WeightWatchers 2011 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2011 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

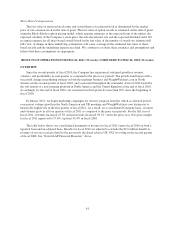

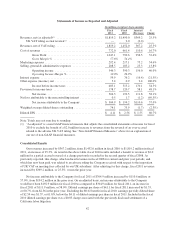

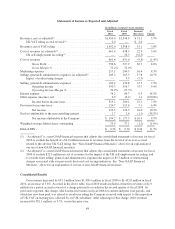

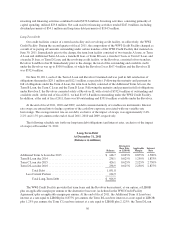

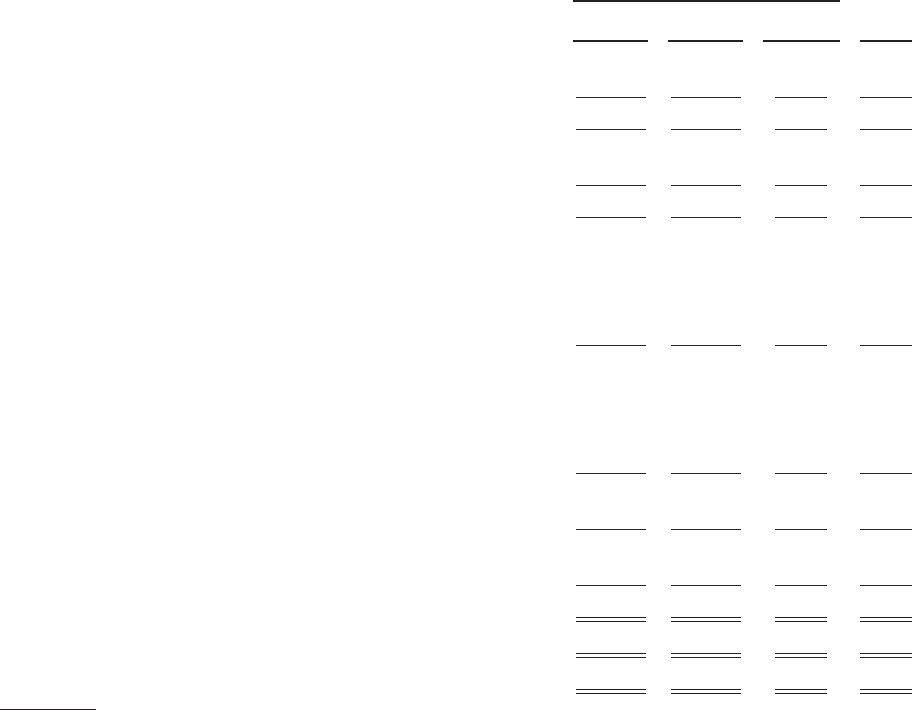

Statements of Income as Reported and Adjusted

(In millions, except per share amounts)

Fiscal

2010

Fiscal

2009

Increase/

(Decrease)

%

Change

Revenues, net (as adjusted)(1) ............................... $1,450.0 $1,398.9 $ 51.1 3.7%

UK VAT ruling accrual reversal(1) ....................... 2.0 — $ 2.0

Revenues, net of VAT ruling ................................ 1,452.0 1,398.9 53.1 3.8%

Cost of revenues (as adjusted)(2) ............................. 661.4 638.5 22.9 3.6%

UK self-employment tax ruling(2) ........................ — 32.5 (32.5)

Cost of revenues ......................................... 661.4 671.0 (9.5) (1.4%)

Gross Profit ..................................... 790.6 727.9 62.7 8.6%

Gross Margin % ................................. 54.4% 52.0%

Marketing expenses ....................................... 217.1 200.5 16.6 8.3%

Selling, general & administrative expenses (as adjusted)(2) ........ 183.2 165.3 17.8 10.7%

Impact of restructuring charges .......................... — 5.5 (5.5)

Selling, general & administrative expenses .................... 183.2 170.8 12.3 7.2%

Operating income ................................ 390.3 356.7 33.7 9.4%

Operating Income Margin % ........................ 26.9% 25.5%

Interest expense .......................................... 76.2 66.7 9.5 14.2%

Other expense (income), net ................................ 0.9 (0.2) 1.1 (100.0%)

Income before income taxes ........................ 313.2 290.1 23.1 7.9%

Provision for income taxes ................................. 120.7 115.6 5.1 4.4%

Net income ...................................... 192.5 174.5 18.0 10.3%

Net loss attributable to the noncontrolling interest ............... 1.7 2.8 (1.1) (38.2%)

Net income attributable to the Company ............... $ 194.2 $ 177.3 $ 16.9 9.5%

Weighted average diluted shares outstanding ................... 75.9 77.1 (1.2) (1.6%)

Diluted EPS ............................................. $ 2.56 $ 2.30 $ 0.26 11.3%

(1) “As adjusted” is a non-GAAP financial measure that adjusts the consolidated statements of income for fiscal

2010 to exclude the benefit of a $2.0 million increase to revenues from the reversal of an over-accrual

related to the adverse UK VAT ruling. See “Non-GAAP Financial Measures” above for an explanation of

our use of non-GAAP financial measures.

(2) “As adjusted” is a non-GAAP financial measure that adjusts the consolidated statements of income for fiscal

2009 to exclude $32.5 million in cost of revenues for the impact of the UK self-employment tax ruling, and

to exclude from selling, general and administrative expenses the impact of $5.5 million of restructuring

charges associated with our previously disclosed cost savings initiatives. See “Non-GAAP Financial

Measures” above for an explanation of our use of non-GAAP financial measures.

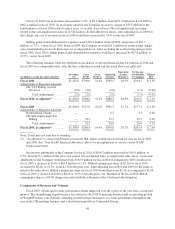

Consolidated Results

Our revenues increased by $53.1 million from $1,398.9 million in fiscal 2009 to $1,452.0 million in fiscal

2010, an increase of 3.8%. As noted in the above table, fiscal 2010 results included a benefit to revenue of $2.0

million for a partial accrual reversal of a charge previously recorded in the second quarter of fiscal 2008. As

previously reported, this charge, which reduced revenues in fiscal 2008 for current and prior year periods, and

which has now been paid, was related to an adverse ruling the Company received with respect to the imposition

of UK VAT on meeting fees collected by our UK subsidiary. After adjusting for this charge, 2010 revenues

increased by $51.1 million, or 3.7%, versus the prior year.

48