TripAdvisor 2015 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2015 TripAdvisor annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

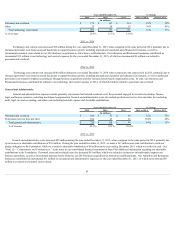

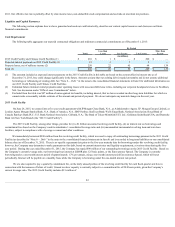

Investing Activities

FortheyearendedDecember31,2014,netcashusedininvestingactivitiesincreasedby$38millionwhencomparedtothesameperiodin2013,primarily

duetoanincreaseincashpaidforacquisitionsofbusinessesin2014of$296millionandanincreaseincapitalexpendituresof$26millionin2014,when

comparedagainst2013,partiallyoffsetbyanetdecreaseincashusedforthepurchases,salesandmaturitiesofmarketablesecuritiesof$284million.

Financing Activities

FortheyearendedDecember31,2014,netcashusedinfinancingactivitiesdecreasedby$129millionwhencomparedtothesameperiodin2013,

primarilyduetoanincreaseof$8millioninexcesstaxbenefitsrelatedtostockcompensation,adecreaseof$12millioninrepaymentsofouroutstanding

borrowingsonourChineseCreditFacilitiesin2014,andpaymentsof$145millionforcommonstocksharerepurchasesunderourauthorizedsharerepurchase

programin2013,whichdidnotreoccurin2014.Thiswasoffsetbyareductioninproceedsfromtheexerciseofourstockoptionsof$21millionin2014,duetothe

introductioninthethirdquarterof2013ofthenetsharesettlementofthemajorityofourstockoptionsandanincreaseinpaymentsofminimumwithholdingtaxes

relatedtonetsharesettlementofequityawardsof$19millionin2014.

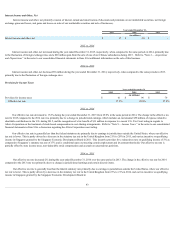

Off-Balance Sheet Arrangements

AsofDecember31,2015,wedidnothaveanyoff-balancesheetarrangements,asdefinedinItem303(a)(4)(ii)ofRegulationS-KoftheSEC,thathave,or

arereasonablylikelytohave,acurrentorfutureeffectonourfinancialcondition,resultsofoperations,liquidity,capitalexpendituresorcapitalresources.

Contingencies

Intheordinarycourseofbusiness,weandoursubsidiariesarepartiestoregulatoryandlegalmatters.Thesemattersmayrelatetoclaimsinvolvingalleged

infringementofthird-partyintellectualpropertyrights,defamation,taxes,regulatorycomplianceandotherclaims.Periodically,wereviewthestatusofall

significantoutstandingmatterstoassessthepotentialfinancialexposure.When(i)itisprobablethatanassethasbeenimpairedoraliabilityhasbeenincurred,

and(ii)theamountofthelosscanbereasonablyestimated,werecordtheestimatedlossinourconsolidatedstatementsofoperations.Weprovidedisclosureinthe

notestotheconsolidatedstatementsforlosscontingenciesthatdonotmeetbothoftheseconditionsifthereisareasonablepossibilitythatalossmayhavebeen

incurredthatwouldbematerialtothefinancialstatements.Significantjudgmentisrequiredtodeterminetheprobabilitythataliabilityhasbeenincurredand

whethersuchliabilityisreasonablyestimable.Webaseaccrualsmadeonthebestinformationavailableatthetimewhichcanbehighlysubjective.Although

occasionaladversedecisionsorsettlementsmayoccur,theCompanydoesnotbelievethatthefinaldispositionofanyofthesematterswillhaveamaterialadverse

effectonthebusiness.However,thefinaloutcomeofthesematterscouldvarysignificantlyfromourestimates.Theremaybeclaimsoractionspendingor

threatenedagainstusofwhichwearecurrentlynotawareandtheultimatedispositionofwhichwouldhaveamaterialadverseeffectonus.

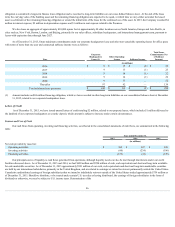

WearealsounderauditbytheInternalRevenueService(IRS)andvariousotherdomesticandforeigntaxauthoritieswithregardstoincometaxmatters.

Wehavereservedforpotentialadjustmentstoourprovisionforincometaxesthatmayresultfromexaminationsby,oranynegotiatedagreementswith,thesetax

authorities.Althoughwebelieveourtaxestimatesarereasonable,thefinaldeterminationofauditscouldbemateriallydifferentfromourhistoricalincometax

provisionsandaccruals.Theresultsofanauditcouldhaveamaterialeffectonourfinancialposition,resultsofoperations,orcashflowsintheperiodforwhich

thatdeterminationismade.

Additionally,weearnanincreasingportionofourincome,andaccumulateagreaterportionofcashflows,inforeignjurisdictionswhichweconsider

indefinitelyreinvested.Anyrepatriationoffundscurrentlyheldinforeignjurisdictionsmayresultinhighereffectivetaxratesandincrementalcashtaxpayments.

Inaddition,therehavebeenproposalstoamendU.S.taxlawsthatwouldsignificantlyimpactthemannerinwhichU.S.companiesaretaxedonforeignearnings.

Althoughwecannotpredictwhetherorinwhatformanylegislationwillpass,ifenacted,itcouldhaveamaterialadverseimpactonourU.S.taxexpenseandcash

flows.See“Note9—Income Taxes ”inthenotestoourconsolidatedfinancialstatementsinItem8forfurtherinformationonpotentialcontingenciessurrounding

incometaxes.

Related Party Transactions

ForinformationonourrelationshipswithExpediaandLibertyTripAdvisorHoldings,Inc.referto“Note15—Related Party Transactions ”inthenotesto

ourconsolidatedfinancialstatementsinItem8.

48