Tyson Foods 2003 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2003 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

38 Tyson Foods, Inc.

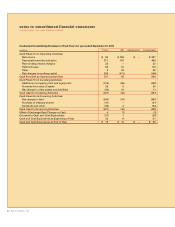

notes to consolidated financial statements

TYSON FOODS, INC. 2003 ANNUAL REPORT

Minority Interest: The results of operations of IBP for the

nine weeks ended September 29, 2001, are included

in the Company’s consolidated results of operations.

Minority interest in fiscal 2001 primarily consisted of the

49.9% of IBP that was acquired on September 28, 2001.

Use of Estimates: The consolidated financial statements

are prepared in conformity with accounting principles

generally accepted in the United States, which require

management to make estimates and assumptions that

affect the amounts reported in the consolidated financial

statements and accompanying notes. Actual results

could differ from those estimates.

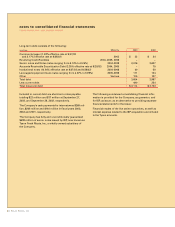

Recently Issued Accounting Standards: In January 2003,

the Financial Accounting Standards Board (FASB) issued

Interpretation No. 46, “Consolidation of Variable Interest

Entities, an Interpretation of Accounting Research

Bulletin No. 51” (the Interpretation). The Interpretation

requires the consolidation of variable interest entities in

which an enterprise absorbs a majority of the entity’s

expected losses, receives a majority of the entity’s

expected residual returns, or both, as a result of owner-

ship, contractual or other financial interests in the entity.

Currently, entities are generally consolidated by an enter-

prise that has a controlling financial interest through

ownership of a majority voting interest in the entity. The

Interpretation was originally immediately effective for

variable interest entities created after January 31, 2003,

and effective in the fourth quarter of the Company’s

fiscal 2003 for those created prior to February 1, 2003.

However, in October 2003, the FASB deferred the effec-

tive date for those variable interest entities created prior

to February 1, 2003, until the Company’s first quarter of

fiscal 2004. The Company has substantially completed

the process of evaluating the Interpretation and believes

its adoption will not have a material impact on its finan-

cial position or results of operations.

In April 2003, the FASB issued Statement of Financial

Accounting Standards No. 149, “Amendment of

Statement 133 on Derivative Instruments and Hedging

Activities” (SFAS No. 149). SFAS No. 149 amends SFAS

No. 133 to provide clarification on the financial account-

ing and reporting of derivative instruments and hedging

activities and requires that contracts with similar charac-

teristics be accounted for on a comparable basis. The

standard is effective for contracts entered into or modi-

fied after June 30, 2003, and for hedging relationships

designated after June 30, 2003. The Company’s adoption

of SFAS No. 149 did not have a material impact on its

financial position or results of operations.

In May 2003, the FASB issued SFAS No. 150, “Accounting

for Certain Instruments with Characteristics of Both

Liabilities and Equity” (SFAS No. 150). SFAS No. 150

establishes how an issuer classifies and measures certain

freestanding financial instruments with characteristics of

liabilities and equity and requires that such instruments

be classified as liabilities. The standard is effective for

financial instruments entered into or modified after May

31, 2003, and is otherwise effective in the fourth quarter

of the Company’s fiscal 2003. The Company’s adoption of

SFAS No. 150 did not have a material impact on its finan-

cial position or results of operations.

note 2:

acquisitions

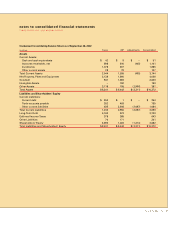

In September 2003, the Company purchased Choctaw

Maid Farms, Inc. (Choctaw), an integrated poultry

processor. Since 1992, Tyson had been purchasing all of

Choctaw’s production under a “cost plus” supply agree-

ment, which was scheduled to expire in 2007. The

Company had previously negotiated a purchase option

with Choctaw’s owners, which initially became exercis-

able in 2002. The Company decided to exercise its

purchase option rather than continue under the “cost

plus” arrangement of the supply agreement. The acquisi-

tion has been recorded as a purchase in accordance with

SFAS No. 141, “Business Combinations.” Accordingly, the

assets and liabilities have been adjusted for fair values

with the remainder of the purchase price, $18 million,

recorded as goodwill. The purchase price consisted of

$1 million cash to exercise the purchase option in Tyson’s

supply agreement with Choctaw and the settlement of

$85 million owed to Tyson by Choctaw. In addition the

Company assumed approximately $4 million of Choctaw’s

debt to a third party. In June 2003, the Company exercised

2