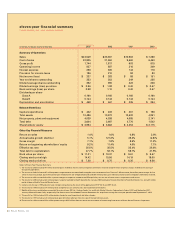

Tyson Foods 2003 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2003 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

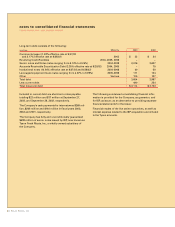

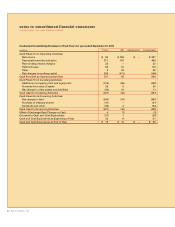

Approximately 8 million, 6 million and 10 million of the

Company’s option shares outstanding at September 27,

2003, September 28, 2002, and September 29, 2001,

respectively, were antidilutive and were not included in the

dilutive earnings per share calculation. On September 28,

2001, the Company issued approximately 129 million

shares for the remaining IBP shares. These shares were

excluded from the fiscal 2001 weighted average share

calculation along with the dilutive effect of acquired stock

options and restricted shares.

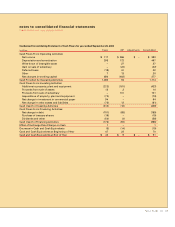

note 17:

segment reporting

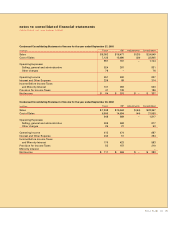

The Company operates in five business segments:

Chicken, Beef, Pork, Prepared Foods and Other. The

Company measures segment profit as operating income.

The following information includes 52 weeks of IBP’s

operating results for the periods ending September 27,

2003, and September 28, 2002, and nine weeks for the

period ending September 29, 2001.

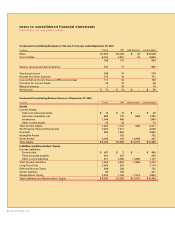

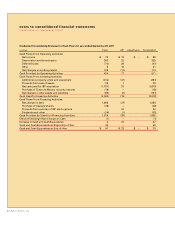

Chicken segment is primarily involved in the processing

of live chickens into fresh, frozen and value-added

chicken products sold through domestic foodservice,

domestic food retailers, wholesale club markets that

service small foodservice operations, small businesses

and individuals, as well as specialty and commodity

distributors who deliver to restaurants, schools and

international markets throughout the world. The Chicken

segment also includes sales from allied products and the

chicken breeding stock subsidiary.

Beef segment is primarily involved in the processing of

live fed cattle and fabrication of dressed beef carcasses

into primal and sub-primal meat cuts and case-ready

products. It also involves deriving value from allied prod-

ucts such as hides and variety meats for sale to further

processors and others. The Beef segment markets its

17

products to food retailers, distributors, wholesalers,

restaurants, hotel chains and other food processors in

domestic and international markets. Allied products are

also marketed to manufacturers of pharmaceuticals and

technical products.

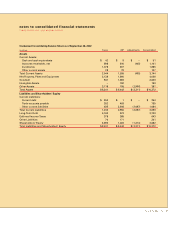

Pork segment is primarily involved in the processing of

live market hogs and fabrication of pork carcasses into

primal and sub-primal cuts and case-ready products.

This segment also represents the Company’s live swine

group and related allied product processing activities.

The Pork segment markets its products to food retailers,

distributors, wholesalers, restaurants, hotel chains and

other food processors in domestic and international

markets. It also sells allied products to pharmaceutical

and technical products manufacturers, as well as live

swine to pork processors.

Prepared Foods segment includes the Company’s

operations that manufacture and market frozen and

refrigerated food products. Products include pepperoni,

beef and pork toppings, pizza crusts, flour and corn

tortilla products, appetizers, hors d’oeuvres, desserts,

prepared meals, ethnic foods, soups, sauces, side dishes,

specialty pasta and meat dishes as well as branded and

processed meats. The Prepared Foods segment markets

its products to food retailers, distributors, wholesalers,

restaurants and hotel chains.

Other segment includes the logistics group and other cor-

porate activities not identified with specific protein groups.

This segment also includes proceeds of $167 million

received in fiscal 2003 related to the settlement of the

vitamin antitrust litigation, as compared to $30 million

received in fiscal 2002.

54 Tyson Foods, Inc.

notes to consolidated financial statements

TYSON FOODS, INC. 2003 ANNUAL REPORT