WeightWatchers 2011 Annual Report Download - page 69

Download and view the complete annual report

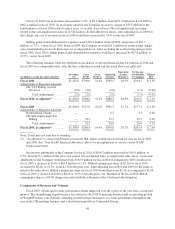

Please find page 69 of the 2011 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.30.3 million in fiscal 2010,as a result of performance weakness in the early part of the year. First quarter 2010

meeting attendance was down 16.0%, and paid weeks declined 8.0% versus the prior year period. This first

quarter performance weakness was the result of a marketing campaign in NACO that was ineffective at attracting

our target consumer, coupled with the impact of very poor weather conditions, which caused some meeting

closures and low attendance in the remaining meetings in weather affected areas. In the spring, NACO launched

a new marketing strategy and campaign focused on member experience, featuring Jennifer Hudson as its new

spokesperson. With this change, business performance began an improvement trend in the second quarter 2010

that continued through the rest of the year. Compared to prior year periods, second quarter 2010 attendance and

paid weeks declined 4.9% and 1.8%, respectively, while in the third quarter, attendance improved to a decline of

3.8% and paid weeks increased by 2.8%.

In addition to the benefits realized from the new marketing strategy, NACO initiated other growth strategies

during fiscal 2010, including revamping the retail structure in select markets, with a focus on a new look and feel

for the meeting centers, and consolidating meetings toward stronger locations and better performing leaders.

These new strategies coupled with the launch of the new PointsPlus program in late November resulted in a

positive end to fiscal 2010 for NACO, with solid growth in the fourth quarter in both paid weeks and attendance,

up 4.2% and 6.8%, respectively, versus the fourth quarter of fiscal 2009.

For fiscal 2010, our international meeting fees were $274.4 million, an increase of $3.8 million, or 1.4%,

from $270.6 million in the prior year period. After the $2.0 million adjustment to 2010 international meeting fees

for the UK VAT accrual reversal noted above, fiscal 2010 international meeting fees would have been $272.3

million, down $1.8 million, or 0.6%, versus prior year, or up $2.9 million or 1.1% on a constant currency basis.

Paid weeks increased by 2.8% in the international meetings business, from 31.7 million in fiscal 2009 to

32.6 million in fiscal 2010. Attendance, however, declined by 6.6%, from 22.1 million in fiscal 2009 to

20.7 million in fiscal 2010.

The lack of substantive growth in international meeting fees was primarily the result of weakness in the

United Kingdom throughout the year and a slowdown in momentum in Continental Europe in the second half of

the year. Meeting fees in the United Kingdom declined by 1.3%, but excluding the benefit of the UK VAT

accrual reversal would have declined by 2.0% on a constant currency basis, in fiscal 2010 versus fiscal 2009. Full

year attendance performance in this market was weak, declining 10.5% versus the prior year. Paid weeks,

however, were nearly on par with the prior year, down 0.4%, reflecting a continuation of growth in Monthly Pass

penetration and strong retention. In the first quarter 2010, UK attendance volumes were down 12.8%,

significantly impacted by weather and cycling against a program innovation in the prior year. Absent a new

marketing campaign in the spring to draw enrollments, the United Kingdom continued to experience deep

declines in attendance throughout 2010. In November 2010, the United Kingdom launched its new program,

ProPoints; however, because of a decision to significantly limit marketing in the fall campaign prior to the new

program launch, and as result of bad weather during this program launch period, fourth quarter 2010 attendances

were down 11.3% versus the fourth quarter of 2009.

Meeting fees in Continental Europe increased by 0.1%, or 3.4% on a constant currency basis, in fiscal 2010

versus fiscal 2009. In the first half of 2010, the Continental European market experienced 3.3% meeting

attendance growth over the prior year period as a result of the ProPoints program,which drove an influx of

returning members to our meetings who were attracted by the new program. The marketing of this new program,

however, was not successful in capturing the attention of new members, and as a result, attendance began a

decline in the third quarter which continued through the end of the year. In addition, France faced strong

competition from a new fad diet. For fiscal 2010, paid weeks in Continental Europe increased by 6.9%,

benefiting from enrollment growth early in the year and an increase in Monthly Pass penetration, but attendances

declined by 1.6% versus prior year.

51