Tyson Foods 2003 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2003 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

22 Tyson Foods, Inc.

management’s discussion and analysis

TYSON FOODS, INC. 2003 ANNUAL REPORT

RESULTS OF OPERATIONS

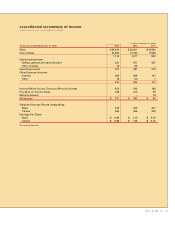

Earnings for fiscal 2003 were $337 million or $0.96 per

diluted share compared to $383 million or $1.08 per

diluted share in fiscal 2002. Fiscal 2003 pretax earnings

include $167 million received in connection with vitamin

antitrust litigation and $76 million of costs related to the

closing of poultry operations during the first, third and

fourth quarters of fiscal 2003.

The Company’s accounting cycle resulted in a 52-week

year for fiscal years 2003, 2002 and 2001.

2003 vs. 2002

Certain reclassifications have been made to prior periods

to conform to current presentations.

Sales increased $1.2 billion or 5.1%, with a slight increase

in volume and a 5.0% increase in price.

Cost of sales increased $1.3 billion or 5.8%. As a percent of

sales, cost of sales was 92.9% for 2003 compared to 92.2%

for 2002. This increase is primarily due to higher live cattle

prices in the Beef segment, increases in grain costs in

the Chicken segment and increased accruals related to

ongoing litigation, partially offset by $167 million

received in connection with vitamin antitrust litigation.

Selling, general and administrative expenses decreased

$46 million or 5.4%. As a percent of sales, selling, general

and administrative expenses decreased from 3.8% to 3.4%.

The decrease is primarily due to the expense reductions

of approximately $42 million related to the sale of

Specialty Brands in the fourth quarter of fiscal 2002, and

approximately $16 million associated with the ongoing

integration of Tyson and IBP, inc. (IBP) corporate functions.

Additional decreases were due to favorable investment

returns of approximately $18 million on Company owned

life insurance, actuarial gains of $13 million related to

changes in certain retiree medical benefit plans and

decreased litigation costs of approximately $19 million

resulting primarily from the reversal of certain legal

accruals which are no longer required due to cases being

closed. The decreases in selling, general and administra-

tive expenses were partially offset by increased pro-

fessional fees of approximately $26 million primarily

related to the Company’s ongoing integration and strategic

initiatives and increased sales promotions and marketing

costs of approximately $45 million primarily due to the

introduction and rollout of several new products.

Other charges include $76 million of plant closing

costs incurred in fiscal 2003, and $53 million of charges

incurred in fiscal 2002 related to the discontinuation of

the Thomas E. Wilson brand and the restructuring of the

Company’s live swine operations.

Interest expense decreased $9 million or 2.8% compared

to 2002, primarily resulting from an 8.2% decrease in the

Company’s average indebtedness. As a percent of sales,

interest expense was 1.2% compared to 1.3% for 2002.

The overall weighted average borrowing rate increased

to 7.4% from 7.0%, primarily resulting from premiums

paid on bonds repurchased in the first and fourth quar-

ters of fiscal 2003. Excluding the premiums paid, interest

expense decreased $21 million.

Other expense increased $29 million from the same

period last year, primarily resulting from the $10 million

write-down related to the impairment of an equity inter-

est in a live swine operation recorded in fiscal 2003, and

the prior year gain of $22 million from the sale of the

Specialty Brands, Inc. subsidiary.

The effective tax rate was 35.5% in both 2003 and 2002.

Several factors impact the effective tax rate including

average state income tax rates, the tax rates for interna-

tional operations and the Extraterritorial Income

Exclusion (ETI) for foreign sales. Taxes on international

earnings were comparable for 2003 and 2002. Average

state taxes added 2.2% and 3% to the effective tax rate

for 2003 compared to 2002 and ETI reduced the effective

rate by 1.9% in 2003 compared to a 1.4% reduction in

2002. Various legislative bills have been introduced in

2003 which would repeal the ETI exclusion over a period

of time, and replace ETI with a partial tax exclusion for

certain domestic production activities. If the ETI exclu-

sion is repealed and replacement legislation is not

enacted, the loss of the ETI tax benefit may adversely

impact the Company’s effective tax rate.