TripAdvisor 2015 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2015 TripAdvisor annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

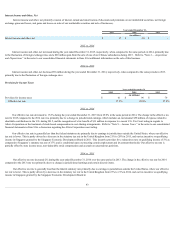

2011.Oureffectivetaxrateispartiallyoffsetbystateincometaxes,non-deductiblestockcompensationandaccrualsonuncertaintaxpositions.

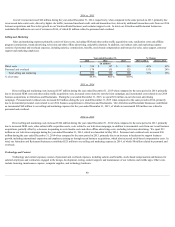

Liquidity and Capital Resources

Thefollowingsectionexplainshowwehavegeneratedandusedourcashhistorically,describesourcurrentcapitalresourcesanddiscussesourfuture

financialcommitments.

Cash Requirements

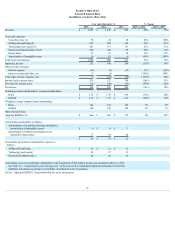

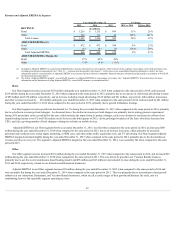

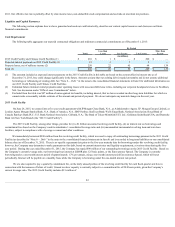

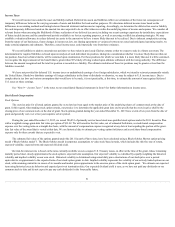

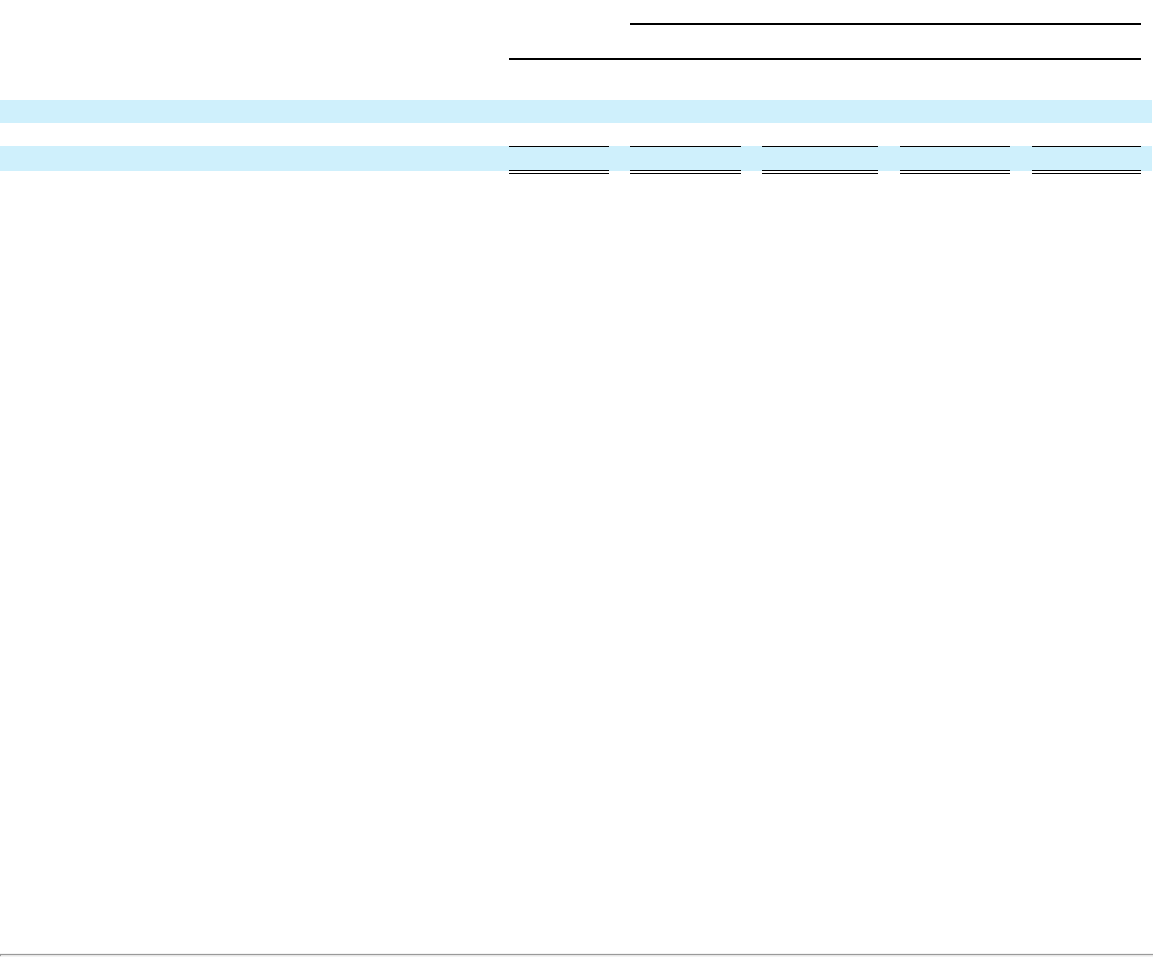

ThefollowingtableaggregatesourmaterialcontractualobligationsandminimumcommercialcommitmentsasofDecember31,2015:

By Period

Total

Less than

1 year 1 to 3 years 3 to 5 years

More than

5 years

(in millions)

2015CreditFacilityandChineseCreditFacilities(1) $ 201 $ 1 $ — $ 200 $ —

Expectedinterestpaymentson2015CreditFacility(1) 15 3 7 5 —

Propertyleases,netofsubleaseincome(2) 250 22 45 44 139

Total(3) $ 466 $ 26 $ 52 $ 249 $ 139

(1) Theamountsincludedasexpectedinterestpaymentsonthe2015CreditFacilityinthistablearebasedonthecurrenteffectiveinterestrateasof

December31,2015,but,couldchangesignificantlyinthefuture.Amountsassumethatourexistingdebtisrepaidatmaturityanddonotassumeadditional

borrowingsorrefinancingofexistingdebt.See“Note8—Debt ”inthenotestotheconsolidatedfinancialstatementsinItem8foradditionalinformationon

our2015CreditFacilityandChineseCreditFacilities.

(2) Estimatedfutureminimumrentalpaymentsunderoperatingleaseswithnon-cancelableleaseterms,includingourcorporateheadquartersleaseinNeedham,

MA.Seediscussionunder“OfficeLeaseCommitments”below.

(3) Excludedfromthetablewas$87millionofunrecognizedtaxbenefits,includinginterest,thatwehaverecordedinotherlong-termliabilitiesforwhichwe

cannotmakeareasonablyreliableestimateoftheamountandperiodofpayment.Wedonotanticipateanymaterialchangesinthenextyear.

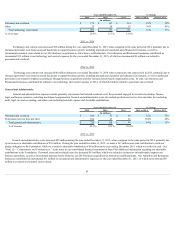

2015 Credit Facility

OnJune26,2015,weenteredintoafiveyearcreditagreementwithJPMorganChaseBank,N.A.,asAdministrativeAgent;J.P.MorganEuropeLimited,as

LondonAgent;MorganStanleyBank,N.A.;BankofAmerica,N.A.;BNPParibas;SunTrustBank;WellsFargoBank,NationalAssociation;RoyalBankof

Canada;BarclaysBankPLC;U.S.BankNationalAssociation;Citibank,N.A.;TheBankofTokyo-MitsubishiUFJ,Ltd.;GoldmanSachsBankUSA;andDeutsche

BankAGNewYorkBranch(the“2015CreditFacility”).

The2015CreditFacility,amongotherthings,providesfor(i)a$1billionunsecuredrevolvingcreditfacility,(ii)aninterestrateonborrowingsand

commitmentfeesbasedontheCompany’sanditssubsidiaries’consolidatedleverageratioand(iii)uncommittedincrementalrevolvingloanandtermloan

facilities,subjecttocompliancewithaleveragecovenantandotherconditions.

Weimmediatelyborrowed$290millionfromthisrevolvingcreditfacility,whichwasusedtorepayalloutstandingborrowingspursuanttothe2011Credit

Facility(asdescribedin“Note8—Debt ”inthenotestotheconsolidatedfinancialstatementsinItem8)andisrecordedinlongtermliabilitiesonourconsolidated

balancesheetasofDecember31,2015.Thereisnospecificrepaymentdatepriortothefive-yearmaturitydateforborrowingsunderthisrevolvingcreditfacility,

however,theCompanymaydeterminetomakepaymentsonthisdebt,basedoncurrentinterestratesandliquidityrequirements,atvarioustimesduringthefive-

yearperiod.DuringtheyearendedDecember31,2015,theCompanyhasrepaid$90millionofouroutstandingborrowingsonthe2015CreditFacility.Basedon

theCompany’scurrentleverageratio,ourborrowingsbearinterestatLIBORplus125basispoints,ortheEurocurrencySpread.TheCompanyiscurrently

borrowingunderaone-monthinterestperiodofapproximately1.7%perannum,usingaone-monthinterestperiodEurocurrencySpread,whichwillreset

periodically.InterestwillbepayableonamonthlybasiswhiletheCompanyisborrowingundertheone-monthinterestrateperiod.

Wearealsorequiredtopayaquarterlycommitmentfee,onthedailyunusedportionoftherevolvingcreditfacilityforeachfiscalquarterandfeesin

connectionwiththeissuanceoflettersofcredit.Unusedrevolvercapacityiscurrentlysubjecttoacommitmentfeeof20.0basispoints,giventheCompany’s

currentleverageratio.The2015CreditFacilityincludes$15millionof

44