Tyson Foods 2003 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2003 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Tyson Foods, Inc. 53

notes to consolidated financial statements

TYSON FOODS, INC. 2003 ANNUAL REPORT

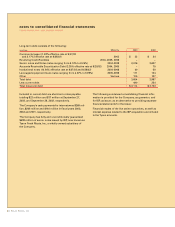

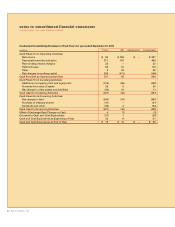

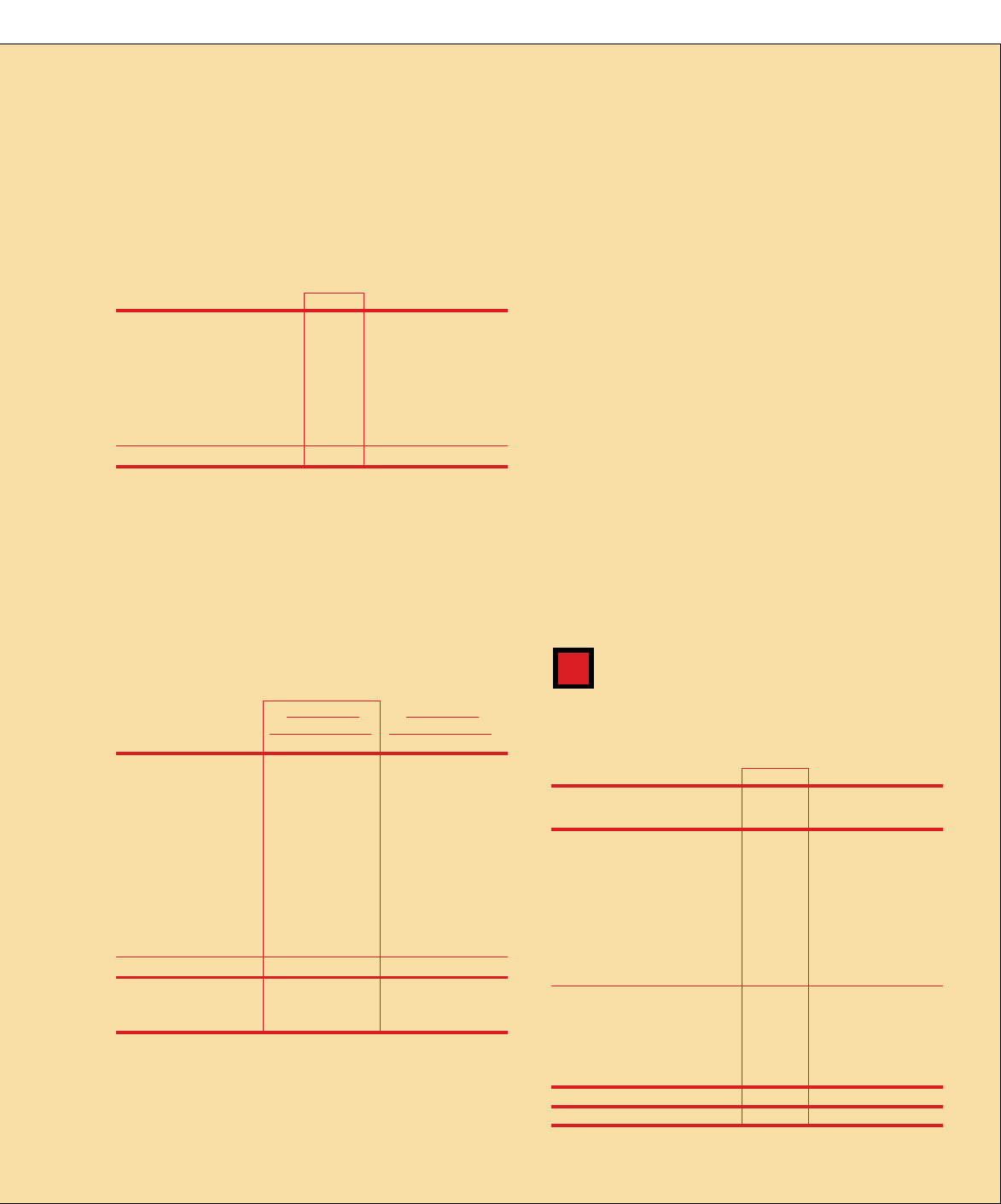

The reasons for the difference between the effective

income tax rate and the statutory U.S. federal income tax

rate are as follows:

2003 2002 2001

U.S. federal income

tax rate 35.0% 35.0% 35.0%

Amortization of goodwill – – 6.5

State income taxes 2.2 3.0 2.1

Extraterritorial income

exclusion1(1.9) (1.4) (6.2)

Other 0.2 (1.1) (2.0)

35.5% 35.5% 35.4%

1 Extraterritorial income exclusion for 2003 and 2002 and foreign sales corporation

benefit for 2001.

The Company follows the liability method in accounting

for deferred income taxes which provides that deferred

tax liabilities are recorded at current tax rates based on

the difference between the tax basis of assets and liabili-

ties and their carrying amounts for financial reporting

purposes referred to as temporary differences.

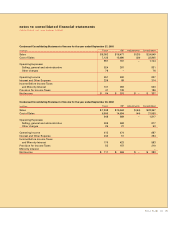

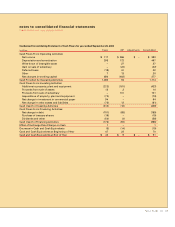

The tax effects of major items recorded as deferred tax

assets and liabilities are:

2003 2002

Deferred Tax Deferred Tax

in millions Assets Liabilities Assets Liabilities

Property, plant

and equipment $ 4 $543 $ 5 $417

Suspended taxes

from conversion

to accrual method – 138 – 138

Intangible assets 28 28 1 64

Inventory 5 86 5 78

Accrued expenses 120 2 122 2

Net operating loss

carryforwards 77 – 69 –

All other 93 190 137 155

$327 $987 $339 $854

Valuation allowance (49) (49)

Net deferred

tax liability $709 $564

Net deferred tax liabilities are included in other current

liabilities and deferred income taxes on the Consolidated

Balance Sheets.

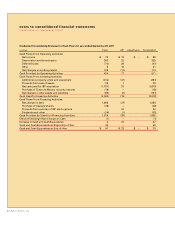

The deferred tax liability for suspended taxes from con-

version to accrual method represents the 1987 change

from the cash to accrual method of accounting and will

be paid down by 2017, subject to income limitations.

The valuation allowance totaling $49 million consists of

$13 million state tax carryforwards, which have been

fully reserved, and $36 million for net operating loss

carryforwards. The state tax credit carryforwards expire

in the years 2004 through 2008. At September 27, 2003,

after considering utilization restrictions, the Company’s

acquired tax loss carryforwards approximated $192 mil-

lion. The net operating loss carryforwards, which are

subject to utilization limitations due to ownership

changes, may be utilized to offset future taxable income

subject to limitations. These carryforwards expire during

the years 2004 through 2022.

The Company’s cash payments for income taxes were

$36 million, $90 million and $54 million in fiscal years

2003, 2002 and 2001, respectively.

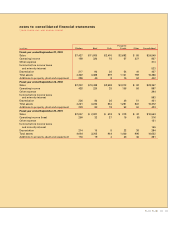

note 16:

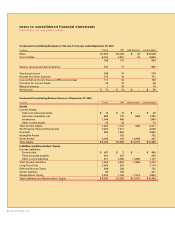

earnings per share

The weighted average common shares used in the com-

putation of basic and diluted earnings per share were

as follows:

in millions, except per share data 2003 2002 2001

Numerator:

Net Income $ 337 $ 383 $ 88

Denominator:

Denominator for

basic earnings per

share–weighted

average shares 346 348 221

Effect of dilutive

securities:

Stock options

and restricted stock 6 7 1

Denominator for

diluted earnings per

share–adjusted

weighted average

shares and assumed

conversions 352 355 222

Basic earnings per share $0.98 $1.10 $ 0.40

Diluted earnings per share $0.96 $1.08 $ 0.40

16