TripAdvisor 2015 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2015 TripAdvisor annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

revenueatthetimeofbookingandlaterrecognizedwhentheconsumerhascompletedthedestinationactivity.Wepaythedestinationactivityoperatorsafterthe

travelers’use.

Restaurants. Werecognizereservationrevenues(orperseateddinerfees)onatransaction-by-transactionbasisasdinersareseatedbyourrestaurant

customers.Subscription-basedrevenueisrecognizedratablyovertherelatedcontractualperiodoverwhichtheserviceisdelivered.

Vacation Rentals. Wegeneraterevenuefromcustomersforonlineadvertisingservicesrelatedtothelistingoftheirpropertiesforrentprimarilyoneithera

subscriptionbasisoverafixed-term,oronacommissionbasisfortransactionsthatarebookedonourplatform.Paymentsforterm-basedsubscriptionsreceivedin

advanceofservicesbeingrenderedarerecordedasdeferredrevenueandrecognizedratablytorevenueonastraight-linebasisoverthelistingperiod.Our

commissionrevenueisprimarilygeneratedonourfree-to-listoption,inlieuofapre-paidsubscriptionfee.Whenacommissionabletransactionisbookedonour

platform,wereceivecashfromthetravelerthatincludesbothourcommission,whichisrecordedasdeferredrevenue,andtheamountduetothepropertyowner,

whichisrecordedtodeferredmerchantpayablesonourconsolidatedbalancesheet.Wepaytheamountduetothepropertyownerandrecognizeourcommission

revenueatthetimeofthetraveler’sstay.Additionalrevenuesarederivedonapay-per-leadbasis,asweprovideleadsforrentalpropertiestopropertymanagers.

Pay-per-leadrevenueisbilledandrecognizedintheperiodwhentheleadsaredeliveredtothepropertymanagers.

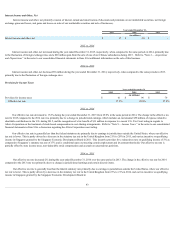

New and Recently Adopted Accounting Pronouncements

New Accounting Pronouncements Not Yet Adopted

InSeptember2015,theFinancialAccountingStandardsBoard(“FASB”)issuednewaccountingguidancewhicheliminatestherequirementforanacquirer

inabusinesscombinationtoaccountformeasurement-periodadjustmentsretrospectively.Instead,acquirersmustrecognizemeasurement-periodadjustments

duringtheperiodinwhichtheydeterminetheamounts,includingtheeffectonearningsofanyamountsthatwouldhavebeenrecordedinpreviousperiodsifthe

accountinghadbeencompletedattheacquisitiondate.ThisupdateiseffectiveforinterimandannualperiodsbeginningafterDecember15,2015,withearly

adoptionpermitted.Theplannedadoptionofthisguidancein2016isnotexpectedtohaveamaterialimpactonourconsolidatedfinancialstatementsandrelated

disclosures.

InMay2014,theFASBissuednewaccountingguidanceonrevenuefromcontractswithcustomers.Thenewguidancerequiresanentitytorecognizethe

amountofrevenuetowhichitexpectstobeentitledforthetransferofpromisedgoodsorservicestocustomers.Theupdatedguidancewillreplacemostexisting

revenuerecognitionguidanceinGAAPwhenitbecomeseffectiveandpermitstheuseofeitherafullretrospectiveapproachoramodifiedretrospectiveapproach,

whichrequirestheinitialcumulativeeffecttoberecognizedatthedateofinitialapplication.Thisguidanceiseffectiveforfiscalyears,andinterimperiodswithin

thosefiscalyears,beginningafterDecember15,2017andearlyadoptionispermittedforfiscalyearsbeginningafterDecember15,2016.Wehavenotyetselected

atransitionmethodandwearecurrentlyevaluatingtheeffectthattheupdatedstandardwillhaveonourconsolidatedfinancialstatementsorrelateddisclosures.

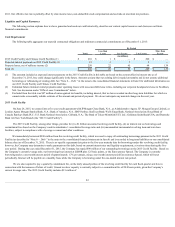

Recently Adopted Accounting Pronouncements

InNovember2015,theFASBissuednewaccountingguidancewhichrequiresanentitytopresentdeferredtaxassetsanddeferredtaxliabilitiesas

noncurrentontheconsolidatedbalancesheet.ThisguidanceiseffectiveforfiscalyearsbeginningafterDecember15,2016,withearlyadoptionpermitted.The

Companyhasearlyadoptedthisguidanceandhasappliedtherequirementsretrospectivelytoallperiodspresented.Theadoptionofthisguidanceresultedinthe

reclassificationof$10millionfromcurrentdeferredincometaxassetstononcurrentdeferredincometaxliabilitiesontheconsolidatedbalancesheetasof

December31,2014.

InApril2015,theFASBissuednewaccountingguidancewhichrequiresdebtissuancecostsrelatedtoarecognizeddebtliabilitybepresentedinthe

balancesheetasadirectdeductionfromthecarryingamountoftherelateddebtliabilityinsteadofbeingpresentedasanasset.Debtdisclosureswillincludethe

faceamountofthedebtliabilityandtheeffectiveinterestrate.InAugust2015,additionalaccountingguidancewasissuedonthistopicthatclarifiestheApril2015

guidancefordebtissuancecostsassociatedwithline-of-creditarrangements,whichstatestheFASBwouldnotobjecttothecontinueddeferralandpresentationof

debtissuancecostsasanasset,whichwouldbesubsequentlyamortizedoverthetermofthearrangement.Thisguidanceiseffectiveforfiscalyears,andthe

interimperiodswithinthosefiscalyears,beginningafterDecember15,2015,withearlyapplicationpermitted.TheCompanyhasearlyadoptedthisguidance.The

retrospectiveapplicationofthisguidancedecreased“Otherlong-termassets”and“Long-termdebt”by$1millionontheconsolidatedbalancesheetasof

December31,2014.

53