TripAdvisor 2015 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2015 TripAdvisor annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

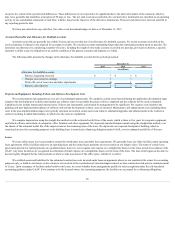

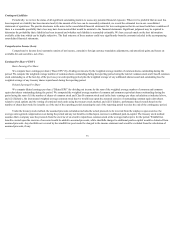

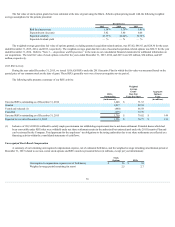

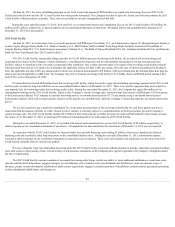

Total

Goodwill $ 17

Intangibleassets(1) 12

Nettangibleassets 1

Deferredtaxliabilities,net (2)

Totalpurchasepriceconsideration(2) $ 28

(1) Identifiabledefinite-livedintangibleassetsacquiredduring2015werecomprisedoftradenamesof$2millionwithaweightedaveragelifeof

approximately10years,customerlistsandsupplierrelationshipsof$7millionwithaweightedaveragelifeofapproximately6yearsandtechnologyand

otherof$3millionwithaweightedaveragelifeofapproximately2years.Theoverallweighted-averagelifeoftheidentifiabledefinite-livedintangible

assetsacquiredinthepurchaseofthesebusinessesduring2015was6years,andwillbeamortizedonastraight-linebasisovertheirestimateduseful

livesfromacquisitiondate.

(2) Subjecttoadjustmentbasedonindemnificationobligationsforgeneralrepresentationsandwarrantiesoftheacquiredcompanystockholders.

2015 Sale of Business

InAugust2015,wesold100%interestinoneofourChinesesubsidiariestoanunrelatedthirdpartyfor$28millionincashconsideration.Accordingly,we

deconsolidated$11millionofassets(whichincluded$3millionofcashsold)and$4millionofliabilitiesfromourconsolidatedbalancesheetandrecognizeda$20

milliongainonsaleofsubsidiaryinourconsolidatedstatementsofoperationsin“Interestincomeandother,net”duringtheyearendedDecember31,2015.

2014 Acquisition of Businesses

InAugust2014,wecompletedouracquisitionofViator,Inc.Viator,whichisheadquarteredinSanFranciscoandhasofficesinLasVegas,London,and

Sydney,isaleadingresourceforresearchingandbookingdestinationactivitiesaroundtheworld.Ourtotalpurchasepricewas$192million,foralltheoutstanding

sharesofcapitalstockofViator,consistingofapproximately$187millionincashconsideration(or$132million,netofcashacquiredfromViatorof$55million)

andthevalueofcertainViatorstockoptionsthatwereassumed.Weissued100,595TripAdvisorstockoptionsrelatedtotheassumedViatorstockoptions.Thefair

valueoftheearnedportionofassumedstockoptionswas$5millionandisincludedinthepurchaseprice,withtheremainingfairvalueof$3millionresultingin

post-acquisitioncompensationexpensethatwillgenerallyberecognizedratablyoverthreeyearsfromthedateofacquisition.Thetotalcashconsiderationwas

paidfromoneofourU.S.basedsubsidiaries.

DuringtheyearendedDecember31,2014,wecompletedsixotheracquisitionsforatotalpurchasepriceconsiderationof$208million,forwhichthe

Companypaidtotalcashconsiderationof$199million,whichisnetofcashacquiredof$7millionandapproximately$2millioninholdbacksforgeneral

representationsandwarrantiesoftherespectivesellers,ofwhich$1millionwaspaidin2015.Thecashconsiderationwaspaidprimarilyfromourinternational

subsidiaries.Weacquired100%oftheoutstandingsharesofcapitalstockforthefollowingcompanies;VacationHomeRentals,aU.S.-basedvacationrental

websitefeaturingpropertiesaroundtheworldpurchasedinMay2014;London-basedTripbod,atravelcommunitythathelpsconnecttravelerstolocalexperts

purchasedinMay2014;Lafourchette,aproviderofanonlineandmobilereservationsplatformforrestaurantsinEuropepurchasedinMay2014;MyTableand

Restopolis,bothprovidersofanonlineandmobilereservationsplatformforrestaurantsinItalypurchasedinOctober2014;andIens,aproviderofanonlineand

mobilereservationsplatformforrestaurantsintheNetherlandspurchasedinDecember2014.During2014,all2014acquisitionsaccountedforapproximately3%

ofconsolidatedrevenuefortheyear.Pro-formaresultsofoperationsfortheseacquisitionshavenotbeenpresentedasthefinancialimpacttoourconsolidated

financialstatements,bothindividuallyandinaggregate,wouldnothavebeenmateriallydifferentfromhistoricalresults.

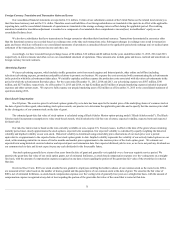

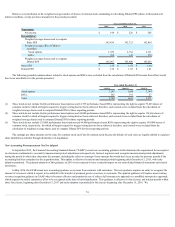

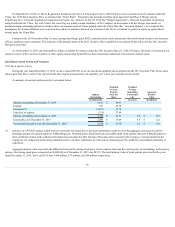

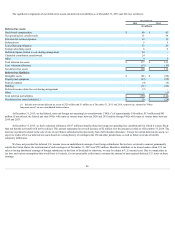

Thefollowingtablepresentsthepurchasepriceallocationsrecordedonourconsolidatedbalancesheetforall2014acquisitions(inmillions):

Total

Goodwill(1) $ 253

Intangibleassets(2) 194

Nettangibleassets(liabilities)(3) (7)

Deferredtaxliabilities,net (40)

Totalpurchasepriceconsideration(4) $ 400

76