Tyson Foods 2003 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2003 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Tyson Foods, Inc. 39

notes to consolidated financial statements

TYSON FOODS, INC. 2003 ANNUAL REPORT

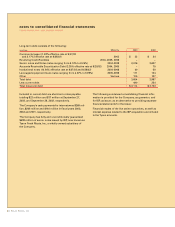

a $74 million purchase option to acquire assets leased

from a third party which the Company had subleased to

Choctaw. Pro forma operating results reflecting the acqui-

sition of Choctaw would not be materially different from

the Company’s actual results of operations.

In May 2002, the Company acquired the assets of Millard

Processing Services, a bacon processing operation, for

approximately $73 million in cash. The acquisition has

been accounted for as a purchase and goodwill of

approximately $14 million has been recorded.

In August 2001, the Company acquired 50.1% of IBP by

paying approximately $1.7 billion in cash. In September

2001, the Company issued approximately 129 million

shares of Class A stock, with a fair value of approxi-

mately $1.2 billion, to acquire the remaining IBP shares,

and assumed approximately $1.7 billion of IBP debt. The

total acquisition cost of approximately $4.6 billion was

accounted for as a purchase in accordance with SFAS

No. 141 “Business Combinations.” Accordingly, the

tangible and identifiable intangible assets and liabilities

have been adjusted to fair values with the remainder of

the purchase price recorded as goodwill. The allocation

of the purchase price has been completed.

note 3:

disposition

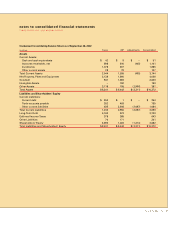

In September 2002, the Company completed the sale of

its Specialty Brands, Inc. subsidiary. The subsidiary had

been acquired with the IBP acquisition, and its results of

operations were included in the Company’s Prepared

Foods segment. The Company received cash proceeds of

approximately $131 million, which were used to reduce

indebtedness, and recognized a pretax gain of $22 million,

which is included in other income on the consolidated

statement of income of fiscal 2002.

note 4:

other charges

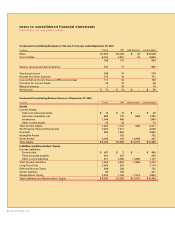

In April 2003, the Company announced its decision to

close its Berlin, Maryland, poultry operation as part of its

ongoing plant rationalization efforts. The Berlin poultry

operation employed approximately 650 people and

included a hatchery, a feed mill, live production and a

4

3

processing facility. The facility ceased processing chick-

ens November 12, 2003. As a result of this decision, the

Company is anticipating total costs of $29 million that

include $14 million of costs related to closing the plant

and $15 million of estimated impairment charges for

assets to be disposed of. The costs related to closing the

plant include $9 million for estimated liabilities for the

resolution of the Company’s obligations under 209

grower contracts, and $5 million of other related costs

associated with the closing of the plant including plant

clean-up costs and employee termination benefits. The

Company is accounting for the closing of the Berlin oper-

ations in accordance with SFAS No. 146, “Accounting

for Costs Associated with Exit or Disposal Activities.” In

fiscal 2003, the Company recorded accruals of $25 million

($19 million in the third quarter and $6 million in the

fourth quarter) that included $10 million of costs related

to closing the plant and $15 million of estimated impair-

ment charges for assets to be disposed. This amount is

reflected in the Chicken segment as a reduction of oper-

ating income and included in the consolidated statements

of income in other charges. The costs related to closing

the plant that have been accrued as of September 27,

2003, include $7 million for estimated liabilities for the

resolution of the Company’s obligations under grower

contracts and $3 million of other related costs associated

with the closing of the plant, including plant clean-up costs

and employee termination benefits. At September 27,

2003, the accrual balance was $16 million, as $4 million

of obligations under grower contracts and $3 million of

other closing costs had been paid, and losses related to

the disposal of assets of $2 million were realized. The

Company anticipates recording additional costs of

approximately $4 million in the first quarter of fiscal

2004 related to closing the plant.

In the first quarter of fiscal 2003, the Company recorded

a $47 million accrual of costs related to the closing of its

Stilwell, Oklahoma, and Jacksonville, Florida, plants that

includes $26 million of costs related to closing the plants

and $21 million of estimated impairment charges for

assets to be disposed. The costs related to closing the

plants include $17 million for estimated liabilities for the

resolution of the Company’s obligations under grower

contracts, and $9 million of other related costs associated

with the closing of the plants including plant clean-up

costs and employee termination benefits.