TripAdvisor 2015 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2015 TripAdvisor annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

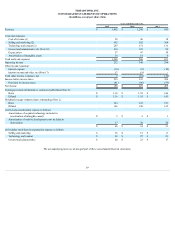

Item 7A. Quantitative and Qualitative Disclosures About Market Risk

Market Risk Management

Weareexposedtocertainmarketrisks,includingchangesininterestratesandforeigncurrencyexchangeratesthatcouldadverselyaffectourresultsof

operationsorfinancialcondition.Wemanageourexposuretotheserisksthroughestablishedpoliciesandproceduresandbyassessingtheanticipatednear-term

andlong-termfluctuationsininterestratesandforeigncurrencyexchangerates.Ourobjectiveistomitigatepotentialincomestatement,cashflowandmarket

exposuresfromchangesininterestandforeignexchangerates.

Interest Rates

Ourcurrentexposuretochangesininterestratesrelateprimarilytoourinvestmentportfolioandtheoutstandingborrowingsonour2015CreditFacility.

OurinterestincomeandexpenseismostsensitivetofluctuationsinU.S.interestratesandLibor.Changesininterestratesaffecttheinterestearnedonourcash,

cashequivalentsandmarketablesecuritiesandthefairvalueofthosesecurities,aswellastheamountofinterestwepayonouroutstandingdebt.

Wecurrentlyinvestourexcesscashincashdepositsatmajorglobalbanks,moneymarketmutualfundsandmarketablesecurities.Ourinvestmentpolicy

andstrategyarefocusedonpreservationofcapitalandsupportingourliquidityrequirements.Weinvestinhighly-ratedsecurities,andourinvestmentpolicylimits

theamountofcreditexposuretoanyoneissuer.Thepolicyrequiresinvestmentstobeinvestmentgrade,withtheprimaryobjectiveofminimizingthepotentialrisk

ofprincipalloss.

Inordertoprovideameaningfulassessmentoftheinterestrateriskassociatedwithourinvestmentportfolio,weperformedasensitivityanalysisto

determinetheimpactachangeininterestrateswouldhaveonthevalueofourcurrentinvestmentportfolioassuminga100basispointparallelshiftintheyield

curve.BasedonourinvestmentpositionsasofDecember31,2015,ahypothetical100basispointincreaseininterestratesacrossallmaturitieswouldresultinan

approximate$1millionincrementaldeclineinthefairmarketvalueoftheportfolio.Suchlosseswouldonlyberealizedifwesoldtheinvestmentspriorto

maturity.

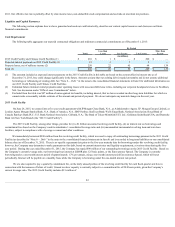

AsofDecember31,2015,wehad$200millionofdebtunderour2015CreditFacility,whichhasavariablerate.Thevariableinterestrateonthe2015

CreditFacilityisbasedoncurrentassumptions,leverageandLIBORrates.BasedonourcurrentoutstandingbalancethroughDecember31,2015,a25basispoint

changeinourinterestrateonthe2015CreditFacilitywouldresultinanincreaseordecreasetointerestexpensethatwouldbelessthan$1millionperannum.We

currentlydonothedgeourinterestraterisk;however,wearecontinuallyevaluatingtheinterestratemarket,andifwebecomeincreasinglyexposedtopotentially

volatilemovementsininterestrates,andifthesemovementsarematerial,thiscouldcauseustoadjustourfinancingstrategy.

WedidnotexperienceanysignificantimpactfromchangesininterestratesfortheyearsendedDecember31,2015,2014or2013.

Foreign Currency Exchange Rates

Weconductbusinessincertaininternationalmarkets,primarilytheEuropeanUnion,theUnitedKingdom,Singapore,AustraliaandChina.Becausewe

operateininternationalmarkets,wehaveexposuretodifferenteconomicclimates,politicalarenas,taxsystemsandregulationsthatcouldaffectforeignexchange

rates.

SomeofourforeignsubsidiariesmaintaintheiraccountingrecordsintheirrespectivelocalcurrenciesotherthantheU.S.dollar(primarilyinBritish

pounds).Consequently,changesincurrencyexchangeratesmayimpactthetranslationofforeignfinancialstatementsintoU.S.dollars.Asaresult,weface

exposuretoadversemovementsincurrencyexchangeratesasthefinancialresultsofourinternationaloperationsaretranslatedfromlocalcurrency,orfunctional

currency,intoU.S.dollarsuponconsolidation.IftheU.S.dollarweakensagainstthelocalcurrency,thetranslationoftheseforeign-currency-denominatedbalances

willresultinincreasednetassets,revenue,operatingexpenses,operatingincomeandnetincome.Similarly,ournetassets,revenue,operatingexpenses,operating

incomeandnetincomewilldecreaseiftheU.S.dollarstrengthensagainstlocalcurrency.Theeffectofforeignexchangeonourbusinesshistoricallyhasvaried

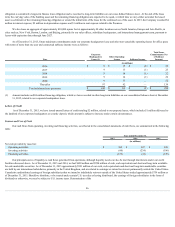

fromquartertoquarterandmaycontinuetodoso,potentiallymaterially.Ahypothetical10%decreaseoftheforeignexchangeratesrelativetotheU.S.Dollar,or

strengtheningoftheU.S.Dollar,wouldgenerateanunrealizedlossofapproximately$22millionrelatedtoadecreaseinournetassetsheldinfunctionalcurrencies

otherthantheU.S.DollarasofDecember31,2015,whichwouldbeinitiallyrecordedtoaccumulatedothercomprehensivelossonourconsolidatedbalancesheet.

Inaddition,foreignexchangeratefluctuationsontransactionsdenominatedincurrenciesotherthanthefunctionalcurrencyresultingainsandlosses.We

recognizethesetransactionalgainsandlosses(primarilyEurocurrencytransactions)inourconsolidated

54