TripAdvisor 2015 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2015 TripAdvisor annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Underthe2011IncentivePlan,100,000sharesofTripAdvisorcommonstockareavailableforissuancetonon-employeedirectors.Fromtheinceptionof

thePlanthroughDecember31,2015,atotalof557shareshavebeenreservedforsuchpurpose.

NOTE 14: STOCKHOLDERS’ EQUITY

Preferred Stock

Inadditiontocommonstock,weareauthorizedtoissueupto100millionpreferredshares,with$0.001parvaluepershare,withtermsdeterminedbyour

BoardofDirectors,withoutfurtheractionbyourstockholders.AtDecember31,2015,nopreferredshareshadbeenissued.

Common Stock and Class B Common Stock

Ourauthorizedcommonstockconsistsof1.6billionsharesofcommonstockwithparvalueof$0.001pershare,and400millionsharesofClassBcommon

stockwithparvalueof$0.001pershare.Bothclassesofcommonstockqualifyforandshareequallyindividends,ifdeclaredbyourBoardofDirectors.Common

stockisentitledtoonevotepershareandClassBcommonstockisentitledto10votespershareonmostmatters.HoldersofTripAdvisorcommonstock,actingas

asingleclass,areentitledtoelectanumberofdirectorsequalto25%percentofthetotalnumberofdirectors,roundeduptothenextwholenumber,whichwas

threedirectorsasofDecember31,2015.ClassBcommonstockholdersmay,atanytime,converttheirsharesintocommonstock,onaoneforonesharebasis.

Uponconversion,theClassBcommonstockisretiredandisnotavailableforreissue.Intheeventofliquidation,dissolution,distributionofassetsorwinding-up

ofTripAdvisortheholdersofbothclassesofcommonstockhaveequalrightstoreceivealltheassetsofTripAdvisoraftertherightsoftheholdersofthepreferred

stockhavebeensatisfied.Therewere133,836,242and132,443,111sharesofcommonstockissuedandoutstanding,respectively,atDecember31,2015and

12,799,999sharesofClassBcommonstockissuedandoutstandingatDecember31,2015.

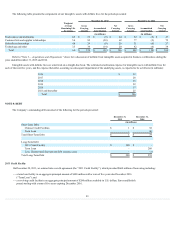

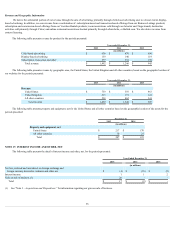

Accumulated Other Comprehensive Income (Loss)

Accumulatedothercomprehensivelossisprimarilycomprisedofaccumulatedforeigncurrencytranslationadjustments,asfollowsfortheperiods

presented:

December 31,

2015

December 31,

2014

(in millions)

Cumulativeforeigncurrencytranslationadjustments(1) $ (63) $ (31)

Totalaccumulatedothercomprehensiveloss $ (63) $ (31)

(1) Weconsiderourforeignsubsidiaryearningsindefinitelyreinvested;therefore;deferredtaxesarenotprovidedonforeigncurrencytranslation

adjustments.

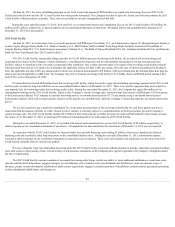

Treasury Stock

OnFebruary15,2013,ourBoardofDirectorsauthorizedtherepurchaseof$250millionofoursharesofcommonstockunderasharerepurchaseprogram.

TherepurchaseprogramhasnoexpirationdatebutmaybesuspendedorterminatedbytheBoardofDirectorsatanytime.OurBoardofDirectorswilldetermine

theprice,timing,amountandmethodofsuchrepurchasesbasedonitsevaluationofmarketconditionsandotherfactors,andanysharesrepurchasedwillbein

compliancewithapplicablelegalrequirements,atpricesdeterminedtobeattractiveandinthebestinterestsofboththeCompanyanditsstockholders.

AsofDecember31,2015,wehaverepurchased2,120,709sharesofoutstandingcommonstockunderthesharerepurchaseprogramatanaggregatecostof

$145million.WedidnotrepurchaseanysharesunderthissharerepurchaseprogramduringtheyearendedDecember31,2015.AsofDecember31,2015,from

theauthorizedsharerepurchaseprogramgrantedbytheBoardofDirectorswehave$105millionremainingtorepurchasesharesofourcommonstock.

InDecember2015,weissued801,042treasurysharestotheFoundationinsettlementofallfuturepledgeobligations.Referto“Note12–Commitments

and Contingencies ,”foradiscussionoftheFoundation.Wehave1,393,131treasurysharesremainingasofDecember31,2015withanaggregatecostof$92

million.

92