WeightWatchers 2011 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2011 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.WEIGHT WATCHERS INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(IN THOUSANDS, EXCEPT PER SHARE AMOUNTS)

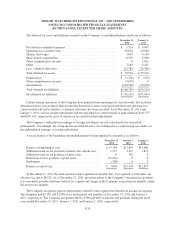

As discussed in further detail in Note 13, in the third quarter of fiscal 2010, the Company recorded a reserve

of $6,500 related to a lawsuit filed by one of its former leaders alleging violations of certain California wage and

hour laws.

18. Recently Issued Accounting Pronouncements

In September 2011, the Financial Accounting Standards Board (the “FASB”) issued updated guidance on

the periodic testing of goodwill for impairment. This guidance will allow companies to assess qualitative factors

to determine if it is more-likely-than-not that goodwill might be impaired and whether it is necessary to perform

the two-step goodwill impairment test required under current accounting standards. This guidance is applicable

for fiscal years beginning after December 15, 2011, with early adoption permitted. The adoption of this guidance

is not expected to have a material effect on the consolidated financial position, results of operations or cash flows

of the Company.

In June 2011, the FASB issued authoritative guidance requiring companies to present the total of

comprehensive income, the components of net income and the components of other comprehensive income either

in a single continuous statement of comprehensive income or in two separate but consecutive statements. The

provisions of the guidance are effective for fiscal years, and interim periods within those years, beginning after

December 15, 2011. In December 2011, the FASB issued an amendment deferring the effective date for the

presentation of reclassification adjustments out of accumulated other comprehensive income. Since the guidance

amends the disclosure requirements concerning comprehensive income, its adoption will not affect the

consolidated financial position, results of operations or cash flows of the Company.

In May 2011, the FASB issued authoritative fair value guidance entitled “Fair Value Measurement:

Amendments to Achieve Common Fair Value Measurement and Disclosure Requirements in U.S. GAAP and

IFRSs”. Some of the amendments included in the guidance clarify the FASB’s intent about the application of

existing fair value measurement requirements. Other amendments change a particular principle or requirement

for measuring fair value or for disclosing information about fair value measurements. This guidance is effective

for interim and annual periods beginning after December 15, 2011. The Company is currently evaluating the full

impact of this guidance, but does not expect it to have a material impact on the disclosures in its consolidated

financial statements in future filings.

In January 2010, the FASB issued authoritative guidance revising certain disclosure requirements

concerning fair value measurements. The guidance requires an entity to disclose separately significant transfers

into and out of Levels 1 and 2 of the fair value hierarchy and to disclose the reasons for such transfers. It also

requires the presentation of purchases, sales, issuances and settlements within Level 3, on a gross basis rather

than a net basis. These new disclosure requirements were effective for the Company beginning with its first fiscal

quarter of 2010, except for the additional disclosure of Level 3 activity, which is effective for fiscal years

beginning after December 15, 2010. The Company did not have any such transfers into and out of Levels 1 and 2

during the twelve months ended January 1, 2011. The Company adopted the guidance based on its effective

dates. The adoption of the guidance did not have a material impact on the disclosures in its consolidated financial

statements.

In October 2009, new revenue recognition guidance was issued regarding arrangements with multiple

deliverables. The new guidance permits companies to recognize revenue from certain deliverables earlier than

previously permitted, if certain criteria are met. The new guidance was effective for fiscal years beginning on or

after June 15, 2010 and did not have a material impact on the Company’s financial position, results of operations

or cash flows.

F-28