Tyson Foods 2003 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2003 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Tyson Foods, Inc. 35

notes to consolidated financial statements

TYSON FOODS, INC. 2003 ANNUAL REPORT

note 1: business and summary of

significant accounting policies

Description of Business: Tyson Foods, Inc. (collectively,

“the Company” or “Tyson”), founded in 1935 with world

headquarters in Springdale, Arkansas, is the world’s

largest processor and marketer of chicken, beef and pork

and the second largest food company in the Fortune 500.

Tyson Foods produces a wide variety of brand name

protein-based and prepared food products marketed in

the United States and more than 80 countries around the

world. Tyson is the recognized market leader in the retail

and foodservice markets it serves. The Company has

approximately 120,000 team members and 300 facilities

and offices in 27 states and 22 countries.

Consolidation: The consolidated financial statements

include the accounts of all majority-owned and wholly-

owned subsidiaries. All significant intercompany accounts

and transactions have been eliminated in consolidation.

Fiscal Year: The Company utilizes a 52- or 53-week

accounting period that ends on the Saturday closest to

September 30.

Reclassifications: Certain reclassifications have been

made to prior periods to conform to current presentations.

Cash and Cash Equivalents: Cash equivalents consist of

investments in short-term, highly liquid securities hav-

ing original maturities of three months or less, which

are made as part of the Company’s cash management

activity. The carrying values of these assets approximate

their fair market values. The Company primarily utilizes

a cash management system with a series of separate

accounts consisting of lockbox accounts for receiving

cash, concentration accounts that funds are moved to,

and several “zero-balance” disbursement accounts for

funding of payroll, accounts payable and grower pay-

ments. As a result of the Company’s cash management

system, checks issued, but not presented to the banks

for payment, may create negative book cash balances.

Checks outstanding in excess of related book cash

balances totaling approximately $313 million at

September 27, 2003, and $292 million at September 28,

2002, are included in trade accounts payable and accrued

salaries, wages and benefits.

1

Inventories: Processed products, livestock (excluding

breeders) and supplies and other are valued at the lower

of cost (first-in, first-out) or market. Livestock includes live

cattle, live chicken and live swine. Cost includes purchased

raw materials, live purchase costs, grow-out costs (prima-

rily feed, contract grower pay and catch and haul costs),

labor and manufacturing and production overhead which

are related to the purchase and production of inventories.

Live chicken consists of broilers and breeders. Breeders are

stated as cost less amortization. The costs associated with

breeders, including breeder chicks, feed and medicine, are

accumulated up to the production stage and amortized to

broiler inventory over the productive life of the flock using

a standard unit of production.

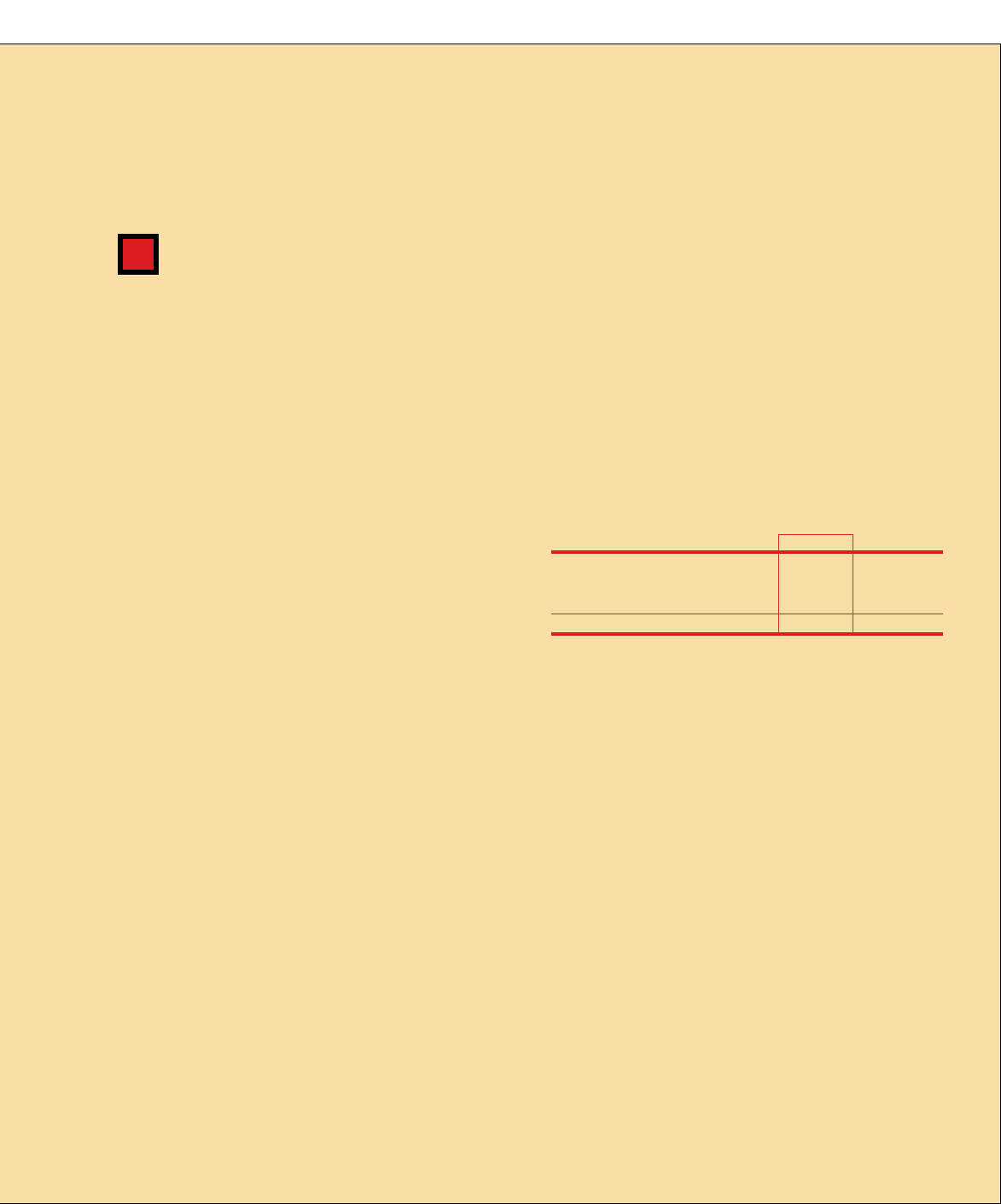

Total inventory consists of:

in millions 2003 2002

Processed products $1,167 $1,112

Livestock 532 505

Supplies and other 295 268

Total inventory $1,994 $1,885

Depreciation: Depreciation is provided primarily by the

straight-line method using estimated lives for buildings

and leasehold improvements of 10 to 39 years, machinery

and equipment of three to 12 years and other of three to

20 years.

Long-Lived Assets: The Company reviews the carrying

value of long-lived assets at each balance sheet date

if indication of impairment exists. Recoverability is

assessed using undiscounted cash flows based upon his-

torical results and current projections of earnings before

interest and taxes. The Company measures impairment

using discounted cash flows of future operating results

based upon a rate that corresponds to the Company’s

cost of capital. Impairments are recognized in operating

results to the extent that carrying value exceeds

discounted cash flows of future operations.