Tyson Foods 2003 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2003 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Tyson Foods, Inc. 61

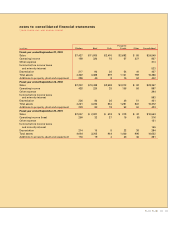

notes to consolidated financial statements

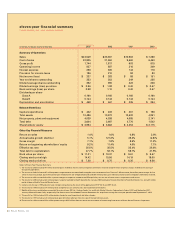

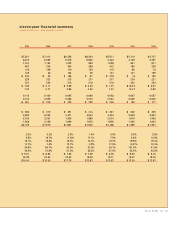

TYSON FOODS, INC. 2003 ANNUAL REPORT

Action Complaint. The plaintiffs allege that, as a result of

the defendants’ alleged conduct, the purported class

members were harmed. On January 22, 2002, the

defendants filed a motion to dismiss the consolidated

complaint. By memorandum order dated October 23,

2002, the court granted in part and denied in part the

defendants’ motion to dismiss. On October 6, 2003, the

court certified the class proposed by plaintiffs. Factual

discovery in the case is in the process of concluding.

General Matters In July 1996, certain cattle producers

filed Henry Lee Pickett, et al. vs. IBP, inc. in the U.S. District

Court, Middle District of Alabama, seeking certification of

a class of all cattle producers. The complaint alleged that

IBP used its market power and alleged “captive supply”

agreements to reduce the prices paid by IBP on purchases

of cattle in the cash market in alleged violation of the

Packers and Stockyards Act (“PSA”). Plaintiffs are seeking

injunctive and declaratory relief, as well as actual and

punitive damages. After Plaintiffs failed a number of times

to get a class certified, the District Court in December

2001 certified a class of cattle producers who have sold

to IBP exclusively on a cash market basis from approxi-

mately 1994 to 2002. IBP sought permission to appeal the

class certification to the 11th Circuit Court of Appeals,

but the Court of Appeals denied that appeal on March 5,

2002. IBP’s motions for summary judgment on both

liability and damages were denied on April 29, 2003.

On November 19, 2003, the District Court judge upheld

the admissibility of an amended Plaintiffs’ expert report

which calculates total class damages, exclusive of pre-

judgment interest, in excess of $2.1 billion. Management

believes IBP’s use of marketing agreements and other

contracts for the purchase of cattle do not violate the

PSA and that IBP has acted properly and lawfully in its

dealings with cattle producers. The case is set for trial on

January 12, 2004.

On September 12, 2002, 82 individual plaintiffs filed

Michael Archer, et al. v. Tyson Foods, Inc. and The Pork

Group, Inc., CIV 2002-497, in the Circuit Court of Pope

County, Arkansas. On August 18, 2002, the Company

announced a restructuring of its live swine operations

which, among other things, will result in the discontinu-

ance of relationships with 132 contract hog producers,

including the plaintiffs. In their complaint, the plaintiffs

allege that the Company committed fraud and should be

promissorily estopped from terminating the parties’ rela-

tionship. The plaintiffs seek an unspecified amount of

compensatory damages, punitive damages, attorney

fees and costs. The Company has filed a motion to Stay

All Proceedings and Compel Arbitration which was

denied, and briefing has begun in the Arkansas Court of

Appeals. Oral argument has not yet been set.

The Company is pursuing various antitrust claims relating

to vitamins, methionine and choline. In partial settlement

of these claims, the Company received approximately

$167 million in 2003. Additional settlements of much

lesser amounts are anticipated in fiscal 2004. Amounts

received for these claims are recorded as income only

upon receipt of settlement proceeds.