TripAdvisor 2015 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2015 TripAdvisor annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

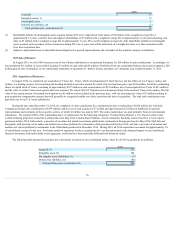

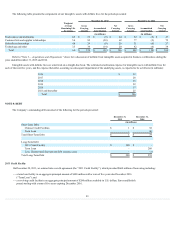

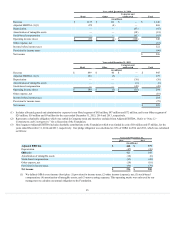

ThesignificantcomponentsofourdeferredtaxassetsanddeferredtaxliabilitiesasofDecember31,2015and2014areasfollows:

December 31,

2015 2014

(in millions)

Deferred tax assets:

Stock-basedcompensation $ 40 $ 43

Netoperatinglosscarryforwards 31 34

Provisionforaccruedexpenses 12 13

Deferredrent 5 5

Leasefinancingobligation 33 26

Foreignadvertisingspend 8 9

Deferredexpenserelatedtocost-sharingarrangement 20 -

Charitablecontributioncarryforward 24 -

Other 4 5

Totaldeferredtaxassets $ 177 $ 135

Less:valuationallowance (17) (19)

Netdeferredtaxassets $ 160 $ 116

Deferred tax liabilities:

Intangibleassets $ (81) $ (88)

Propertyandequipment (27) (25)

Prepaidexpenses (4)(4)

Building (31) (26)

Deferredincomerelatedtocost-sharingarrangement (7) -

Other - (1)

Totaldeferredtaxliabilities $ (150) $ (144)

Netdeferredtaxasset(liability)(1) $ 10 $ (28)

(1)Includesnon-currentdeferredtaxassetsof$25millionand$1millionasofDecember31,2015and2014,respectively,reportedin"Other

long-termassets"onourconsolidatedbalancesheets.

AtDecember31,2015,wehadfederal,stateandforeignnetoperatinglosscarryforwards(“NOLs”)ofapproximately$16million,$13millionand$85

million.Ifnotutilized,thefederalandstateNOLswillexpireatvarioustimesbetween2020and2035andtheforeignNOLswillexpireatvarioustimesbetween

2016and2033.

AtDecember31,2015,wehadavaluationallowanceof$17millionprimarilyrelatedtoforeignnetoperatinglosscarryforwardsforwhichitismorelikely

thannotthatthetaxbenefitwillnotberealized.Thisamountrepresentedanoveralldecreaseof$2millionovertheamountrecordedasofDecember31,2014.The

decreaseisprimarilyrelatedtothesaleofoneofourChinesesubsidiariesthatpreviouslyhadafullvaluationallowance.Exceptforcertaindeferredtaxassets,we

expecttorealizeallofourdeferredtaxassetsbasedonastronghistoryofearningsintheUSandotherjurisdictions,aswellasfuturereversalsoftaxable

temporarydifferences.

WehavenotprovidedfordeferredU.S.incometaxesonundistributedearningsofourforeignsubsidiariesthatwehaveorintendtoreinvestpermanently

outsidetheUnitedStates;thetotalamountofsuchearningsasofDecember31,2015was$759million.ShouldwedistributeorbetreatedundercertainU.S.tax

rulesashavingdistributedearningsofforeignsubsidiariesintheformofdividendsorotherwise,wemaybesubjecttoU.S.incometaxes.Duetocomplexitiesin

taxlawsandvariousassumptionsthatwouldhavetobemade,itisnotpracticableatthistimetoestimatetheamountofunrecognizeddeferredU.S.taxesonthese

earnings.

86