Tyson Foods 2003 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2003 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Tyson Foods, Inc. 27

management’s discussion and analysis

TYSON FOODS, INC. 2003 ANNUAL REPORT

progress that will require approximately $175 million to

complete. Capital spending for fiscal 2004 is expected to

be in the range of $450 to $500 million, which includes

spending on plant automation as well as information

systems technology improvements. Additionally, on

December 5, 2003, the Company announced that in order

to further improve long-term manufacturing efficiencies,

it will be closing facilities in Manchester, New Hampshire,

and Augusta, Maine, in early 2004. The Company antici-

pates recording pretax charges related to these closings

of approximately $23 to $27 million or $0.04 to $0.05 per

diluted share in the first half of fiscal 2004.

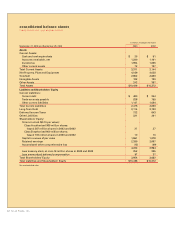

Total debt at September 27, 2003, was $3,604 million, a

decrease of approximately $383 million from September 28,

2002. The Company has unsecured revolving credit

facilities totaling $1 billion that support the Company’s

commercial paper program. These $1 billion in facilities

consist of $200 million that expire in June 2004, $300 mil-

lion that expire in June 2005 and $500 million that expire in

September 2006. At September 27, 2003, there were no

borrowings outstanding under these facilities. Additional

outstanding debt at September 27, 2003, consisted of

$3.3 billion of debt securities, $32 million of commercial

paper and other indebtedness of $256 million.

The revolving credit facilities, senior notes, notes and

accounts receivable securitization contain various

covenants, the more restrictive of which contain a maxi-

mum allowed leverage ratio and a minimum required

interest coverage ratio. The Company is in compliance

with these covenants at fiscal year end.

OFF-BALANCE SHEET ARRANGEMENTS

The Company does not have any off-balance sheet

arrangements that are material to its financial position

or results of operations. The off-balance sheet arrange-

ments the Company has are guarantees of debt of

outside third parties involving letters of credit, a lease,

grower loans and residual value guarantees covering

certain operating leases for various types of equipment.

See Note 9 to the Consolidated Financial Statements for

further discussions of these guarantees.

RECENTLY ISSUED ACCOUNTING STANDARDS

In January 2003, the Financial Accounting Standards Board

(FASB) issued Interpretation No. 46, “Consolidation of

Variable Interest Entities, an Interpretation of Accounting

Research Bulletin No. 51” (the Interpretation). The

Interpretation requires the consolidation of variable

interest entities in which an enterprise absorbs a majority

of the entity’s expected losses, receives a majority of the

entity’s expected residual returns, or both, as a result of

ownership, contractual or other financial interests in the

entity. Currently, entities are generally consolidated by an

enterprise that has a controlling financial interest through

ownership of a majority voting interest in the entity. The

Interpretation was originally effective immediately for

variable interest entities created after January 31, 2003,

and effective in the fourth quarter of the Company’s fiscal

2003 for those created prior to February 1, 2003. However,

in October 2003, the FASB deferred the effective date for

those variable interest entities created prior to February 1,

2003, until the Company’s first quarter of fiscal 2004. The

Company has substantially completed the process of

evaluating the Interpretation and believes its adoption

will not have a material impact on its financial position

or results of operations.

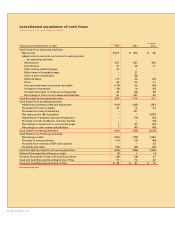

Cash Provided by Operating Activities

dollars in millions

Total Capitalization

dollars in millions

2003

2002

2001

$ 820

$1,174

$ 511

$3,987

$3,662

2003

2002

2001

Debt Equity

$4,776

$3,954

$3,604

$3,354