Tyson Foods 2003 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2003 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Tyson Foods, Inc. 43

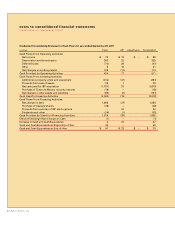

notes to consolidated financial statements

TYSON FOODS, INC. 2003 ANNUAL REPORT

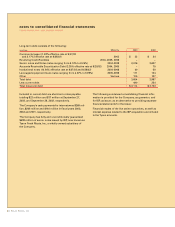

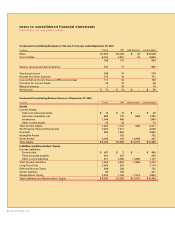

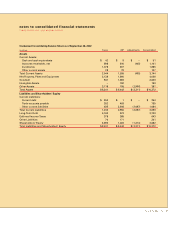

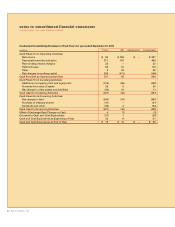

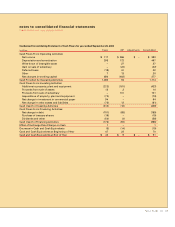

note 10:

long-term debt

The Company has unsecured revolving credit facilities

totaling $1 billion that support the Company’s commer-

cial paper program, letters of credit and other short-term

funding needs. These facilities consist of $200 million that

expires in June 2004, $300 million that expires in June

2005 and $500 million that expires in September 2006. At

September 27, 2003, and September 28, 2002, there were

no amounts drawn under the revolving credit facilities.

The Company has a receivables purchase agreement

with three co-purchasers to sell up to $750 million of

trade receivables that consists of $375 million expiring

in August 2004 and $375 million expiring in August 2005.

The receivables purchase agreement has been accounted

for as a borrowing and has an interest rate based on com-

mercial paper issued by the co-purchasers. Under this

agreement, substantially all of the Company’s accounts

receivable are sold to a special purpose entity, Tyson

Receivables Corporation (TRC), which is a wholly-owned

consolidated subsidiary of the Company. TRC has its

own separate creditors that are entitled to be satisfied

out of all of the assets of TRC prior to any value becom-

ing available to the Company as TRC’s equity holder.

At September 29, 2003, and September 28, 2002, there

was $0 and $75 million outstanding under the receivables

purchase agreement, respectively.

10

At September 27, 2003, the Company had outstanding

letters of credit totaling approximately $294 million

issued primarily in support of workers’ compensation

insurance programs, industrial revenue bonds and lever-

aged equipment loans. There were no draw downs under

these letters of credit at September 27, 2003.

Under the terms of the leveraged equipment loans, the

Company had cash deposits totaling approximately $54 mil-

lion, which is included in other assets at September 27,

2003. Under these leveraged loan agreements, the

Company entered into interest rate swap agreements to

effectively lock in a fixed interest rate for these borrowings.

Annual maturities of long-term debt for the five fiscal

years subsequent to September 27, 2003, are: 2004–

$490 million; 2005–$185 million; 2006–$295 million;

2007–$899 million and 2008–$16 million.

The revolving credit facilities, senior notes, notes and

accounts receivable securitization contain various

covenants, the more restrictive of which contain a maxi-

mum allowed leverage ratio and a minimum required

interest coverage ratio. The Company is in compliance

with these covenants at fiscal year end.

Industrial revenue bonds are secured by facilities with

a net book value of $159 million at September 27, 2003.

The weighted average interest rate on all outstanding

short-term borrowing was 1.5% at September 27, 2003,

and 3.3% at September 28, 2002.