TripAdvisor 2015 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2015 TripAdvisor annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

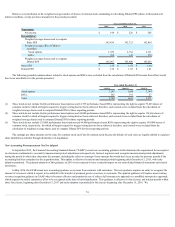

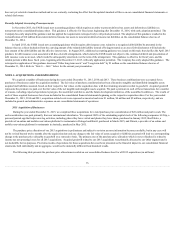

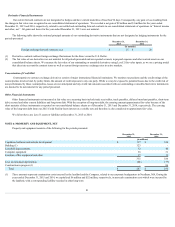

ThefairvalueofstockoptiongrantshasbeenestimatedatthedateofgrantusingtheBlack–Scholesoptionpricingmodelwiththefollowingweighted

averageassumptionsfortheperiodspresented:

December 31,

2015 2014 2013

Riskfreeinterestrate 1.58% 1.79% 1.41%

Expectedterm(inyears) 5.42 5.80 6.06

Expectedvolatility 41.79% 44.04% 50.78%

Expecteddividendyield —% —% —%

Theweighted-averagegrantdatefairvalueofoptionsgranted,excludingassumedacquisition-relatedoptions,was$33.02,$46.65,and$28.30fortheyears

endedDecember31,2015,2014,and2013,respectively.Theweighted-averagegrantdatefairvalueofassumedacquisition-relatedoptionswas$80.31fortheyear

endedDecember31,2014.Referto“Note3—Acquisitions and Dispositions” inthenotestoourconsolidatedfinancialstatementsforadditionalinformationon

ouracquisitions.ThetotalfairvalueofstockoptionsvestedfortheyearsendedDecember31,2015,2014,and2013were$36million,$34million,and$27

million,respectively.

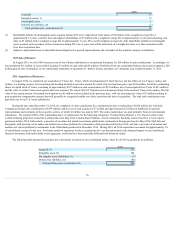

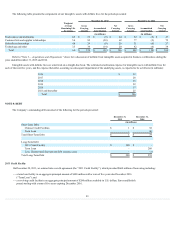

2015 RSU Activity

DuringtheyearendedDecember31,2015,weissued1,016,626RSUsunderthe2011IncentivePlanforwhichthefairvaluewasmeasuredbasedonthe

quotedpriceofourcommonstockonthedateofgrant.TheseRSUsgenerallyvestoverafour-yearrequisiteserviceperiod.

ThefollowingtablepresentsasummaryofourRSUactivity:

Weighted

Average

Grant- Aggregate

RSUs Date Fair Intrinsic

Outstanding Value Per Share Value

(in thousands) (in millions)

UnvestedRSUsoutstandingasofDecember31,2014 1,448 $ 71.33

Granted 1,017 82.95

Vestedandreleased(1) (440) 66.58

Cancelled (275) 72.76

UnvestedRSUsoutstandingasofDecember31,2015 1,750 $ 79.02 $ 149

ExpectedtovestafterDecember31,2015 1,556 $ 78.77 $ 133

(1) Inclusiveof128,341RSUswithheldtosatisfyemployeeminimumtaxwithholdingrequirementsduetonetsharesettlement.Potentialshareswhichhad

beenconvertibleunderRSUsthatwerewithheldundernetsharesettlementremainintheauthorizedbutunissuedpoolunderthe2011IncentivePlanand

canbereissuedbytheCompany.Totalpaymentsfortheemployees’taxobligationstothetaxingauthoritiesduetonetsharesettlementsarereflectedasa

financingactivitywithintheconsolidatedstatementsofcashflows.

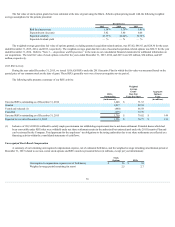

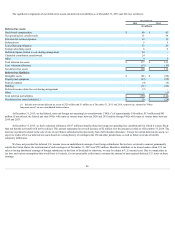

Unrecognized Stock-Based Compensation

Asummaryofourremainingunrecognizedcompensationexpense,netofestimatedforfeitures,andtheweightedaverageremainingamortizationperiodat

December31,2015relatedtoournon-vestedstockoptionsandRSUawardsispresentedbelow(inmillions,exceptperyearinformation):

Stock

Options RSUs

Unrecognizedcompensationexpense(netofforfeitures) $ 56 $ 94

Weightedaverageperiodremaining(inyears) 2.5 2.7

79