TripAdvisor 2015 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2015 TripAdvisor annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

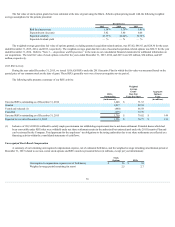

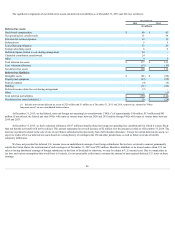

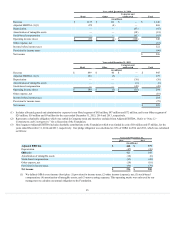

ThefollowingtablesummarizesourmaterialcommitmentsandobligationsasofDecember31,2015:

By Period

Total

Less than

1 year 1 to 3 years 3 to 5 years

More than

5 years

(in millions)

Propertyleases,netofsubleaseincome(1) $ 250 $ 22 $ 45 $ 44 $ 139

Expectedinterestpaymentson2015CreditFacility(2) 15 3 7 5 —

Total(3) $ 265 $ 25 $ 52 $ 49 $ 139

(1) Estimatedfutureminimumrentalpaymentsunderoperatingleaseswithnon-cancelableleaseterms,includingourcorporateheadquartersleaseinNeedham,

MA.

(2) Theamountsincludedasexpectedinterestpaymentsonthe2015CreditFacilityinthistablearebasedonthecurrenteffectiveinterestrateandoutstanding

borrowingsasofDecember31,2015,but,couldchangesignificantlyinthefuture.Amountsassumethatourexistingdebtisrepaidatexpirationdateanddo

notassumeadditionalborrowingsorrefinancingsofexistingdebt.Referto“Note8—Debt ”foradditionalinformationonour2015CreditFacility.

(3) Excludedfromthetablewas$87millionofunrecognizedtaxbenefits,includingaccruedinterest,thatwehaverecordedinotherlong-termliabilitiesonour

consolidatedbalancesheetforwhichwecannotmakeareasonablyreliableestimateoftheamountandperiodofpayment.Wedonotanticipateanymaterial

changesinthenextyear.

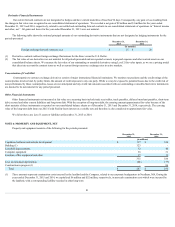

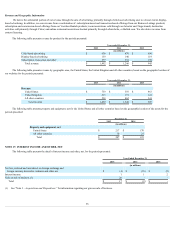

Office Lease Commitments

Wehavecontractualobligationsintheformofoperatingleasesforofficespaceforwhichwerecordtherelatedexpenseonamonthlybasis.Certainleases

containperiodicrentescalationadjustmentsandrenewaloptions.Rentexpenserelatedtosuchleasesisrecordedonastraight-linebasis.Operatinglease

obligationsexpireatvariousdateswiththelatestmaturityinDecember2030.FortheyearsendedDecember31,2015,2014and2013,werecordedrentalexpense

of$19million,$17millionand$11million,respectively.

Corporate Headquarters Lease

InJune2013,TripAdvisorLLC(“TALLC”),ourindirect,whollyownedsubsidiary,enteredintoalease,foranewcorporateheadquarters(the“Lease”).

PursuanttotheLease,thelandlordbuiltanapproximately280,000squarefootrentalbuildinginNeedham,Massachusetts(the“Premises”),andleasedthe

PremisestoTALLCasournewcorporateheadquartersforaninitialtermof15yearsand7monthsorthroughDecember2030.TALLCalsohasanoptionto

extendthetermoftheLeasefortwoconsecutivetermsoffiveyearseach.

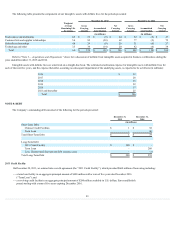

Becausewewereinvolvedintheconstructionprojectandwereresponsibleforpayingaportionofthecostsofnormalfinishworkandstructuralelements

ofthePremises,theCompanywasdeemedforaccountingpurposestobetheownerofthePremisesduringtheconstructionperiodunderbuildtosuitlease

accountingguidanceunderGAAP.Therefore,theCompanyrecordedprojectconstructioncostsduringtheconstructionperiodincurredbythelandlordasa

construction-in-progressassetandarelatedconstructionfinancingobligationonourconsolidatedbalancesheets.TheamountsthattheCompanyhaspaidor

incurredfornormaltenantimprovementsandstructuralimprovementshadalsobeenrecordedtotheconstruction-in-progressasset.

Uponcompletionofconstructionatendofthesecondquarterof2015,weevaluatedtheconstruction-in-progressassetandconstructionfinancing

obligationforde-recognitionunderthecriteriafor“sale-leaseback”treatmentunderGAAP.Weconcludedthatwehaveformsofcontinuedeconomicinvolvement

inthefacility,andthereforedidnotmeettheprovisionsforsale-leasebackaccounting.ThisdeterminationwasbasedontheCompany'scontinuinginvolvement

withthepropertyintheformofnon-recoursefinancingtothelessor.Therefore,theLeasehasbeenaccountedforasafinancingobligation.Accordingly,webegan

depreciatingthebuildingassetoveritsestimatedusefullifeandincurringinterestexpenserelatedtothefinancingobligationimputedusingtheeffectiveinterest

ratemethod.WewillbifurcateourleasepaymentspursuanttothePremisesinto:(i)aportionthatisallocatedtothebuilding(areductiontothefinancing

obligation)and;(ii)aportionthatisallocatedtothelandonwhichthebuildingwasconstructed.Theportionoftheleaseobligationsallocatedtothelandistreated

asanoperatingleasethatcommencedin2013.Thefinancingobligationisconsideredalong-termfinanceleaseobligationandisrecordedtolong-termliabilities

onourconsolidatedbalancesheet.Attheendoftheleaseterm,thecarryingvalueofthebuildingassetandtheremainingfinancingobligationareexpectedtobe

equal,atwhichtimewemayeithersurrendertheleasedassetassettlementoftheremainingfinancingobligationorextendtheinitialtermoftheleaseforthe

continueduseoftheasset.In2015,theCompanyrecorded$4millionininterestexpense,$2millionindepreciationexpenseand$1millioninrentexpenserelated

tothePremises.

89