WeightWatchers 2011 Annual Report Download - page 92

Download and view the complete annual report

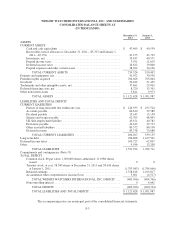

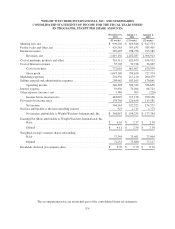

Please find page 92 of the 2011 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.WEIGHT WATCHERS INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(IN THOUSANDS, EXCEPT PER SHARE AMOUNTS)

Inventories:

Inventories, which consist of finished goods, are stated at the lower of cost or market on a first-in, first-out

basis, net of reserves for obsolescence and shrinkage.

Property and Equipment:

Property and equipment are recorded at cost. For financial reporting purposes, equipment is depreciated on

the straight-line method over the estimated useful lives of the assets (3 to 10 years). Leasehold improvements are

amortized on the straight-line method over the shorter of the term of the lease or the useful life of the related

assets. Expenditures for new facilities and improvements that substantially extend the useful life of an asset are

capitalized. Ordinary repairs and maintenance are expensed as incurred. When assets are retired or otherwise

disposed of, the cost and related depreciation are removed from the accounts and any related gains or losses are

included in income.

Impairment of Long Lived Assets:

The Company reviews long-lived assets, including amortizable intangible assets, for impairment whenever

events or changes in business circumstances indicate that the carrying amount of the assets may not be fully

recoverable.

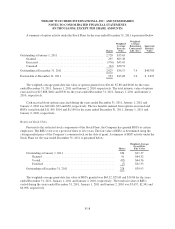

Goodwill and Intangible Assets:

Finite-lived intangible assets are amortized using the straight-line method over their estimated useful lives

of 3 to 20 years. The Company reviews goodwill and other indefinite-lived intangible assets, including franchise

rights acquired, for potential impairment on at least an annual basis or more often if events so require. The

Company performed fair value impairment testing as of the end of fiscal 2011 and fiscal 2010 on its goodwill

and other indefinite-lived intangible assets and determined that the carrying amounts of these assets did not

exceed their respective fair values, and therefore, no impairment existed. When determining fair value, the

Company utilizes various assumptions, including projections of future cash flows, growth rates and discount

rates. A change in these underlying assumptions will cause a change in the results of the tests and, as such, could

cause fair value to be less than the carrying amounts. In the event such a decrease occurred, the Company would

be required to record a corresponding charge, which would impact earnings. The Company would also be

required to reduce the carrying amounts of the related assets on its balance sheet. The Company continues to

evaluate these estimates and assumptions and believes that these assumptions are appropriate.

In performing the impairment analysis for franchise rights acquired, the fair value for the Company’s

franchise rights acquired is estimated using a discounted cash flow approach. This approach involves projecting

future cash flows attributable to the franchise rights acquired and discounting those estimated cash flows using an

appropriate discount rate. The estimated fair value is then compared to the carrying value of the unit of

accounting for those franchise rights. In determining the appropriate unit of accounting, the Company has

concluded that the unit of accounting for each franchise right acquired is the country corresponding to the

acquired franchise territory. The carrying values of these franchise rights acquired in the United States, Canada,

United Kingdom, Australia/New Zealand and other countries at December 31, 2011 were $656,638, $70,688,

$16,575, $15,171 and $4,954, respectively, totaling $764,026.

The Company estimates future cash flows for each unit of accounting by utilizing the historical cash flows

attributable to the rights in that country and then applying a growth rate using a blend of the historical operating

F-8