WeightWatchers 2011 Annual Report Download - page 54

Download and view the complete annual report

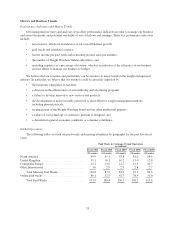

Please find page 54 of the 2011 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.in early November 2010, and saw attendance growth as a result of the launch. However, because of a decision to

significantly limit marketing in the fall campaign prior to the new program launch and as result of bad weather

during the program launch period, fourth quarter 2010 attendances were down 11.3% versus the fourth quarter of

fiscal 2009.

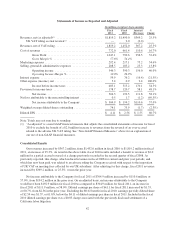

In fiscal 2011, paid weeks grew 18.3% versus the prior year, benefiting from enrollment growth concurrent

with the launch of ProPoints late in fiscal 2010 and early fiscal 2011 and an increase in Monthly Pass

penetration. As with NACO, this growth in recruitment resulted in a larger customer base and as a result,

attendances also grew, up 13.7% versus the prior year period, as the new program drove members, both new and

returning, into our meeting rooms. For all four quarters of fiscal 2011, paid weeks grew as compared to the

comparable prior year period, up 21.9%, 16.1%, 18.1% and 17.1% and attendances grew 22.2%, 8.5% (impacted

by the Royal Wedding and Easter timing), 10.1% and 13.0%, respectively, as compared to the prior year periods.

Continental Europe Meeting Metrics and Business Trends

In 2007, meeting attendance declined by 8.5% versus the prior year, and we began the process of

strengthening the local management teams in our Continental European markets. We saw some improvement in

the negative attendance trend in 2008, with attendance down 4.1% versus the prior year. Prior to the launch of

Monthly Pass, attendance performance had more closely approximated the declines in meeting paid weeks. With

the introduction of Monthly Pass into Continental Europe, beginning with Germany in the third quarter of fiscal

2007 and then moving into France in April 2008, paid weeks began to outpace attendances. Monthly Pass drove

an overall 16.5% increase in paid weeks for fiscal 2008 in Continental Europe versus the prior year.

In fiscal 2009, most of our Continental European markets were deeply affected by the difficult recessionary

conditions. While Continental Europe experienced paid weeks growth of 1.6% versus the prior year as the market

continued to benefit from increased Monthly Pass penetration, meeting attendance declined 11.8% versus the

prior year. During fiscal 2009, we took the step of re-evaluating the meeting base in a number of countries,

including Germany, closing weaker meetings and building on stronger meetings for a better meeting experience

for our members. This initiative resulted in better compensation for our service providers and higher gross

margins, and created a stronger foundation from which to grow. In addition, during fiscal 2009, the management

teams in Continental Europe prepared for the launch of a major new innovative program, ProPoints, which

launched in the fourth quarter of fiscal 2009.

For fiscal 2010, meeting paid weeks, benefiting from enrollment growth early in the year and an increase in

Monthly Pass penetration, grew 6.9% versus the prior year, while attendance in Continental Europe declined

1.6% versus the prior year. In the first half of fiscal 2010, the Continental European market experienced meeting

attendance growth as a result of the ProPoints program, which drove an influx of returning members to our

meetings who were attracted by the new program. The marketing of this new program, however, was not

successful in capturing the attention of new members and, as a result, meeting attendance began to decline in the

third quarter of fiscal 2010.

Entering fiscal 2011, Continental European performance continued its downward trend, with meeting paid

weeks down 9.8% versus the prior year and attendances down 15.4% versus the prior year. In the first half of

fiscal 2011, meeting paid weeks declined by 13.1% and attendance declined by 18.9% versus the prior year

period, as the business lapped its program launch in the prior year. Promotional strategies in the first quarter of

fiscal 2011 resulted in an increase in Monthly Pass penetration in some Continental European markets, which

accounted for a smaller decline in meeting paid weeks versus attendance. While still negative versus the prior

year period, the trend began to improve in the third quarter of fiscal 2011 with paid weeks down 6.0% and

attendances down 15.1%. In the fourth quarter of fiscal 2011, Continental Europe soft launched its updated

version of ProPoints in December, resulting in a less negative performance with paid weeks down 4.9% and

attendances down 4.3% versus the prior year period.

36