WeightWatchers 2011 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2011 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

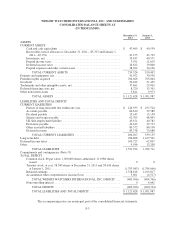

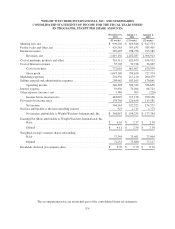

WEIGHT WATCHERS INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(IN THOUSANDS, EXCEPT PER SHARE AMOUNTS)

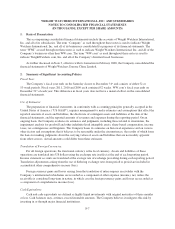

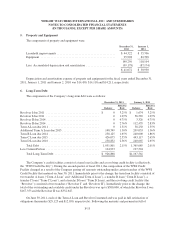

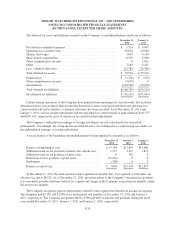

5. Property and Equipment

The components of property and equipment were:

December 31,

2011

January 1,

2011

Leasehold improvements ........................................ $ 44,322 $ 35,706

Equipment ................................................... 95,928 82,398

140,250 118,104

Less: Accumulated depreciation and amortization .................... (99,178) (87,174)

$ 41,072 $ 30,930

Depreciation and amortization expense of property and equipment for the fiscal years ended December 31,

2011, January 1, 2011 and January 2, 2010 was $14,450, $14,118 and $14,211, respectively.

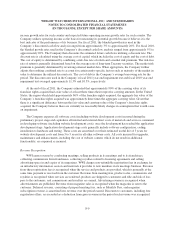

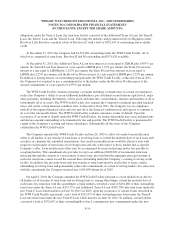

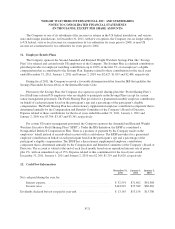

6. Long-Term Debt

The components of the Company’s long-term debt were as follows:

December 31, 2011 January 1, 2011

Balance

Effective

Rate Balance

Effective

Rate

Revolver I due 2011 .................................... $ 0 3.25% $ 1,674 3.25%

Revolver I due 2011 .................................... 0 1.29% 56,565 1.29%

Revolver II due 2014 .................................... 0 4.75% 3,326 4.75%

Revolver II due 2014 .................................... 0 2.76% 112,435 2.83%

Term A Loan due 2011 .................................. 0 1.31% 58,250 1.35%

Additional Term A Loan due 2013 ......................... 148,749 1.30% 209,053 1.36%

Term B Loan due 2014 .................................. 238,125 1.65% 240,000 1.86%

Term C Loan due 2015 .................................. 426,075 2.55% 443,117 2.65%

Term D Loan due 2016 .................................. 238,852 2.56% 240,665 2.65%

Total Debt ........................................ 1,051,801 2.15% 1,365,085 2.01%

Less Current Portion .................................... 124,933 197,524

Total Long-Term Debt .............................. $ 926,868 $1,167,561

The Company’s credit facilities consist of a term loan facility and a revolving credit facility (collectively,

the “WWI Credit Facility”). During the second quarter of fiscal 2011, the composition of the WWI Credit

Facility changed as a result of the Company paying off amounts outstanding under certain tranches of the WWI

Credit Facility that matured on June 30, 2011. Immediately prior to the change, the term loan facility consisted of

two tranche A loans (“Term A Loan” and “Additional Term A Loan”), a tranche B loan (“Term B Loan”), a

tranche C loan (“Term C Loan”), and a tranche D loan (“Term D Loan), and the revolving credit facility (the

“Revolver”) consisted of two tranches (“Revolver I” and “Revolver II”). Immediately prior to the change, the

total of the outstanding and available credit under the Revolver was up to $500,000, of which the Revolver I was

$167,353 and the Revolver II was $332,647.

On June 30, 2011, each of the Term A Loan and Revolver I matured and was paid in full satisfaction of

obligations thereunder ($29,125 and $12,050, respectively). Following the maturity and payment in full of

F-13