TripAdvisor 2015 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2015 TripAdvisor annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

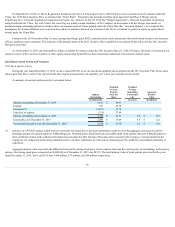

Indefinite-Lived Intangible Assets

IntangibleassetsthathaveindefinitelivesarenotamortizedandaretestedforimpairmentannuallyonOctober1,orwhenevereventsorchangesin

circumstancesindicatethatthecarryingvaluemaynotberecoverable.Similartothequalitativeassessmentforgoodwill,wemayassessqualitativefactorsto

determineifitismorelikelythannotthattheimpliedfairvalueoftheindefinite-livedintangibleassetislessthanitscarryingamount.Ifwedeterminethatitisnot

morelikelythannotthattheimpliedfairvalueoftheindefinite-livedintangibleassetislessthanitscarryingamount,nofurthertestingisnecessary.If,however,

wedeterminethatitismorelikelythannotthattheimpliedfairvalueoftheindefinite-livedintangibleassetislessthanitscarryingamount,wecomparethe

impliedfairvalueoftheindefinite-livedassetwithitscarryingamount.Ifthecarryingvalueofanindividualindefinite-livedintangibleassetexceedsitsimplied

fairvalue,theindividualassetiswrittendownbyanamountequaltosuchexcess.Theassessmentofqualitativefactorsisoptionalandatourdiscretion.Wemay

bypassthequalitativeassessmentforanyindefinite-livedintangibleassetinanyperiodandresumeperformingthequalitativeassessmentinanysubsequentperiod.

Aspartofourqualitativeassessmentforour2015impairmentanalysis,thefactorsthatweconsideredforourindefinite-livedintangibleassetsincluded,but

werenotlimitedto:(a)changesinmacroeconomicconditionsintheoveralleconomyandthespecificmarketsinwhichweoperate,(b)ourabilitytoaccesscapital,

(c)changesintheonlinetravelindustry,(d)changesinthelevelofcompetition,(e)comparisonofourcurrentfinancialperformancetohistoricalandbudgeted

results,(f)changesinexcessmarketcapitalizationoverbookvaluebasedonourcommonstockprice,and(g)theamountofexcessofthefairvalueofourtrade

namesandtrademarkstothecarryingvalueofthosesameassets,usingtheresultsofourmostrecentquantitativeassessment.Afterconsideringthesefactorsand

theimpactthatchangesinsuchfactorswouldhaveontheinputsusedinourpreviousquantitativeassessment,wedeterminedthatitwasmorelikelythannotthat

theseassetswerenotimpaired.

Recoverability of Intangible Assets with Definite Lives and Other Long-Lived Assets

Intangibleassetswithdefinitelivesandotherlong-livedassetsarecarriedatcostandareamortizedonastraight-linebasisovertheirestimatedusefullives

ofonetotwelveyears.Thestraight-linemethodofamortizationiscurrentlyusedforourdefinite-livedintangibleassetsasitapproximates,orisourbestestimate,

ofthedistributionoftheeconomicuseofouridentifiableintangibleassets.Wereviewthecarryingvalueoflong-livedassetsorassetgroups,includingproperty

andequipment,tobeusedinoperationswhenevereventsorchangesincircumstancesindicatethatthecarryingamountoftheassetsmightnotberecoverable.

Factorsthatwouldnecessitateanimpairmentassessmentincludeasignificantadversechangeintheextentormannerinwhichanassetisused,asignificant

adversechangeinlegalfactorsorthebusinessclimatethatcouldaffectthevalueoftheasset,orasignificantdeclineintheobservablemarketvalueofanasset,

amongothers.Ifsuchfactsindicateapotentialimpairment,weassesstherecoverabilityoftheassetgroupbydeterminingifthecarryingvalueoftheassetgroup

exceedsthesumoftheprojectedundiscountedcashflowsexpectedtoresultfromtheuseandeventualdispositionoftheassetsovertheremainingeconomiclifeof

theprimaryassetofthegroup.Iftherecoverabilitytestindicatesthatthecarryingvalueoftheassetgroupisnotrecoverable,wewillestimatethefairvalueofthe

assetgroupusingappropriatevaluationmethodologieswhichwouldtypicallyincludeanestimateofdiscountedcashflows.Anyimpairmentwouldbemeasuredby

theamountthatthecarryingvalueofsuchassetgroupsexceedtheirfairvalueandwouldbeincludedinoperatingincomeontheconsolidatedstatementof

operations.Wehavenotidentifiedanycircumstancesthatwouldwarrantanimpairmentchargeforanyrecordeddefinitelivedorotherlongtermassetsonour

consolidatedbalancesheetatDecember31,2015.

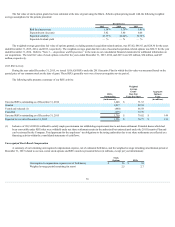

Income Taxes

Werecordincometaxesundertheassetandliabilitymethod.Deferredtaxassetsandliabilitiesreflectourestimationofthefuturetaxconsequencesof

temporarydifferencesbetweenthecarryingamountsofassetsandliabilitiesforbookandtaxpurposes.Wedeterminedeferredincometaxesbasedonthe

differencesinaccountingmethodsandtimingbetweenfinancialstatementandincometaxreporting.Accordingly,wedeterminethedeferredtaxassetorliability

foreachtemporarydifferencebasedontheenactedtaxratesexpectedtobeineffectwhenwerealizetheunderlyingitemsofincomeandexpense.Weconsiderall

relevantfactorswhenassessingthelikelihoodoffuturerealizationofourdeferredtaxassets,includingourrecentearningsexperiencebyjurisdiction,expectations

offuturetaxableincome,andthecarryforwardperiodsavailabletousfortaxreportingpurposes,aswellasassessingavailabletaxplanningstrategies.Wemay

establishavaluationallowancetoreducedeferredtaxassetstotheamountwebelieveismorelikelythannottoberealized.Duetoinherentcomplexitiesarising

fromthenatureofourbusinesses,futurechangesinincometaxlaw,taxsharingagreementsorvariancesbetweenouractualandanticipatedoperatingresults,we

makecertainjudgmentsandestimates.Therefore,actualincometaxescouldmateriallyvaryfromtheseestimates.

Werecordliabilitiestoaddressuncertaintaxpositionswehavetakeninpreviouslyfiledtaxreturnsorthatweexpecttotakeinafuturetaxreturn.The

determinationforrequiredliabilitiesisbaseduponananalysisofeachindividualtaxposition,takingintoconsiderationwhetheritismorelikelythannotthatour

taxposition,basedontechnicalmerits,willbesustaineduponexamination.

70