WeightWatchers 2011 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2011 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

investing and financing activities combined totaled $270.6 million. Investing activities, consisting primarily of

capital spending, utilized $23.6 million. Net cash used for financing activities totaled $247.0 million, including

dividend payments of $54.1 million and long-term debt payments of $194.5 million.

Long-Term Debt

Our credit facilities consist of a term loan facility and a revolving credit facility, or collectively, the WWI

Credit Facility. During the second quarter of fiscal 2011, the composition of the WWI Credit Facility changed as

a result of us paying off amounts outstanding under certain tranches of the WWI Credit Facility that matured on

June 30, 2011. Immediately prior to the change, the term loan facility consisted of two tranche A loans, or Term

A Loan and Additional Term A Loan, a tranche B loan, or Term B Loan, a tranche C loan, or Term C Loan, and

a tranche D loan, or Term D Loan, and the revolving credit facility, or the Revolver, consisted of two tranches,

Revolver I and Revolver II. Immediately prior to the change, the total of the outstanding and available credit

under the Revolver was up to $500.0 million, of which the Revolver I was $167.4 million and the Revolver II

was $332.6 million.

On June 30, 2011, each of the Term A Loan and Revolver I matured and was paid in full satisfaction of

obligations thereunder ($29.1 million and $12.1 million, respectively). Following the maturity and payment in

full of obligations under the Term A Loan, the term loan facility consisted of the Additional Term A Loan, the

Term B Loan, the Term C Loan and the Term D Loan. Following the maturity and payment in full of obligations

under Revolver I, the Revolver consisted solely of Revolver II, with a total of $332.6 million of outstanding and

available credit. At the end of fiscal 2011, we had $1,051.8 million outstanding under the WWI Credit Facility.

In addition, at the end of fiscal 2011, there was $0 outstanding and $331.6 million available under the Revolver.

At the end of fiscal 2011, 2010 and 2009, our debt consisted entirely of variable-rate instruments. Interest

rate swaps are entered into to hedge a portion of the cash flow exposure associated with our variable-rate

borrowings. The average interest rate on our debt, exclusive of the impact of swaps, was approximately 2.4%,

2.2% and 1.5% per annum at the end of fiscal 2011, 2010 and 2009, respectively.

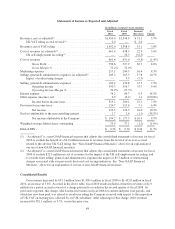

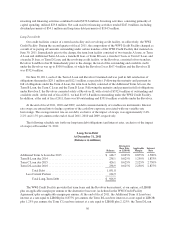

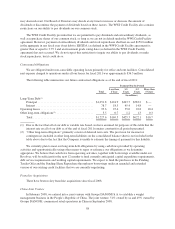

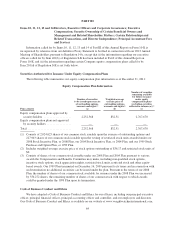

The following schedule sets forth our long-term debt obligations (and interest rates, exclusive of the impact

of swaps) at December 31, 2011:

Long-Term Debt

At December 31, 2011

(Balances in millions)

Balance

Alternative

Base Rate

or LIBOR

Applicable

Margin

Interest

Rate

Additional Term A Loan due 2013 ........................... $ 148.7 0.625% 0.875% 1.500%

Term B Loan due 2014 ..................................... 238.1 0.625% 1.250% 1.875%

Term C Loan due 2015 ..................................... 426.1 0.625% 2.125% 2.750%

Term D Loan due 2016 ..................................... 238.9 0.625% 2.250% 2.875%

Total Debt ....................................... 1,051.8

Less Current Portion ................................... 124.9

Total Long-Term Debt ............................. $ 926.9

The WWI Credit Facility provides that term loans and the Revolver bear interest, at our option, at LIBOR

plus an applicable margin per annum or the alternative base rate (as defined in the WWI Credit Facility

Agreement) plus an applicable margin per annum. At the end of fiscal 2011, the Additional Term A Loan bore

interest at a rate equal to LIBOR plus 0.875% per annum; the Term B Loan bore interest at a rate equal to LIBOR

plus 1.25% per annum; the Term C Loan bore interest at a rate equal to LIBOR plus 2.125%; the Term D Loan

56