Tyson Foods 2003 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2003 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Tyson Foods, Inc. 37

notes to consolidated financial statements

TYSON FOODS, INC. 2003 ANNUAL REPORT

determined based on the fair value method of accounting

for the Company’s stock option plans, the tax-effected

impact would be as follows:

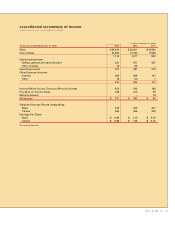

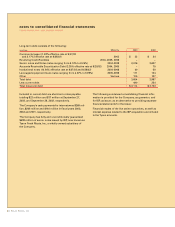

in millions, except per share data 2003 2002 2001

Net income as

reported $ 337 $ 383 $ 88

Stock-based employee

compensation expense

included in net income,

net of tax 16 15 5

Total stock-based

employee compensation

expense determined

under fair value based

method for all awards,

net of tax (20) (19) (8)

Pro forma

net income $ 333 $ 379 $ 85

Earnings per share

As reported

Basic $0.98 $1.10 $0.40

Diluted 0.96 1.08 0.40

Pro forma

Basic 0.96 1.09 0.38

Diluted $ 0.95 $1.07 $0.38

Pro forma net income reflects only options granted after

fiscal 1995. Additionally, the pro forma disclosures are not

likely to be representative of the effects on net income for

future years.

Financial Instruments: The Company is a purchaser of

certain commodities, such as corn, soybeans, livestock

and natural gas in the course of normal operations. The

Company uses derivative financial instruments to reduce

its exposure to various market risks. Generally, contract

terms of a hedge instrument closely mirror those of the

hedged item, providing a high degree of risk reduction

and correlation. Contracts that are highly effective at

meeting the risk reduction and correlation criteria are

recorded using hedge accounting, as defined by SFAS

No. 133, “Accounting for Derivative Instruments and

Hedging Activities” (SFAS No. 133), as amended. If a

derivative instrument is a hedge, depending on the

nature of the hedge, changes in the fair value of the instru-

ment will either be offset against the change in fair value

of the hedged assets, liabilities or firm commitments

through earnings or recognized in other comprehensive

income (loss) until the hedged item is recognized in earn-

ings. The ineffective portion of an instrument’s change in

fair value will be immediately recognized in earnings as

a component of cost of sales. Instruments the Company

holds as economic hedges that do not meet the criteria

for hedge accounting, as defined by SFAS No. 133, as

amended, are marked to fair value with unrealized gains

or losses reported currently in earnings. The Company

generally does not hedge anticipated transactions

beyond 12 months.

Revenue Recognition: The Company recognizes revenue

when title and risk of loss are transferred to customers,

which is generally upon delivery based upon terms of

sale. Revenue is recognized as the net amount estimated

to be received after deducting estimated amounts for

discounts, trade allowances and product terms.

Litigation Reserves: There are a variety of legal proceed-

ings pending or threatened against the Company. Accruals

are recorded when it is probable that a liability has been

incurred and the amount of the liability can be reasonably

estimated based on current law, progress of each case,

opinions and views of legal counsel and other advisers,

the Company’s experience in similar matters and man-

agement’s intended response to the litigation. These

amounts, which are not discounted and are exclusive

of claims against third parties, are adjusted periodically

as assessment efforts progress or legal information

becomes available. Accruals for legal proceedings are

included in other current liabilities in the accompanying

balance sheets.

Freight Expense: Freight expense associated with prod-

ucts shipped to customers is recognized in cost of

products sold.

Advertising and Promotion Expenses: Advertising and

promotion expenses are charged to operations in the

period incurred. Advertising and promotion expenses for

fiscal 2003, 2002 and 2001 were $504 million, $396 million

and $337 million, respectively.