WeightWatchers 2011 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2011 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.WEIGHT WATCHERS INTERNATIONAL, INC. AND SUBSIDIARIES

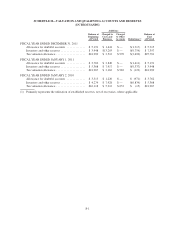

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(IN THOUSANDS, EXCEPT PER SHARE AMOUNTS)

19. Subsequent Events

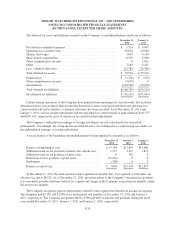

Pending Tender Offer and Pending Share Repurchase

On February 23, 2012, the Company commenced a tender offer in which it is seeking to acquire up to

$720,000 of its common stock at a price between $72.00 and $83.00 per share (the “Pending Tender Offer”).

Prior to the Pending Tender Offer, the Company entered into an agreement with Artal Holdings whereby Artal

Holdings agreed to sell to the Company, at the same price as was determined in the Pending Tender Offer, the

number of its shares of the Company’s common stock necessary to keep its current percentage ownership interest

in the Company at substantially the same level after the Pending Tender Offer (the “Pending Share Repurchase”).

Artal Holdings also agreed not to participate in the Pending Tender Offer so that it would not affect the

determination of the price in the Pending Tender Offer. The Pending Tender Offer will expire at midnight, New

York time, on March 22, 2012, unless the Company extends it. The Company has reserved the right to purchase

up to an additional 2% of the Company’s shares outstanding without amending or extending the Pending Tender

Offer.

A condition to the Pending Tender Offer is the consummation of financing, on terms satisfactory to the

Company, resulting in aggregate proceeds to the Company that are sufficient to fund the purchase of shares under

the Pending Tender Offer and the Pending Share Repurchase.

F-29