TripAdvisor 2015 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2015 TripAdvisor annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

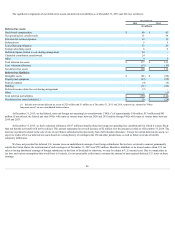

Legal Proceedings

Intheordinarycourseofbusiness,weandoursubsidiariesarepartiestoregulatoryandlegalmattersarisingoutofouroperations.Thesemattersmay

involveclaimsinvolvingallegedinfringementofthird-partyintellectualpropertyrights(includingpatentinfringement),defamation,taxes,regulatorycompliance

privacyissuesandotherclaims.Periodically,wereviewthestatusofallsignificantoutstandingmatterstoassessanypotentialfinancialexposure.When(i)itis

probablethatanassethasbeenimpairedoraliabilityhasbeenincurredand(ii)theamountofthelosscanbereasonablyestimated,werecordtheestimatedlossin

ourconsolidatedfinancialstatementsofoperations.Weprovidedisclosuresinthenotestotheconsolidatedfinancialstatementsforlosscontingenciesthatdonot

meetbothoftheseconditionsifthereisareasonableprobabilitythatalossmayhavebeenincurredandwhethersuchlossisreasonablyestimable.Webase

accrualsmadeonthebestinformationavailableatthetimewhichcanbehighlysubjective.Althoughoccasionaladversedecisionsorsettlementsmayoccur,the

Companydoesnotbelievethatthefinaldispositionofanyofthesematterswillhaveamaterialadverseeffectonthebusiness.However,thefinaloutcomeofthese

matterscouldvarysignificantlyfromourestimates.Finally,theremaybeclaimsoractionspendingorthreatenedagainstusofwhichwearecurrentlynotaware

andtheultimatedispositionofwhichcouldhaveamaterialadverseeffectonus.

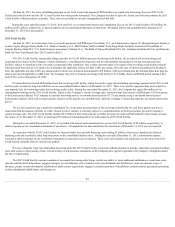

Income Taxes

WearealsounderauditbytheIRSandvariousotherdomesticandforeigntaxauthoritieswithregardstoincometaxmatters.Wehavereservedfor

potentialadjustmentstoourprovisionforincometaxesthatmayresultfromexaminationsby,oranynegotiatedagreementswith,thesetaxauthorities.Although

webelieveourtaxestimatesarereasonable,thefinaldeterminationofauditscouldbemateriallydifferentfromourhistoricalincometaxprovisionsandaccruals.

Theresultsofanauditcouldhaveamaterialeffectonourfinancialposition,resultsofoperations,orcashflowsintheperiodforwhichthatdeterminationismade.

Additionally,weearnanincreasingportionofourincome,andaccumulateagreaterportionofcashflows,inforeignjurisdictionswhichweconsider

indefinitelyreinvested.Anyrepatriationoffundscurrentlyheldinforeignjurisdictionsmayresultinhighereffectivetaxratesandincrementalcashtaxpayments.

Inaddition,therehavebeenproposalstoamendU.S.taxlawsthatwouldsignificantlyimpactthemannerinwhichU.S.companiesaretaxedonforeignearnings.

Althoughwecannotpredictwhetherorinwhatformanylegislationwillpass,ifenacted,itcouldhaveamaterialadverseimpactonourU.S.taxexpenseandcash

flows.See“Note9—Income Taxes ”aboveforfurtherinformationonpotentialcontingenciessurroundingincometaxes.

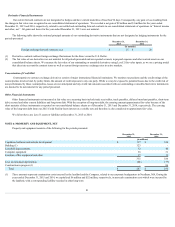

NOTE 13: EMPLOYEE BENEFIT PLANS

Retirement Savings Plan

TheTripAdvisorRetirementSavingsPlan(the“401(k)Plan”),qualifiesunderSection401(k)oftheInternalRevenueCode.The401(k)Planallows

participatingemployees,mostofourU.S.employees,tomakecontributionsofaspecifiedpercentageoftheireligiblecompensation.Participatingemployeesmay

contributeupto50%oftheireligiblesalaryonapre-taxbasis,butnotmorethanstatutorylimits.Employee-participantsage50andovermayalsocontributean

additionalamountoftheirsalaryonapre-taxtaxbasisuptotheIRSCatch-UpProvisionLimit,orcatch-upcontributions.Employeesmayalsocontributeintothe

401(k)Planonanafter-taxbasisuptoanannualmaximumof10%.The401(k)Planhasanautomaticenrollmentfeatureat6%pre-tax.Wematch50%ofthefirst

6%ofemployeecontributionstotheplanforamaximumemployercontributionof3%ofaparticipant’seligibleearnings.The“catchupcontributions”,arenot

eligibleforemployermatchingcontributions.Thematchingcontributionsportionofanemployee’saccount,vestsaftertwoyearsofservice.ThePlanalsopermits

certainafter-taxRoth401(k)contributions.Additionally,attheendofthe401(k)Planyear,wemakeadiscretionarymatchingcontributiontoeligibleparticipants.

Thisadditionaldiscretionarymatchingemployercontributionreferredtoas“trueup”islimitedtomatchonlycontributionsupto3%ofeligiblecompensation.

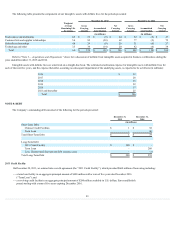

Wealsohavevariousdefinedcontributionplansforourinternationalemployees.Ourcontributiontothe401(k)Planandourinternationaldefined

contributionplanswas$7million,$5million,and$5millionfortheyearsendedDecember31,2015,2014and2013,respectively,andrecordedtoour

consolidatedstatementsofoperations,respectively,forthoseyears.

TripAdvisor, Inc. Deferred Compensation Plan for Non-Employee Directors

TheCompanyalsohasaDeferredCompensationPlanforNon-EmployeeDirectors(the“Plan”).UnderthePlan,eligibledirectorswhodefertheirdirectors’

feesmayelecttohavesuchdeferredfees(i)appliedtothepurchaseofshareunits,representingthenumberofsharesofourcommonstockthatcouldhavebeen

purchasedonthedatesuchfeeswouldotherwisebepayable,or(ii)creditedtoacashfund.Thecashfundwillbecreditedwithinterestatanannualrateequalto

theweightedaverageprimeorbaselendingrateofafinancialinstitutionselectedinaccordancewiththetermsofthePlanandapplicablelaw.Uponterminationof

serviceasadirectorofTripAdvisor,adirectorwillreceive(i)withrespecttoshareunits,suchnumberofsharesofourcommonstockastheshareunitsrepresent,

and(ii)withrespecttothecashfund,acashpayment.Paymentsuponterminationwillbemadeineitheronelumpsumoruptofiveannualinstallments,aselected

bytheeligibledirectoratthetimeofthedeferralelection.

91