TripAdvisor 2015 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2015 TripAdvisor annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

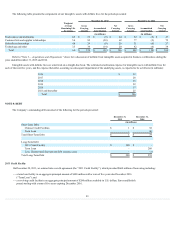

Derivative Financial Instruments

Ourcurrentforwardcontractsarenotdesignatedashedgesandhavecurrentmaturitiesoflessthan90days.Consequently,anygainorlossresultingfrom

thechangeinfairvaluewasrecognizedinourconsolidatedstatementofoperations.Werecordedanetgainof$2millionand$1millionfortheyearsended

December31,2015and2014,respectively,relatedtooursettledandoutstandingforwardcontractsinourconsolidatedstatementsofoperationsin“Interestincome

andother,net.”AllgainsandlossesfortheyearendedDecember31,2013werenotmaterial.

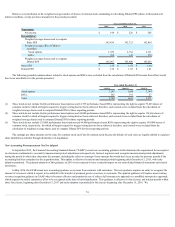

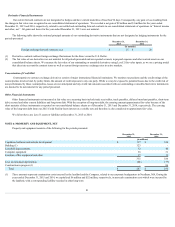

Thefollowingtableshowsthenotionalprincipalamountsofouroutstandingderivativeinstrumentsthatarenotdesignatedashedginginstrumentsforthe

periodspresented:

December 31,

2015 December 31,

2014

(in millions)

Foreignexchange-forwardcontracts(1)(2) $ 25 $ 20

(1) DerivativecontractsaddressforeignexchangefluctuationsfortheEuroversustheU.S.Dollar.

(2) Thefairvalueofourderivativesarenotmaterialforallperiodspresentedandarereportedasassetsinprepaidexpensesandothercurrentassetsonour

consolidatedbalancesheets.WemeasurethefairvalueofouroutstandingorunsettledderivativesusingLevel2fairvalueinputs,asweuseapricingmodel

thattakesintoaccountthecontracttermsaswellascurrentforeigncurrencyexchangeratesinactivemarkets.

Concentration of Credit Risk

Counterpartiestocurrencyexchangederivativesconsistofmajorinternationalfinancialinstitutions.Wemonitorourpositionsandthecreditratingsofthe

counterpartiesinvolvedand,bypolicylimits,theamountofcreditexposuretoanyoneparty.Whilewemaybeexposedtopotentiallossesduetothecreditriskof

non-performancebythesecounterparties,lossesarenotanticipatedandanycreditriskamountsassociatedwithouroutstandingorunsettledderivativeinstruments

aredeemedtobenotmaterialforanyperiodpresented.

Other Financial Instruments

Otherfinancialinstrumentsnotmeasuredatfairvalueonarecurringbasisincludetradereceivables,tradepayables,deferredmerchantpayables,short-term

debt,accruedandothercurrentliabilitiesandlong-termdebt.Withtheexceptionoflong-termdebt,thecarryingamountapproximatesfairvaluebecauseofthe

shortmaturityoftheseinstrumentsasreportedonourconsolidatedbalancesheetsasofDecember31,2015andDecember31,2014,respectively.Thecarrying

valueofthelong-termdebtfromour2015CreditFacilitybearsinterestatavariablerateandthereforeisalsoconsideredtoapproximatefairvalue.

WedidnothaveanyLevel3assetsorliabilitiesatDecember31,2015or2014.

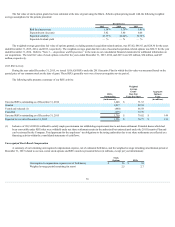

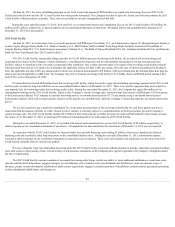

NOTE 6: PROPERTY AND EQUIPMENT, NET

Propertyandequipmentconsistsofthefollowingfortheperiodspresented:

December 31,

2015

December 31,

2014

(in millions)

Capitalizedsoftwareandwebsitedevelopment $ 127 $ 104

Building(1) 123 -

Leaseholdimprovements 32 40

Computerequipment 36 31

Furniture,officeequipmentandother 17 11

335 186

Less:accumulateddepreciation (88) (77)

Constructioninprogress(1) - 86

Total $ 247 $ 195

(1) TheseamountsrepresentconstructioncostsincurredbythelandlordandtheCompany,relatedtoourcorporateheadquartersinNeedham,MA.Duringthe

yearsendedDecember31,2015and2014,wecapitalized$6millionand$52million,respectively,innon-cashconstructioncostswhichwereincurredby

thelandlord,withacorrespondingliabilityrecordedinotherlong-term

81