Tyson Foods 2003 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2003 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Tyson Foods, Inc. 51

notes to consolidated financial statements

TYSON FOODS, INC. 2003 ANNUAL REPORT

note 11:

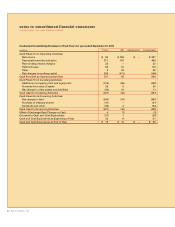

comprehensive income (loss)

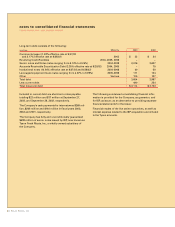

The components of accumulated other comprehensive

income (loss) include: foreign currency translation adjust-

ment of $(2) million, $(23) million and $(16) million for

2003, 2002 and 2001, respectively; unrealized hedging

gains (losses), net of taxes, of $(9) million, $(18) million

and $(21) for 2003, 2002 and 2001, respectively; unreal-

ized gain (loss) on investments, net of taxes, of $1, $0

and $2 million for 2003, 2002 and 2001, respectively; and

minimum pension liability adjustment, net of taxes, of

$(5) million and $(8) million for 2003 and 2002, respectively.

note 12:

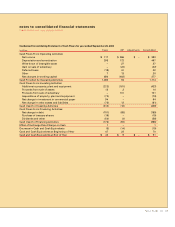

stock options and restricted stock

The shareholders approved the Tyson Foods, Inc. 2000

Stock Incentive Plan (Incentive Plan) in January 2001.

The Incentive Plan is administered by the Compensation

Committee of the Board of Directors and permits awards

of shares of Class A stock, awards of derivative securities

related to the value of Class A stock and tax reimburse-

ment payments to eligible persons. The Incentive Plan

provides for the award of a variety of equity-based incen-

tives such as incentive stock options, nonqualified stock

options, stock appreciation rights, dividend equivalent

rights, performance unit awards and phantom shares.

The Incentive Plan provides for granting incentive stock

options for shares of Class A stock at a price not less

than the fair market value at the date of grant. Non-

qualified stock options may be granted at a price equal

to, less than or more than the fair market value of Class A

stock on the date that the option is granted. Stock options

under the Incentive Plan generally become exercisable rat-

ably over three to eight years from the date of grant and

must be exercised within 10 years from the date of grant.

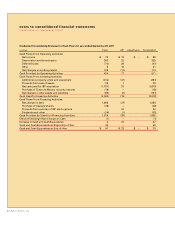

In May 2000, the Company cancelled approximately four

million option shares and granted approximately one

million restricted shares of Class A stock. The restriction

expires over periods through December 1, 2003. At

12

11

September 27, 2003, the Company had outstanding

approximately nine million restricted shares of Class A

stock with restrictions expiring over periods through

July 1, 2020. The unearned portion of the restricted stock

is classified on the Consolidated Balance Sheets as

unamortized deferred compensation in shareholders’

equity. The Company issues restricted stock at the market

value as of the date of grant. The weighted average fair

value of restricted stock granted was $11.20 per share

during 2003 and $9.52 per share during 2002.

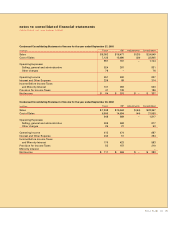

A summary of the Company’s stock option activity is as

follows: Weighted average

Shares exercise price

under option per share

Outstanding,

September 30, 2000 6,798,005 $16.19

Exercised – –

Canceled (689,520) 15.57

Granted 4,291,650 11.50

Options assumed with

IBP acquisition 5,918,068 8.70

Outstanding,

September 29, 2001 16,318,203 12.27

Exercised (800,596) 9.50

Canceled (997,816) 12.97

Granted 2,509,695 9.45

Outstanding,

September 28, 2002 17,029,486 12.01

Exercised (775,682) 8.99

Canceled (1,697,581) 13.38

Granted 6,316,704 11.69

Outstanding,

September 27, 2003 20,872,927 $11.94

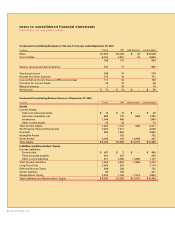

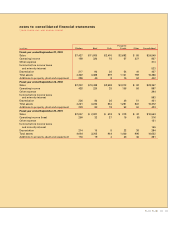

The number of options exercisable was as follows:

September 27, 2003–9,135,306, September 28, 2002–

9,373,360 and September 29, 2001–9,644,323. The remain-

der of the options outstanding at September 27, 2003, are

exercisable ratably through September 2008. The number

of shares available for future grants was 21,327,929 and

10,536,763 at September 27, 2003, and September 28,

2002, respectively.