operating leases primarily for office and rent facilities. Consolidated

rent expense charged to operations under all our leases for fiscal 2011 was approximately $36.5 million.

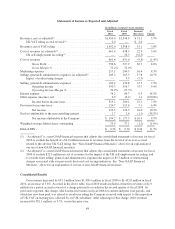

The following table summarizes our future contractual obligations as of the end of fiscal 2011:

Payment Due by Period

Total

Less than

1 Year

1-3

Years

3-5

Years

More than

5 Years

(in millions)

Long-Term Debt(1)

Principal ...................................... $1,051.8 $124.9 $343.7 $583.2 $ —

Interest ....................................... 78.7 18.5 45.4 14.8 —

Operating leases .................................... 93.6 25.4 35.0 22.8 10.4

Other long-term obligations(2) ......................... 3.5 0.7 1.2 1.3 0.3

Total ......................................... $1,227.6 $169.5 $425.3 $622.1 $10.7

(1) Due to the fact that all of our debt is variable rate based, we have assumed for purposes of this table that the

interest rate on all of our debt as of the end of fiscal 2011 remains constant for all periods presented.

(2) “Other long-term obligations” primarily consist of deferred rent costs. The provision for income tax

contingencies included in other long-term liabilities on the consolidated balance sheet is not included in the

table above due to the fact that the Company is unable to estimate the timing of payment for this liability.

We currently plan to meet our long-term debt obligations by using cash flows provided by operating

activities and opportunistically using other means to repay or refinance our obligations as we determine

appropriate. We believe that cash flows from operating activities, together with borrowings available under our

Revolver, will be sufficient for the next 12 months to fund currently anticipated capital expenditure requirements,

debt service requirements and working capital requirements. We expect to fund the purchases in the Pending

Tender Offer and the Pending Share Repurchase through new borrowings under an amended and extended

version of our existing credit facilities that we are currently negotiating.

Franchise Acquisitions

There have been no key franchise acquisitions since fiscal 2008.

China Joint Venture

In February 2008, we entered into a joint venture with Groupe DANONE S.A. to establish a weight

management business in the People’s Republic of China. The joint venture, 51% owned by us and 49% owned by

Groupe DANONE, commenced retail operations in China in September 2008.

58