TripAdvisor 2015 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2015 TripAdvisor annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

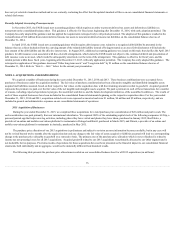

Performance-basedstockoptionsandRSUsvestuponachievementofcertaincompany-basedperformanceconditionsandarequisiteserviceperiod.Onthe

dateofgrant,thefairvalueofaperformance-basedawardiscalculatedusingthesamemethodasourservicebasedstockoptionsandRSUsdescribedabove.We

thenassesswhetheritisprobablethattheindividualperformancetargetswouldbeachieved.Ifassessedasprobable,compensationexpensewillberecordedfor

theseawardsovertheestimatedperformanceperiod.Ateachreportingperiod,wewillreassesstheprobabilityofachievingtheperformancetargetsandthe

performanceperiodrequiredtomeetthosetargets.Theestimationofwhethertheperformancetargetswillbeachievedandoftheperformanceperiodrequiredto

achievethetargetsrequiresjudgment,andtotheextentactualresultsorupdatedestimatesdifferfromourcurrentestimates,thecumulativeeffectoncurrentand

priorperiodsofthosechangeswillberecordedintheperiodestimatesarerevised,orthechangeinestimatewillbeappliedprospectivelydependingonwhetherthe

changeaffectstheestimateoftotalcompensationcosttoberecognizedormerelyaffectstheperiodoverwhichcompensationcostistoberecognized.Theultimate

numberofsharesissuedandtherelatedcompensationexpenserecognizedwillbebasedonacomparisonofthefinalperformancemetricstothespecifiedtargets.

Estimatesoffairvaluearenotintendedtopredictactualfutureeventsorthevalueultimatelyrealizedbyemployeeswhoreceivetheseawards,and

subsequenteventsarenotindicativeofthereasonablenessofouroriginalestimatesoffairvalue.Weusehistoricaldatatoestimatepre-vestingstockoptionand

RSUforfeituresandrecordshare-basedcompensationexpenseonlyforthoseawardsthatareexpectedtovest.Changesinestimatedforfeituresarerecognized

throughacumulativecatch-upadjustmentintheperiodofchangewhichalsoimpactstheamountofstockcompensationexpensetoberecognizedinfutureperiods.

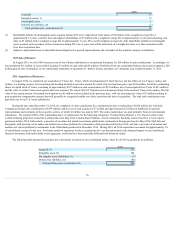

Treasury Stock

Sharesofourcommonstockrepurchasedarerecordedatcostastreasurystockandresultinthereductionofstockholders'equityinourconsolidatedbalance

sheet.Wemayreissuethesetreasuryshares.Whentreasurysharesarereissued,weusetheaveragecostmethodfordeterminingthecostofreissuedshares.Ifthe

issuancepriceishigherthanthecost,theexcessoftheissuancepriceoverthecostiscreditedtoadditionalpaid-in-capital.Iftheissuancepriceislowerthanthe

cost,thedifferenceisfirstchargedagainstanycreditbalanceinadditionalpaid-in-capitalfromthepreviousissuancesoftreasurystockandtheremainingbalance

ischargedtoretainedearnings.

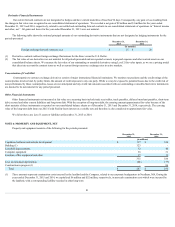

Deferred Merchant Payables

Wereceivecashfromtravelersatthetimeofbookingrelatedtoourvacationrental,attractionsandtransaction-basedbusinessesandwerecordthese

amounts,netofcommissions,onourconsolidatedbalancesheetsasdeferredmerchantpayables.Wepaythehotel,attractionproviderorvacationrentalowner

afterthetravelers’useandsubsequentbillingfromthehotel,attractionproviderorvacationrentalowner.Therefore,wereceivecashfromthetravelerpriorto

payingthehotel,attractionproviderorvacationrentalowner,andthisoperatingcyclerepresentsaworkingcapitalsourceoruseofcashtous.Aslongasthese

businessesgrow,weexpectthatchangesinworkingcapitalrelatedtothesetransactions,dependingontimingofpaymentsandseasonality,willcontinuetoimpact

operatingcashflows.Ourdeferredmerchantpayablesbalancewas$105millionand$93millionfortheyearsendedDecember31,2015and2014,respectively.

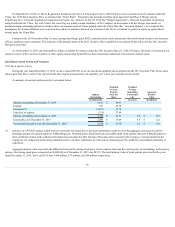

Credit Risk and Concentrations

Financialinstruments,whichpotentiallysubjectustoconcentrationofcreditrisk,consistprimarilyofcashandcashequivalents,corporatedebtsecurities,

foreignexchangecontracts,accountsreceivableandcustomerconcentrations.Wemaintainsomecashandcashequivalentsbalanceswithfinancialinstitutionsthat

areinexcessofFederalDepositInsuranceCorporationinsurancelimits.Ourcashandcashequivalentsareprimarilycomposedofprimeinstitutionalmoneymarket

fundsaswellasbankaccountbalancesprimarilydenominatedinU.S.dollars,Euros,Britishpoundsterling,Chineserenminbi,AustraliandollarsandSingapore

dollars.Weinvestinhighly-ratedcorporatedebtsecurities,andourinvestmentpolicylimitstheamountofcreditexposuretoanyoneissuer,industrygroupand

currency.Ourcreditriskrelatedtocorporatedebtsecuritiesisalsomitigatedbytherelativelyshortmaturityperiodrequiredbyourinvestmentpolicy.Foreign

exchangecontractsaretransactedwithvariousinternationalfinancialinstitutionswithhighcreditstanding.

Ourbusinessisalsosubjecttocertainrisksduetoconcentrationsrelatedtodependenceonourrelationshipswithourcustomers.Fortheyearsended

December31,2015,2014and2013ourtwomostsignificantadvertisingpartners,ExpediaandPriceline,eachaccountedformorethan10%ofourconsolidated

revenueandcombinedaccountedfor46%,46%and47%ofourconsolidatedrevenue,respectively.ThisconcentrationofrevenueisrecordedinourHotelsegment

forthesereportingperiods.AsofDecember31,2015and2014,Expediaaccountedfor11%and15%,respectively,ofourtotalaccountsreceivable.Ouroverall

creditriskrelatedtoaccountsreceivableisalsomitigatedbytherelativelyshortcollectionperiod.

72