TripAdvisor 2015 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2015 TripAdvisor annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

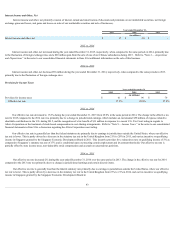

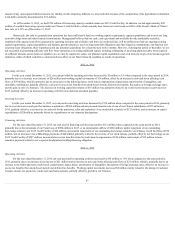

Income Taxes

Werecordincometaxesundertheassetandliabilitymethod.Deferredtaxassetsandliabilitiesreflectourestimationofthefuturetaxconsequencesof

temporarydifferencesbetweenthecarryingamountsofassetsandliabilitiesforbookandtaxpurposes.Wedeterminedeferredincometaxesbasedonthe

differencesinaccountingmethodsandtimingbetweenfinancialstatementandincometaxreporting.Accordingly,wedeterminethedeferredtaxassetorliability

foreachtemporarydifferencebasedontheenactedtaxratesexpectedtobeineffectwhenwerealizetheunderlyingitemsofincomeandexpense.Weconsiderall

relevantfactorswhenassessingthelikelihoodoffuturerealizationofourdeferredtaxassets,includingourrecentearningsexperiencebyjurisdiction,expectations

offuturetaxableincomeandthecarryforwardperiodsavailabletousfortaxreportingpurposes,aswellasassessingavailabletaxplanningstrategies.Wemay

establishavaluationallowancetoreducedeferredtaxassetstotheamountwebelieveismorelikelythannottoberealized.Duetoinherentcomplexitiesarising

fromthenatureofourbusinesses,futurechangesinincometaxlaw,taxsharingagreementsorvariancesbetweenouractualandanticipatedoperatingresults,we

makecertainjudgmentsandestimates.Therefore,actualincometaxescouldmateriallyvaryfromtheseestimates.

Werecordliabilitiestoaddressuncertaintaxpositionswehavetakeninpreviouslyfiledtaxreturnsorthatweexpecttotakeinafuturetaxreturn.The

determinationforrequiredliabilitiesisbaseduponananalysisofeachindividualtaxposition,takingintoconsiderationwhetheritismorelikelythannotthatour

taxposition,basedontechnicalmerits,willbesustaineduponexamination.Forthosepositionsforwhichweconcludeitismorelikelythannotitwillbesustained,

werecognizethelargestamountoftaxbenefitthatisgreaterthan50%likelyofbeingrealizeduponultimatesettlementwiththetaxingauthority.Thedifference

betweentheamountrecognizedandthetotaltaxpositionisrecordedasaliability.Theultimateresolutionofthesetaxpositionsmaybegreaterorlessthanthe

liabilitiesrecorded.

WehavenotprovidedfordeferredU.S.incometaxesonundistributedearningsofourforeignsubsidiaries,whichweintendtoreinvestpermanentlyoutside

theUnitedStates.Shouldwedistributeearningsofforeignsubsidiariesintheformofdividendsorotherwise,wemaybesubjecttoU.S.incometaxes.Dueto

complexitiesintaxlawsandvariousassumptionsthatwouldhavetobemade,itisnotpracticable,atthistime,toestimatetheamountofunrecognizeddeferred

U.S.taxesontheseearnings.

See“Note9—Income Taxes ”inthenotestoourconsolidatedfinancialstatementsinItem8forfurtherinformationonincometaxes.

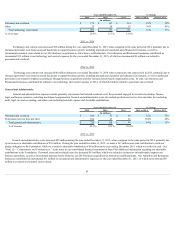

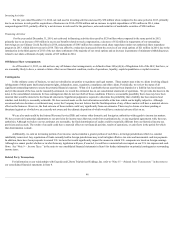

Stock-Based Compensation

Stock Options

Theexercisepriceforallstockoptionsgrantedbyustodatehasbeenequaltothemarketpriceoftheunderlyingsharesofcommonstockatthedateof

grant.Inthisregard,whenmakingstockoptionawards,ourpracticeistodeterminetheapplicablegrantdateandtospecifythattheexercisepriceshallbethe

closingpriceofourcommonstockonthedateofgrant.StockoptionsgrantedduringtheyearendedDecember31,2015haveatermoftenyearsfromthedateof

grantandgenerallyvestoverafour-yearrequisiteserviceperiod.

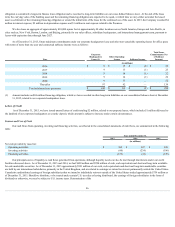

DuringtheyearendedDecember31,2015,weissued586,851ofprimarilyservicebasedstocknon-qualifiedstockoptionsunderthe2011IncentivePlan

withaweightedaveragegrant-datefairvalueperoptionof$33.02.Wewillamortizethefairvalue,netofestimatedforfeitures,asstock-basedcompensation

expenseoverthevestingtermonastraight-linebasis,withtheamountofcompensationexpenserecognizedatanydateatleastequalingtheportionofthegrant-

datefairvalueoftheawardthatisvestedatthatdate.Weusehistoricaldatatoestimatepre-vestingoptionforfeituresandrecordshare-basedcompensation

expenseonlyforthoseawardsthatareexpectedtovest.

Theestimatedfairvalueoftheoptionsgrantedunderthe2011IncentivePlantodate,havebeencalculatedusingaBlack-ScholesMertonoption-pricing

model(“Black-Scholesmodel”).TheBlack-Scholesmodelincorporatesassumptionstovaluestock-basedawards,whichincludestherisk-freerateofreturn,

expectedvolatility,expectedtermandexpecteddividendyield.

Ourrisk-freeinterestrateisbasedontheratescurrentlyavailableonzero-couponU.S.Treasuryissues,ineffectatthetimeofthegrant,whoseremaining

maturityperiodmostcloselyapproximatesthestockoption’sexpectedtermassumption.Ourexpectedvolatilityiscalculatedbyequallyweightingthehistorical

volatilityandimpliedvolatilityonourownstock.Historicalvolatilityisdeterminedusingactualdailypriceobservationsofourstockpriceoveraperiod

equivalenttoorapproximatetotheexpectedtermofourstockoptiongrantstodate.Impliedvolatilityrepresentsthevolatilityofouractivelytradedoptionsonour

stock,withremainingmaturitiesinexcessofsixmonthsandmarketpricesapproximatetotheexercisepricesofthestockoptiongrant.Weestimateourexpected

termusinghistoricalexercisebehaviorandexpectedpost-vestterminationdata.Ourexpecteddividendyieldiszero,aswehavenotpaidanydividendsonour

commonstocktodateanddonotexpecttopayanycashdividendsfortheforeseeablefuture.

51