Tyson Foods 2003 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2003 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Tyson Foods, Inc. 25

management’s discussion and analysis

TYSON FOODS, INC. 2003 ANNUAL REPORT

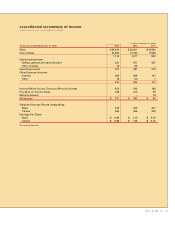

Cost of sales increased $12 billion or 123.1%, primarily

due to the inclusion of IBP’s cost of sales in fiscal 2002.

As a percent of sales, cost of sales was 92.2% for 2002

compared to 91.5% for 2001.

Selling, general and administrative expenses increased

$290 million or 49.5%, primarily due to the inclusion of

IBP’s operations in fiscal 2002. As a percent of sales,

operating expenses were 3.8% for 2002 compared to

5.6% in 2001. In its effort to integrate, restructure and

reorganize, the Company improved efficiencies and

lowered plant operating costs. These costs were also

reduced through other cost-containment efforts and

improved sales expense management.

Other charges include $27 million related to the discon-

tinuation of the Thomas E. Wilson brand and $26 million

related to the restructuring of the Company’s live swine

operation.

Interest expense increased 111.8% compared to 2001. As

a percent of sales, interest expense was 1.3% compared

to 1.4% for 2001. The Company’s average indebtedness

increased by 109.7% over fiscal 2001 due to debt incurred

to purchase IBP. The Company’s short-term interest rates

decreased to 3.3% in fiscal 2002 as compared to 5.1% in

fiscal 2001. The overall weighted average borrowing rate

on total debt was 7.0% for fiscal 2002 compared to 6.9%

for fiscal 2001.

Other income increased in the current year due to a gain

of $22 million from the sale of the Specialty Brands, Inc.

subsidiary.

The effective tax rate was 35.5% in 2002 compared to

35.4% in 2001. The Company adopted Statement of

Financial Accounting Standards No. 142, “Goodwill and

Other Intangible Assets” (SFAS No. 142), at the beginning

of 2002. Under SFAS No. 142 the Company no longer

amortized goodwill which resulted in a decrease in the

effective tax rate for 2002, offset primarily by a reduction

in the foreign sales benefit.

SEGMENT INFORMATION

For the periods ending September 28, 2002, and

September 29, 2001, the following information includes

100% of IBP results for 52 weeks and nine weeks, respec-

tively. Information on segments is as follows:

Sales by Segment

in millions 2002 2001 Change

Chicken $ 7,222 $ 7,057 $ 165

Beef 10,488 2,027 8,461

Pork 2,503 619 1,884

Prepared Foods 3,072 818 2,254

Other 82 42 40

Total $23,367 $10,563 $12,804

Operating Income (Loss) by Segment

in millions 2002 2001 Change

Chicken $ 428 $ 250 $ 178

Beef 220 32 188

Pork 25 27 (2)

Prepared Foods 158 15 143

Other 56 (8) 64

Total $ 887 $ 316 $ 571

Chicken segment sales increased $165 million or 2.3%

compared to 2001, with a 1.1% increase in average sale

prices and a 1.2% increase in volume. Foodservice chicken

sales increased 4.9%, retail chicken sales increased 2.0%

and international chicken sales decreased 6.3%. In fiscal

2002, the Company’s Mexican subsidiary sales increased

36.1% due to the acquisition of a production facility in

Mexico in the third quarter of 2001. This increase was

more than offset by decreases in other international sales

demand as markets were impacted by import restrictions

and political pressures primarily in Russia and China.

Operating income for Chicken increased $178 million as

compared to 2001, primarily due to decreases in live and

production costs along with improvements in price and

growth in value-added product mix. Additionally, fiscal

2001 costs were negatively impacted by weather related

effects and higher grain and energy costs.