Tyson Foods 2003 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2003 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

of all persons who purchased IBP common stock during

the period from February 7, 2000, through January 25,

2001, and approving proposed notice to the Settlement

Class members. The court also set December 8, 2003, as

the date for a hearing as to whether the settlement should

receive final court approval. The Company does not antic-

ipate that effectuation of the tentative settlement will

have any material impact on its financial condition, espe-

cially in view of IBP’s insurance coverage for the matter.

Between June 22 and July 20, 2001, various plaintiffs

commenced actions (the Delaware Federal Actions)

against the Company, Don Tyson, John Tyson and Les

Baledge in the U.S. District Court for the District of

Delaware, seeking monetary damages on behalf of a

purported class of those who sold IBP stock or traded in

certain IBP options from March 29, 2001, when the

Company announced its intention to terminate the

Merger Agreement with IBP, through June 15, 2001,

when the Delaware Court rendered its Post-Trial Opinion

in the Consolidated Action. The actions, entitled Meyer v.

Tyson Foods, Inc., et al., C.A. No. 01-425 SLR; Banyan

Equity Mgt. v. Tyson Foods, Inc., et al., C.A. No. 01-426

GMS; Steiner v. Tyson Foods, Inc., et al., C.A. No. 01-462

GMS; Aetos Corp., et al. v. Tyson, et al., C.A. No. 01-463

GMS; Meyers, et al. v. Tyson Foods, Inc., et al., C.A. No.

01-480; Binsky v. Tyson Foods, Inc., et al., C.A. No. 01-495;

Management Risk Trading LP v. Tyson Foods, Inc., et al.,

C.A. No. 01-496; and Stark Investments, L.P., et al. v.

Tyson et al., C.A. No. 01-565 alleged that the defendants

violated federal securities laws by making, or causing to

be made, certain false and misleading statements in con-

nection with the Company’s attempted termination of the

Merger Agreement. Plaintiffs are seeking an unspecified

amount of compensatory damages, interest, attorney

fees and costs. The various actions were subsequently

consolidated under the caption In re Tyson Foods, Inc.

Securities Litigation. On December 4, 2001, the plaintiffs

in the consolidated action filed a Consolidated Class

60 Tyson Foods, Inc.

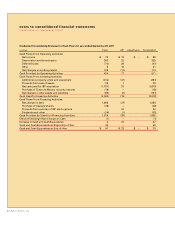

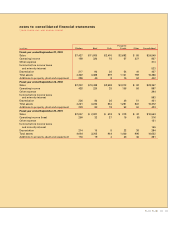

notes to consolidated financial statements

TYSON FOODS, INC. 2003 ANNUAL REPORT

Securities Matters Between January and March 2001, a

number of lawsuits were filed by certain stockholders in

the U.S. District Court for the District of South Dakota and

one suit filed in the U.S. District Court for the Southern

District of New York seeking to certify a class of all per-

sons who purchased IBP stock between February 7, 2000,

and January 25, 2001. The plaintiff in the New York action

voluntarily dismissed and refiled its complaint in South

Dakota, where the suits were consolidated under the

name In re IBP, inc. Securities Litigation and a single, con-

solidated amended complaint was filed. The complaint,

seeking unspecified compensatory damages, alleges

that IBP and certain members of management violated

Sections 10(b) and 20(a) of the Securities Exchange Act of

1934, and Rule 10b-5 thereunder, and claims IBP issued

materially false statements about IBP’s financial results

in order to inflate its stock price. IBP filed a Motion to

Dismiss on December 21, 2001, which was then fully

briefed. While the motion was awaiting decision, IBP and

the plaintiffs reached a tentative settlement of all claims,

as reflected by a Memorandum of Understanding (“MOU”)

that was executed on March 19, 2003. The MOU set forth

the essential terms of a settlement to be reflected in final

settlement documents to be prepared and submitted to

the court for approval, including, among other terms and

conditions, the dismissal with prejudice of all claims

against defendants, releases by class members, and a

payment by IBP of a total amount of $8 million. In July

2003, a finalized Stipulation of Settlement consistent with

the MOU was executed and submitted to the court for its

preliminary approval. The tentative settlement is subject

to various conditions, including among other things,

execution of definitive documentation and receiving pre-

liminary and final court approvals. In light of this tentative

settlement, IBP was permitted by the court to withdraw its

pending motion to dismiss, without prejudice. On July 31,

2003, the court issued an order preliminarily approving

the settlement, preliminarily certifying a Settlement Class