Tyson Foods 2003 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2003 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

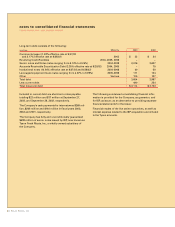

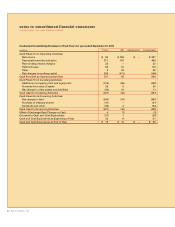

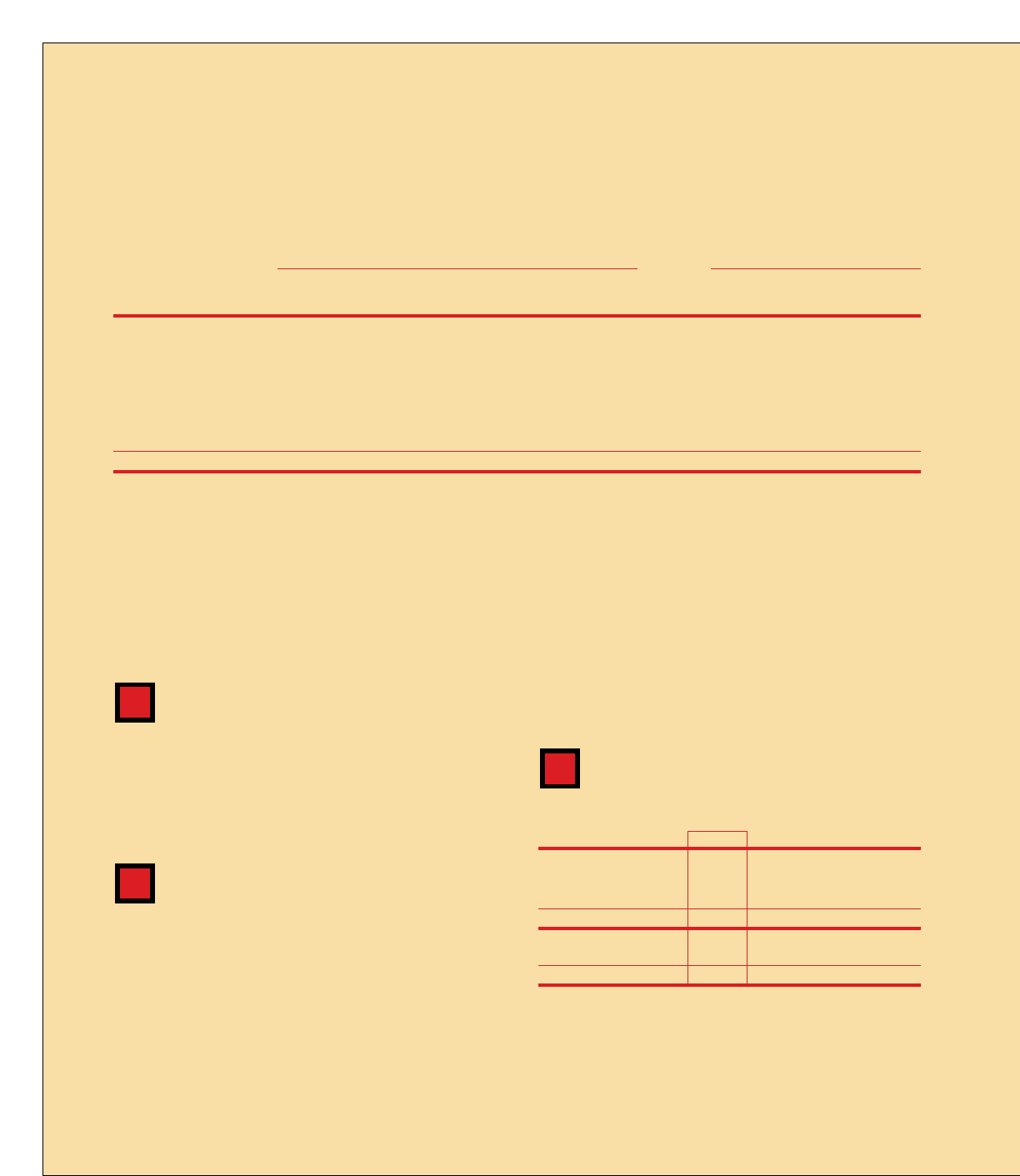

The following table summarizes information about stock options outstanding at September 27, 2003:

Options outstanding Options exercisable

Weighted average Weighted

Range of Shares remaining contractual Weighted average Shares average

exercise prices outstanding life (in years) exercise price excercisable exercise price

$ 4.93 – 6.69 665,219 4.9 $ 5.59 665,219 $ 5.59

6.71 – 10.91 3,275,013 4.1 9.32 3,275,013 9.32

10.92 – 13.85 232,206 4.7 11.71 232,206 11.71

9.30 – 9.75 4,194,022 8.5 9.49 44,731 9.47

11.23 – 11.63 4,919,286 9.6 11.45 961,548 11.50

13.33 – 15.17 4,950,981 7.3 13.89 1,893,069 14.77

17.92 – 18.00 2,636,200 3.1 17.92 2,063,520 17.92

20,872,927 9,135,306

52 Tyson Foods, Inc.

notes to consolidated financial statements

TYSON FOODS, INC. 2003 ANNUAL REPORT

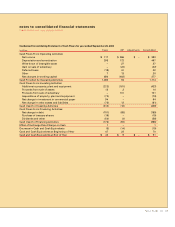

The weighted average fair value of options granted during

2003 was approximately $4.32. The fair value of each option

grant is established on the date of grant using the Black-

Scholes option-pricing model. Assumptions include an

expected life of six years, risk-free interest rate ranging

from 2.56% to 3.30%, expected volatility ranging from

38.2% to 40.1% and dividend yield ranging from 1.20%

to 1.72% in 2003.

note 13:

benefit plans

The Company has defined contribution retirement

and incentive benefit programs for various groups of

Company personnel. Company contributions totaled

$48 million, $50 million and $35 million in 2003, 2002

and 2001, respectively.

note 14:

transactions with related parties

The Company has operating leases for farms, equipment

and other facilities with the former Senior Chairman of

the Board of Directors of the Company and certain mem-

bers of his family, as well as a trust controlled by him,

for rentals of $8 million in 2003, $9 million in 2002 and

$9 million in 2001. Other facilities have been leased from

other officers and directors for rentals totaling $2 million

in fiscal years 2003, 2002 and 2001.

14

13

An entity owned by a former director that resigned from

the Board of Directors during 2003 received from the sale

of cattle to a subsidiary of the Company $10 million in

2003, $10 million in 2002 and $5 million in 2001.

Certain officers and directors are engaged in chicken and

swine growout operations with the Company whereby

these individuals purchase animals, feed, housing and

other items to raise the animals to market weight. The

total value of these transactions, which were discontin-

ued during fiscal 2003, amounted to $10 million in fiscal

years 2003, 2002 and 2001.

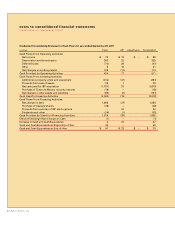

note 15:

income taxes

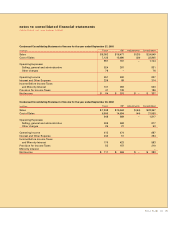

Detail of the provision for income taxes consists of:

in millions 2003 2002 2001

Federal $156 $173 $ 50

State 10 17 5

Foreign 20 20 3

$186 $210 $ 58

Current $ 73 $188 $105

Deferred 113 22 (47)

$186 $210 $ 58

15