Tyson Foods 2003 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2003 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

40 Tyson Foods, Inc.

notes to consolidated financial statements

TYSON FOODS, INC. 2003 ANNUAL REPORT

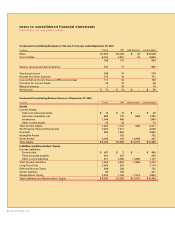

The costs are reflected in the Chicken segment as a

reduction of operating income and included in the con-

solidated statements of income in other charges. At

September 27, 2003, the remaining accrual balance for

closing the two poultry operations was $2 million, as

$16 million of obligations under grower contracts and

$12 million of other closing costs had been paid, and

losses related to the disposal of assets of $17 million

were realized. No material adjustments to the total

accrual are anticipated at this time.

In the fourth quarter of fiscal 2002, the Company recorded

a $26 million accrual for restructuring its live swine opera-

tions that consists of $21 million of estimated liabilities for

resolution of Company obligations under producer con-

tracts and $5 million of other related costs associated with

this restructuring including lagoon and pit closure costs

and employee termination benefits. At September 27,

2003, the remaining accrual balance was $16 million,

as $6 million of obligations under grower contracts and

$4 million of other related costs had been paid. No material

adjustments to the total accrual are anticipated at this time.

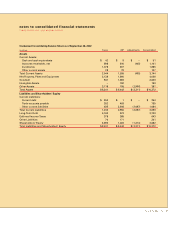

In August 2002, the Company made the decision to capi-

talize on the strong recognition of the Tyson brand by

expanding the Tyson brand to beef and pork. Thus, in the

fourth quarter of fiscal 2002 the Company recorded a

write-down of $27 million related to the discontinuation

of the Thomas E. Wilson brand. This amount is reflected

in the Prepared Foods segment as a reduction to operat-

ing income and included on the consolidated statement

of income in other charges.

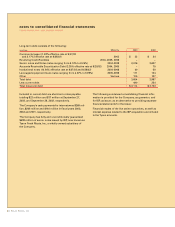

note 5:

allowance for doubtful accounts

At September 27, 2003, and September 28, 2002, the

allowance for doubtful accounts was $16 million and

$26 million, respectively.

5

note 6:

financial instruments

The Company recognizes all derivatives on the balance

sheet at fair value as required by SFAS No. 133,

“Accounting for Derivative Instruments and Hedging

Activities,” as amended. Derivatives that are not hedges

must be adjusted to fair value through earnings. If the

derivative is a hedge, depending on the nature of the

hedge, changes in the fair value of derivatives will either

be offset against the change in fair value of the hedged

assets, liabilities or firm commitments through earnings,

or recognized in other comprehensive income (loss) until

the hedged item is recognized in earnings. The ineffec-

tive portion of a derivative’s change in fair value is

recognized in earnings.

The Company had derivative related balances totaling

$20 million and $1 million recorded in other current

assets at September 27, 2003, and September 28, 2002,

respectively, and $37 million and $19 million recorded in

other current liabilities at September 27, 2003, and

September 28, 2002, respectively.

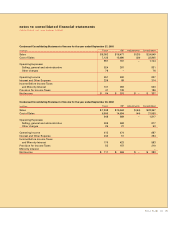

Cash Flow Hedges: The Company uses derivatives to

moderate the financial and commodity market risks of its

business operations. Derivative products, such as futures

and option contracts, are considered to be a hedge against

changes in the amount of future cash flows related to

commodities procurement. The Company also enters into

interest rate swap agreements to adjust the proportion of

total long-term debt and leveraged equipment loans that

are subject to variable interest rates. Under these interest

rate swaps, the Company agrees to pay a fixed rate of

interest times a notional principal amount and to receive

in return an amount equal to a specified variable rate of

interest times the same notional principal amount. These

interest rate swaps are considered to be a hedge against

changes in the amount of future cash flows associated

with the Company’s variable rate interest payments.

6