WeightWatchers 2011 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2011 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

WEIGHT WATCHERS INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(IN THOUSANDS, EXCEPT PER SHARE AMOUNTS)

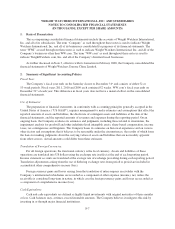

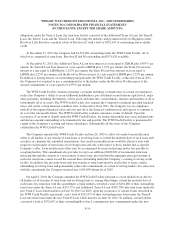

Asia’s minority equity interest by Weight Watchers Asia, the Company owns 100% of the China Joint Venture

and no longer accounts for a non-controlling interest in the China Joint Venture. The noncontrolling interest that

had been reflected on the Company’s balance sheet was reclassified to retained earnings.

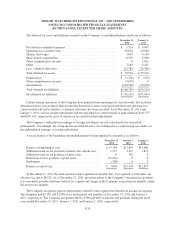

4. Goodwill and Other Intangible Assets

The Company performed its annual impairment review of goodwill and other indefinite-lived intangible

assets as of December 31, 2011 and January 1, 2011 and determined that no impairment existed. Goodwill is due

mainly to the acquisition of the Company by H.J. Heinz Company (“Heinz”) in 1978 and the acquisition of

WW.com in 2005. For the year ended December 31, 2011, the change in goodwill is due to the closing of the

Company’s Finland business and foreign currency fluctuations. Franchise rights acquired are due to acquisitions

of the Company’s franchised territories. For the year ended December 31, 2011, franchise rights acquired

decreased due to foreign currency fluctuations.

The Company’s goodwill by reportable segment at the end of fiscal 2011 and fiscal 2010 was $23,812 and

$25,225, respectively, related to the WWI segment and $26,200 related to the WW.com segment for both years,

totaling $50,012 and $51,425, respectively.

Aggregate amortization expense for finite-lived intangible assets was recorded in the amounts of $16,545,

$14,894, and $13,664 for the fiscal years ended December 31, 2011, January 1, 2011 and January 2, 2010,

respectively.

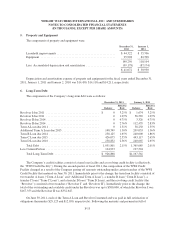

The carrying amount of finite-lived intangible assets as of December 31, 2011 and January 1, 2011 was as

follows:

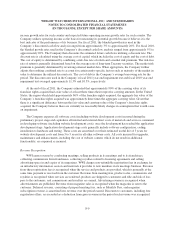

December 31, 2011 January 1, 2011

Gross

Carrying

Amount

Accumulated

Amortization

Gross

Carrying

Amount

Accumulated

Amortization

Capitalized software costs ............................ 67,223 $44,003 $ 52,293 $34,423

Trademarks ........................................ 10,006 9,276 9,813 8,952

Website development costs ........................... 43,987 30,747 35,245 24,350

Other ............................................. 7,033 6,762 7,033 6,697

$128,249 $90,788 $104,384 $74,422

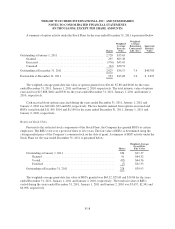

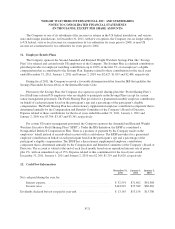

Estimated amortization expense of existing finite-lived intangible assets for the next five fiscal years is as

follows:

2012 ............................................................. $14,630

2013 ............................................................. $11,466

2014 ............................................................. $ 7,355

2015 ............................................................. $ 3,241

2016 ............................................................. $ 665

F-12